Best Intraday Trading Strategy for Beginners | 20-50 Moving Average Strategy | No Loss Strategy

Top clips top searched Trading Part Time, Trading Tool, Current Sector Trends, and 20 50 Ema Trading Rule, Best Intraday Trading Strategy for Beginners | 20-50 Moving Average Strategy | No Loss Strategy.

Intraday Strategy for Beginners | 20-50 moving average strategy 100% profit

Best Intraday Trading Strategy for Beginners | 20-50 Moving Average Strategy | No Loss Strategy

intraday trading strategy

best indicator strategy

best moving average strategy

profitable strategy

daily profit strategy

best moving average strategy

no loss strategy

Topics Discussed in this video: –

Bank Nifty , Bank Nifty Option Trading Strategy , Bank Nifty Option Trading , Bank Nifty Option Trading live , Bank Nifty Option buying strategy , bank Nifty Option , Bank Nifty Options live trading , Bank Nifty Options , Bank Nifty options trading for beginners , Bank Nifty options intraday trading strategies , bank nifty intraday option strategy , bank nifty intraday trading , bank nifty intraday strategy , bank nifty scalping strategy , bank nifty scalping , magical trading , stock market, Best Intraday Strategy , Price Action Trading Strategy , Trading Tomorrow , No Loss Buying Strategies Bank Nifty & Nifty , Price Action for Beginners , Bank Nifty Live Trading , Option Trading Strategy , Option Trading Strategy Bank Nifty , Live Trading Strategy , Trading Tomorrow Official ,, Advance Price Action Strategy , How To Identify Market Trend , , Market Trend Strategies ,

Disclosure: I am not SEBI registered. The information provided here is for education purposes only. I will not be responsible for any of your profit/loss with this channel suggestions. Consult your financial advisor before taking any decisions. Videos neither advice nor endorsement. BEST Time of day to Buy Options in Bank Nifty for BIG profit | Best time to buy nifty

20 50 Ema Trading Rule, Best Intraday Trading Strategy for Beginners | 20-50 Moving Average Strategy | No Loss Strategy.

How To Develop A Lucrative Day Trading System

For intra day trading you want to use 3,5 and 15 minute charts. You may likewise begin to move cash into bear ETFs. Go long below the moving average when the channel is increasing, and take earnings at the upper channel line.

Best Intraday Trading Strategy for Beginners | 20-50 Moving Average Strategy | No Loss Strategy, Get new complete videos relevant with 20 50 Ema Trading Rule.

Product Futures Trading – What Is Your Trading Edge? Part 2

Let us say that we wish to make a brief term trade, between 1-10 days. There are certainly some variations on this trading technique too. Small trends can be easily noted on 5-minute charts.

If you trade stocks, you should understand how to chart them. Some people explore charts to discover buy or offer signals. I find this inefficient of a stock traders time. You can and need to chart all types of stocks including cent stocks. When to sell or buy, charting informs you where you are on a stocks price pattern this means it informs you. There are plenty of fantastic business out there, you don’t desire to get caught purchasing them at their 52 week high and needing to wait around while you hope the cost returns to the price you paid.

However if you have a number of bad trades, it can truly sour you on the whole trading video game Moving Average Trader .When you just have to step back and take an appearance at it, this is. Possibly, you just require to escape for a day or more. Relax, do something different. Your unconscious mind will work on the problem and when you return, you will have a much better outlook and can find the trading chances quicker than they can come at you.

So this system trading at $1000 per trade has a favorable expectancy of $5 per trade when traded over many trades. The profit of $5 is 0.5% of the $1000 that is at risk throughout the trade.

Forex MA Trading She composed a greater strike cost this time around because the pattern appeared to be speeding up and she didn’t desire to lose out on excessive capital growth if it continued to rally.

A well implying good friend had pointed out an alternatives trading course he had actually attended and suggested that trading may be a method for Sidney to Stocks MA Trading above typical returns on her settlement payment money, as interest and dividends would not have the ability to provide adequate income for the household to survive on.

