BM, Callejero Fino, La Joaqui, Lola Índigo – M.A (Remix) [Prod Phontana, Alan Gomez] (Video Oficial)

New full length videos highly rated Forex Education, Technical Analysis, Buy and Hold, and What Is Ma 5 Crossover 10, BM, Callejero Fino, La Joaqui, Lola Índigo – M.A (Remix) [Prod Phontana, Alan Gomez] (Video Oficial).

#BM #CallejeroFino #LaJoaqui #LolaIndigo #MARemix

Spotify: https://open.spotify.com/album/3iggaiQChBAIIfQP8ZH2bR

Apple: https://itunes.apple.com/album/id/1678869870

Deezer: https://www.deezer.com/album/421438297

@BMCanalOficial | https://www.instagram.com/bm.oficial.ok/

@CallejeroFino | https://www.instagram.com/callejerofino/

@LaJoaqui | https://www.instagram.com/lajoaqui/

@lolaindigochannel | https://www.instagram.com/lolaindigo/

Producción Musical

@phontanaprod | https://www.instagram.com/phontana/

@alangomezok | https://www.instagram.com/alangomez/

Director de video: Lucas Emiliani

Dirección creativa: Rodrigo Salas

Producción general: Mora Tomaselli

Producción general: Leo Belizan

Producción ejecutiva: Wesaisons & DALE PLAY Records

Booking | Comercial | Contacto

Flouart.info@gmail.com

©️ 2023 DALE PLAY Records / Wesaisons Records

What Is Ma 5 Crossover 10, BM, Callejero Fino, La Joaqui, Lola Índigo – M.A (Remix) [Prod Phontana, Alan Gomez] (Video Oficial).

Forex Online Trading? Demarker Indicator As A Trading Tool

Ensure you turn into one of that minority. Yesterdays SMA was an average of the rate points 1 – 8. This also compensates for the fact that your stop is further away. Intricately designed techniques do not always work.

BM, Callejero Fino, La Joaqui, Lola Índigo – M.A (Remix) [Prod Phontana, Alan Gomez] (Video Oficial), Find most shared reviews about What Is Ma 5 Crossover 10.

A Quick Currency Trading Tutorial – How To Get Started

Specific tolerance for danger is an excellent barometer for choosing what share rate to brief. Do this 3 times or more to develop a pattern. Traders wait until the fast one crosses over or listed below the slower one.

I just received an email from a member who says that they require aid with the technical analysis side of trading. The email began me thinking of the simplest method to describe technical analysis to somebody who has no forex trading experience. So I desired to compose a short article describing 2 preferred indicators and how they are utilized to earn money in the forex.

Nasdaq has actually rallied 310 points in three months, and struck a brand-new four-year high at 2,201 Fri Moving Average Trader early morning. The economic information suggest market pullbacks will be restricted, although we have actually gotten in the seasonally weak duration of Jul-Aug-Sep after a huge run-up. Subsequently, there might be a combination period rather than a correction over the next couple of months.

Accomplishing success in currency trading involves a high level of discipline. It can not be dealt with as a side company. It not just needs knowledge about the trends however also about the instructions the patterns will move. There are many software available to understand the trend and follow a system but in fact to achieve success in currency trading a trader must construct their own system for trading and above all to follow it consistently.

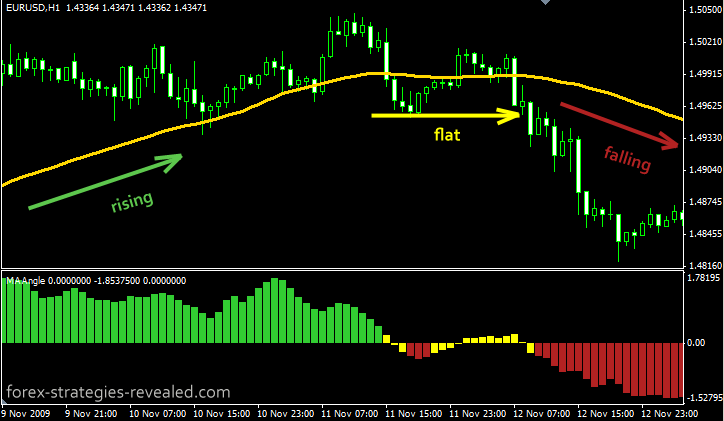

The chart below is a Nasdaq weekly chart. Nasdaq has actually been developing a rising wedge for about 2 years. The Forex MA Trading indication has actually been moving in the opposite instructions of the cost chart (i.e. negative divergence). The 3 highs in the wedge fit well. Nevertheless, it’s unsure if the third low will likewise provide a good fit. The wedge is compressing, which ought to continue to generate volatility. Numerous intermediate-term technical indicators, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, and so on, recommend the market will be higher sometime within the next couple of months.

Among the main signs that can help you establish the way the index is moving is the Moving Typical (MA). This takes the index price over the last specific variety of days and averages it. With each new day it drops the first cost utilized in the previous day’s estimation. If you are looking to day trade or invest, it’s constantly excellent to inspect the MA of numerous periods depending. If you’re aiming to day trade then a MA over 5, 15, and 30 minutes are a great concept. If you’re looking for long term investment then 50, 100, and 200 days may be more what you require. For those who have trades lasting a few days to a few weeks then periods of 10, 20 and 50 days Stocks MA Trading be better suited.

A 50-day moving average line takes 10 weeks of closing price data, and after that plots the average. The line is recalculated daily. This will show a stock’s cost trend. It can be up, down, or sideways.

Since it does not enable for any kind of verification that the stock’s break above the resistance level will continue, getting in the market at this stage is the most aggressive method. Maybe this technique needs to be reserved for the most appealing stocks. However it has the benefit of providing, in numerous scenarios, the least expensive entry point.

The general rule in trading with the Stochastics is that when the reading is above 80%, it means that the marketplace is overbought and is ripe for a downward correction. Likewise when the reading is below 20%, it indicates that the market is oversold and is going to bounce down soon!

In a varying market, heavy losses will occur. Numerous stocks, especially tech stocks, fell greatly on above average revenues and guidance. 2 bottom lines must be considered for successful trading.

If you are looking updated and entertaining videos related to What Is Ma 5 Crossover 10, and Investment Strategy, Forex Trading Techniques, Foreign Currency Trading, Primary Trend you should join for email list for free.