Create a strategy -SMA crossover part 2 #NTT #8

Popular YouTube videos related to Stock Indicator, Range Trading, Buy Weakness, and Best Ma Crossover, Create a strategy -SMA crossover part 2 #NTT #8.

Are you new to Tradetron and planning to begin your own Algo Trading journey with Tradetron?

Join us for the #NewToTradetron video series where we will cover all topics relevant to a beginner. In this video you will build your very first strategy on Tradetron which is based on an SMA crossover. We will also walk you through the various sets, conditions and positions.

We recommend you watch the first video of the SMA crossover series if you haven’t already: https://youtu.be/SzvDwCic8cI

Create strategy: https://tradetron.tech/strategies/create

We have plans that cater to everyone’s needs, visit our pricing plans below

https://tradetron.tech/user/pricing?exchange=IN

We are partnered with more than 35+ brokers and the number keeps growing, see if we support your broker by clicking the link below

https://tradetron.tech/html-view/partners

Useful Links:

Tradetron Home Page: bit.ly/3HAyIuh

Tradetron Strategy Marketplace: bit.ly/3oPjfhh

Tradetron Features: bit.ly/3qVuOWE

Tradetron Pricing: bit.ly/3CBZeQa

For support/queries please email support@tradetron.tech

Best Ma Crossover, Create a strategy -SMA crossover part 2 #NTT #8.

Forex Training Day – The Basics Of Currency Trading

You’ve probably realized that trading online is not almost as easy as you thought it was.

The aim of this short-term momentum trading method is to strike the revenue target as early as possible.

Create a strategy -SMA crossover part 2 #NTT #8, Get new replays relevant with Best Ma Crossover.

Forex Online Trading? What Is Scalping?

Rather, you ought to focus on four to 5 indications to make a trading decision. In a ranging market, heavy losses will occur. There are numerous techniques and signs to recognize the pattern.

Every now and then the technical indications start making news. Whether it’s the VIX, or a moving average, someone selects up the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as a financier one needs to ask, “are technical indications truly a reason to buy or sell?” In some aspects the answer is no, since “investing” is something various from swing trading or day trading.

However if you have a couple of bad trades, it can truly sour you on the entire trading game Moving Average Trader .When you simply have to step back and take an appearance at it, this is. Maybe, you just need to escape for a day or more. Relax, do something various. Your unconscious mind will deal with the problem and when you return, you will have a better outlook and can find the trading chances quicker than they can come at you.

Buy-and-hold say the experts. Buy-and-hold state the advisors who make money from your investment purchases though commissions. Buy-and-hold say most mutual fund companies who benefit from load costs so various in variety it would take too much space to note them all here. Buy-and-hold say TELEVISION analysts and newsletter publishers who’s customers currently own the stock.

You require to identify the beginning of the break out that created the move you are going to trade versus. The majority of people utilize Support and resistance lines to identify these areas. I discover them to be really Forex MA Trading reliable for this function.

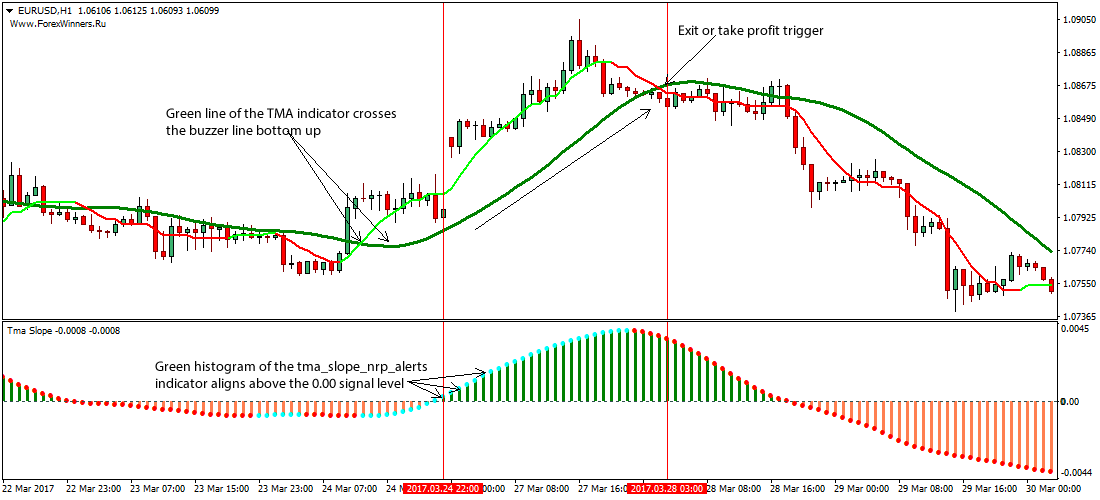

There are lots of techniques and indicators to recognize the pattern. My favorite ones are the most simple ones. I like to apply a moving typical sign with the a great deal of balancing durations. Rising Stocks MA Trading suggests the uptrend, falling MA indicates the sag.

Good forex trading and investing includes increasing earnings and decreasing probabilities of loss. This is not done, especially by newbies in the field. They do not understand correct trading methods.

It’s very true that the marketplace pays a lot of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the difference was a line drawn on a chart. Moving averages for example are best studies in when big blocks of cash will offer or buy. Watch the action surrounding a 200 day moving average and you will see first hand the warfare that occurs as shorts attempt and drive it under, and longs buy for the bounce. It’s cool to see.

To assist you determine patterns you need to likewise study ‘moving averages’ and ‘swing trading’. For example two basic guidelines are ‘do not purchase a stock that is listed below its 200-day moving typical’ and ‘do not buy a stock if its 5-day moving average is pointing down’. If you do not understand what these quotes imply then you require to research ‘moving averages’. Excellent luck with your trading.

In a ranging market, heavy losses will take location. Many stocks, particularly tech stocks, fell dramatically on above typical earnings and assistance. 2 main points need to be thought about for effective trading.

If you are searching best ever exciting comparisons related to Best Ma Crossover, and Chinese Markets, Stock Trading Course you are requested to join our a valuable complementary news alert service for free.