For each time a short article has been e-mailed, award it three points. An e-mailed article suggests you have at least hit the interest nerve of some member of your target market. It might not have actually been a publisher so the classification isn’t as important as the EzinePublisher link, but it is more valuable than a basic page view, which doesn’t necessarily imply that someone read the entire article.

It has been rather a couple of weeks of drawback volatility. The rate has actually dropped some $70 from the peak of the last go to $990. The green line portrays the major battle area for $1,000. While it is $990 instead of $1,000 it does represent that milestone. Therefore we have actually had our 2nd test of the $1,000 according to this chart.

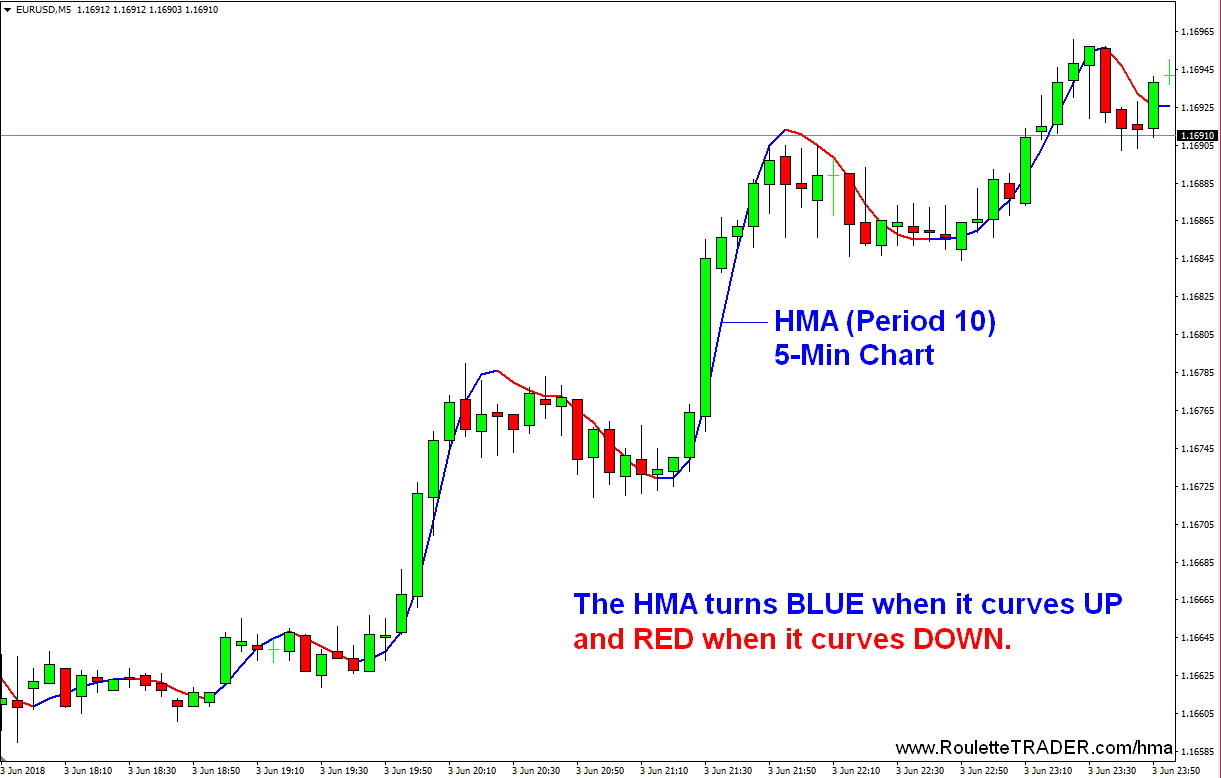

A way to measure the velocity or significance of the move you are going to trade against. This is the trickiest part of the equation. The most typical method is to measure the slope of a MA versus an otherwise longer term pattern.

When trading Forex, one must take care since incorrect expectation of cost can occur. Using the moving averages in your forex trading company would show to be extremely advantageous.

If you are finding more engaging comparisons related to 20 50 Ema Trading Rule, and Learn About Stock Market, Strong Trend, Stock Market Works, Trading Channel you are requested to subscribe for email alerts service totally free.