Aroon Indicator | Aroon indicator and Moving Average Very Powerful Trading Strategy

Interesting clips related to Exit Strategy, Timing the Market, Forex Moving Average Tips and Strategies, and What Is Sma Trading, Aroon Indicator | Aroon indicator and Moving Average Very Powerful Trading Strategy.

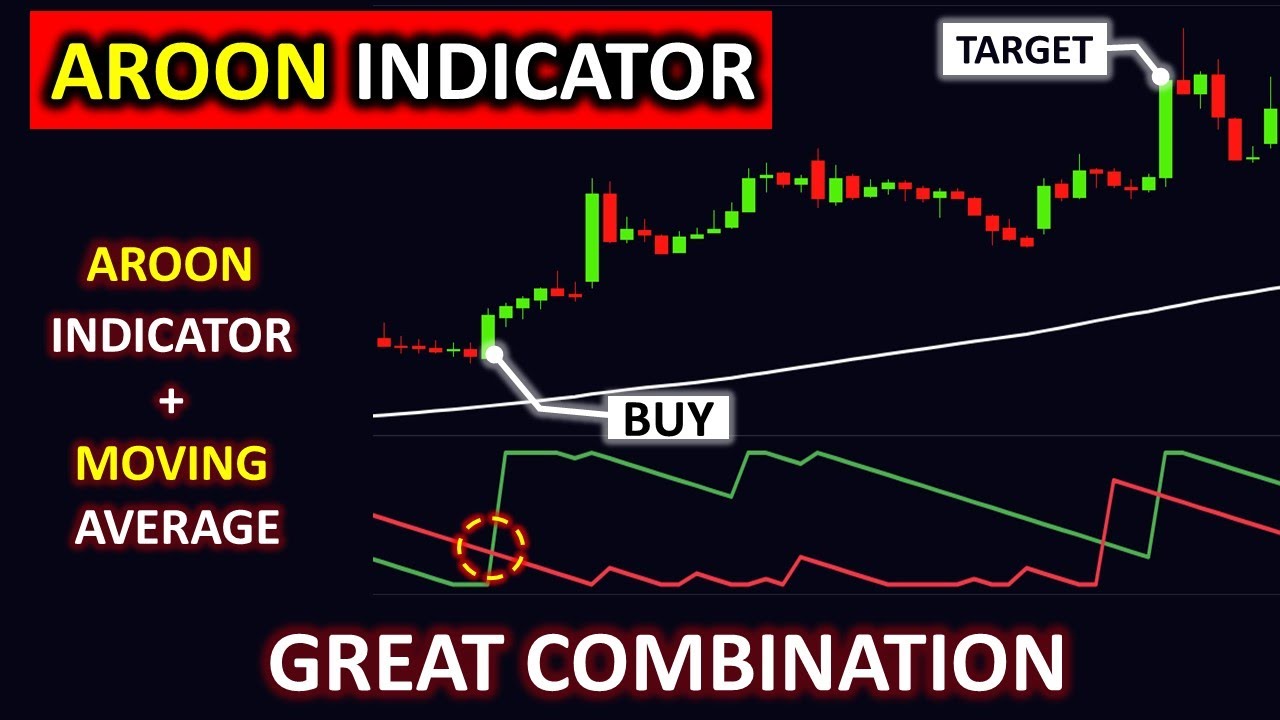

Aroon indicator which is a very important indicator for stock market as well as for forex. Aroon indicator is one type of momentum oscillator. It keeps oscillating between 0 to 100 value. There are two lines in the aroon indicator. The first is aroon up which is indicated by green color and second is aroon down which is indicated by red color.

The Aroon indicator is used to identify the trend of the stock price. when the aroon up is above the aroon down, it is called that the stock is in the uptrend. similarly, when the aroon down is above the aroon up, it is called that the stock is in the downtrend. when the both the aroon up and aroon down lines are parallel to each other then it is called that the stock price is in the consolidation or in the sideways trend. we should not make any trade during this sideways trend.

Here in this video, we will talk about the bullish and bearish crossovers. In our strategy, we will make the combination of the aroon indicator and the moving average. We will discuss the conditions for the buy and sell setup and after that we will take example for the buying and selling.

#aroonindicator #movingaverage #forex

What Is Sma Trading, Aroon Indicator | Aroon indicator and Moving Average Very Powerful Trading Strategy.

Stock Market Method – Stock Trading In A Stock Exchange Crash

Also getting in and out of markets although cheaper than in the past still costs money. As the most traded index in the world, let’s look at the S&P 500. You may likewise begin to move money into bear ETFs.

Aroon Indicator | Aroon indicator and Moving Average Very Powerful Trading Strategy, Find most shared videos relevant with What Is Sma Trading.

Cycles Can Leapfrog Your Trading Success

The manner in which the stock breaks above and trades above the BI will suggest the strength of the bullish belief. A moving average ought to also be utilized on your chart to determine the instructions of the trend.

In less than 4 years, the rate of oil has actually risen about 300%, or over $50 a barrel. The Light Crude Constant Contract (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil costs will ultimately slow economic development, which in turn will cause oil rates to fall, ceritus paribus.

Utilizing the exact same 5% stop, our trading system went from losing nearly $10,000 to getting $4635.26 over the same ten years of data! The efficiency is now a favorable 9.27%. There were 142 rewarding trades with 198 unprofitable trades with the Moving Average Trader revenue being $175.92 and typical loss being $102.76. Now we have a much better trading system!

Achieving success in currency trading includes a high level of discipline. It can not be dealt with as a side organization. It not just requires understanding about the patterns but also about the direction the patterns will move. There are many software application readily available to know the trend and follow a system however in reality to attain success in currency trading a trader need to build their own system for trading and above all to follow it religiously.

The reality that the BI is assessing such an useful duration suggests that it can often figure out the predisposition for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their initial positions for the day. A move far from the BI suggests that a person side is more powerful than the other. A stock moving above the BI means the dominating belief in the stock is bullish. The Forex MA Trading in which the stock breaks above and trades above the BI will indicate the strength of the bullish sentiment. The opposite however very same analysis uses when a stock moves below its BI.

This implies that you require to know how to manage the trade prior to you take an entry. In a trade management technique, you need to have drawn up exactly how you will manage the trade after it is gotten in into the Stocks MA Trading so you know what to do when things show up. Dominating trade management is really crucial for success in trading. This part of the system need to consist of details about how you will react to all sort of conditions one you get in the trade.

Draw a line to recognize the support and resistance levels. The more the line is touched, the more vital it becomes as a support or resistance levels. An uptrend is shown by greater highs and higher lows. A drop is indicated by lower highs and lower lows.

As soon as the buzz calms down and the CME completes its margin increase on Monday, we should see silver rates stabilize. From my viewpoint, I see $33 as a level I may cautiously start to buy. I think assistance will be around $29 until the Fed decides it’s time to cool inflation if silver breaks below that level.

Remember, the trick to knowing when to buy and offer stocks is to be consistent in using your rules and comprehending that they will not work each time, but it’s a lot better than not having any system at all.

The 2 most popular moving averages are the simple moving typical and the exponential moving average. The declining ranges combined with this week’s reversal bar lead me to believe that the next move is greater.

If you are searching unique and exciting videos about What Is Sma Trading, and Online Day Trading, Stock Trading Tips, Successful Forex Trading dont forget to join in email alerts service for free.