Building a crypto/forex bot in 5 minutes with Mirotomi (MA crossover strategy)

New overview highly rated Bear Market, Trading Strong Trend, Buying Signals, and Ma Crossover EA, Building a crypto/forex bot in 5 minutes with Mirotomi (MA crossover strategy).

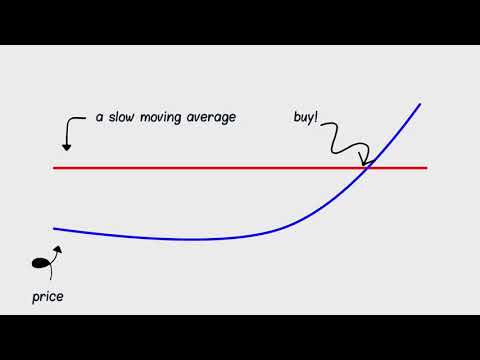

Built with Mirotomi.com – Discover our visual trading builder, shared backtesting engine and strategy report as we build our very first strategy on Mirotomi.com: a SMA crossover strategy

Ma Crossover EA, Building a crypto/forex bot in 5 minutes with Mirotomi (MA crossover strategy).

What It Requires A Day Trading Expert

The wedge is compressing, which need to continue to generate volatility. It was during my look for the perfect robot that I read Marcus B. Your trading strategy ought to include what timespan you are focusing on.

Building a crypto/forex bot in 5 minutes with Mirotomi (MA crossover strategy), Explore interesting updated videos about Ma Crossover EA.

Forex Scalping Trading Systems

Complex indications will likely fail to operate in the long-term. Moving averages are incredibly popular indicators in the forex. Pleased trading and never stop discovering! You ought to develop your own system of day trading.

If you have actually been in currency trading for any length of time you have actually heard the following 2 expressions, “pattern trade” and “counter trend trade.” These 2 techniques of trading have the exact same validity and require just as much work to master. Because I have actually found a system that permits me to discover high frequency trades, I like trading counter trend.

At times, the modifications can take place quickly. These upward and down spikes are a sign of major changes within the operation of a business and they trigger Moving Average Trader reactions in stock trading. To be ahead of the video game and on top of the circumstance, plan ahead for contingency procedures in case of spikes.

The 2 charts below are very same duration everyday charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & utility stocks. The 2 charts below show SPX began the current rally about a month prior to OIH. Likewise, the charts imply, non-energy & energy stocks tipped over the previous week approximately, while energy & utility stocks stayed high or rose further.

You need to determine the beginning of the break out that developed the relocation you are going to trade versus. Many individuals use Support and resistance lines to recognize these areas. I find them to be very Forex MA Trading efficient for this purpose.

Given that we are using historic information, it is worth keeping in mind that moving averages are ‘lag Stocks MA Trading indicators’ and follow the actual duration the higher the responsiveness of the chart and the close it is to the actual rate line.

A 50-day moving average line takes 10 weeks of closing rate information, and after that plots the average. The line is recalculated daily. This will reveal a stock’s price trend. It can be up, down, or sideways.

Shorting isn’t for everybody, however here is among my methods for choosing stocks to brief. Weak point is a stock trading below the 200 day moving average – make a list of all stocks that are trading below that level.

Combining these two moving averages gives you a great foundation for any trading plan. Chances are great that you will be able to make money if you wait for the 10-day EMA to agree with the 200-day SMA. Simply utilize good money management, don’t risk too much on each trade, and you need to be great.

What does the stock action need to appear like for your technique? Did you lose cash in 2008 stock exchange down turn? However even in that nonreligious bearishness, there were big cyclical booming market.

If you are finding exclusive exciting comparisons about Ma Crossover EA, and Stock Trading, Beginner Trading, Forex Market please signup our email subscription DB now.