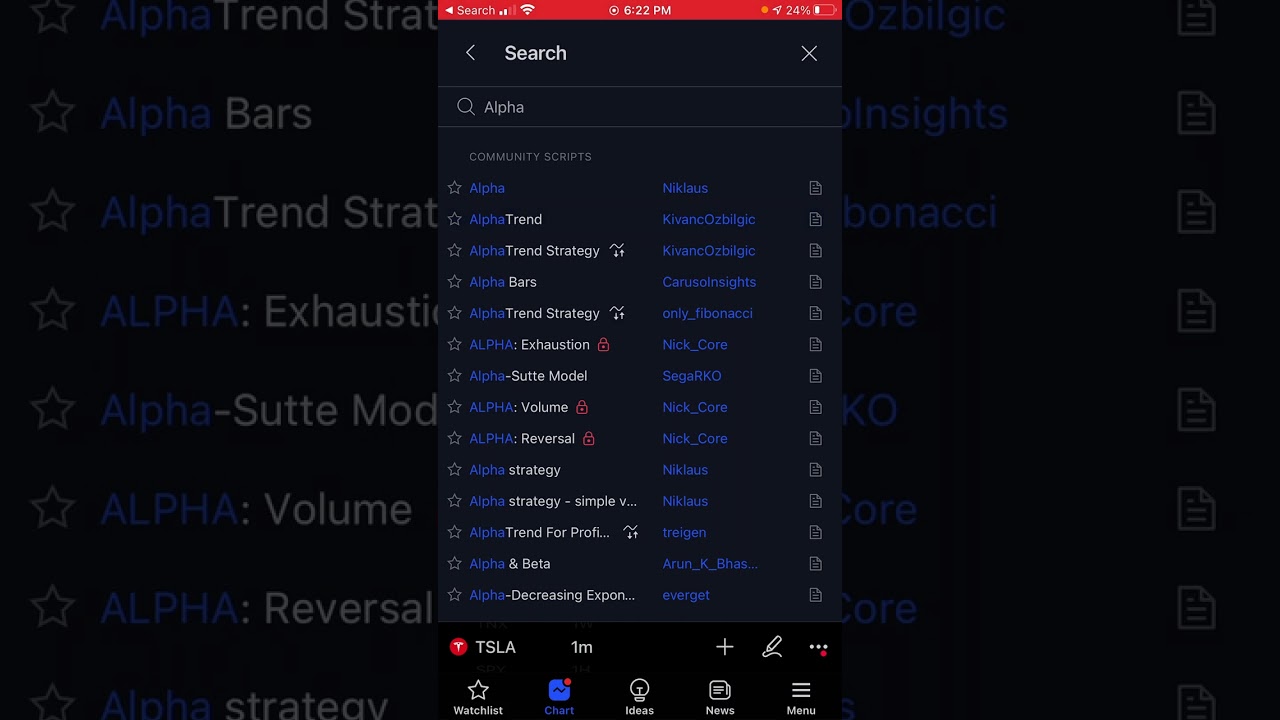

Alpha trend indicator tradingview |alpha trend-setting | Alpha trend strategy |#shorts

Popular YouTube videos related to Forex Moving Average Tips and Strategies, Forex Trading Strategies, Swing Trading for Beginners, and Sma Tradingview, Alpha trend indicator tradingview |alpha trend-setting | Alpha trend strategy |#shorts.

Alpha Trend

#shorts

https://www.tradingview.com/script/o50NYLAZ-AlphaTrend/

In Magic Trend we had some problems, Alpha Trend tries to solve those problems such as:

1-To minimize stop losses and overcome sideways market conditions.

2-To have more accurate BUY/SELL signals during trending market conditions.

3- To have significant support and resistance levels.

4- To bring together indicators from different categories that are compatible with each other and make a meaningful combination regarding momentum, trend, volatility, volume, and trailing stop loss.

according to those purposes Alpha Trend:

1- Acts like a dead indicator like its ancestor Magic Trendin sideways market conditions and doesn’t give many false signals.

2- With another line with 2 bars offsetted off the original one Alpha Trend have BUY and SELL signals from their crossovers.

BUY / LONG when Alpha Trend line crosses above its 2 bars offsetted line and there would be a green filling between them

SELL / SHORT when Alpha Trend line crosses below its 2 bars offsetted line and filling would be red then.

3- Alpha Trend lines

-act as support levels when an uptrend occurs trailing 1*ATR (default coefficient) distance from bar’s low values

-conversely act as resistancelevels when a downtrend occurs trailing 1*ATR (default coefficient) distance from bar’s high values

and acting as trailing stop losses

the more Alpha Trend lines straighter the more supports and resistances become stronger.

4- Trend Magic has CCI in calculation

Alpha Trend has MFI as momentum, but when there’s no volume data MFI has 0 values, so there’s abutton to change calculation considering RSI after checking the relevant box to overcome this problem when there is no volume data in that chart.

Momentum: RSI and MFI

Trend: Magic Trend

Volatility: ATR,

Trailing STOP: ATR TRAILING STOP

Volume: MFI

Alpha trend is really a combination of different types…

default values:

coefficient: 1 which is the factor of trailing ATR value

common period: 14 which is the length of ATR MFI and RSI

Sma Tradingview, Alpha trend indicator tradingview |alpha trend-setting | Alpha trend strategy |#shorts.

Biggest Forex Day Trading Strategy

It is presented in a chart where all you need to do is to keep an eager eye on the best entrance and exit points. The greatest signal is where the present rate goes through both the SMAs at a high angle.

Alpha trend indicator tradingview |alpha trend-setting | Alpha trend strategy |#shorts, Find more videos related to Sma Tradingview.

Stochastic System – A Swing Trading Stochastics System For Huge Gains

Five circulation days throughout March of 2000 indicated the NASDAQ top. The trading platforms are more easy to use than they were years earlier. It is invariably utilized in double format, e.g. a 5 day moving average and a 75 day moving average.

There are an excellent variety of forex indicators based upon the moving average (MA). This is a review on the simple moving average (SMA). The easy moving average is line produced by computing the average of a set variety of duration points.

Out of all the stock trading ideas that I have actually been provided over the ears, bone helped me on a more useful level than these. Moving Average Trader Use them and use them well.

Peter cautioned him nevertheless, “Remember Paul, not all trades are this simple and turn out as well, however by trading these kinds of patterns on the everyday chart, when the weekly trend is likewise in the exact same instructions, we have a high possibility of a rewarding outcome in a big portion of cases.

To make this much easier to understand, let’s put some numbers to it. These are simplified examples to illustrate the idea and the numbers Forex MA Trading or might not match genuine FX trading techniques.

Taking the high, low, close and open worths of the previous day’s cost action, strategic levels can be determined which Stocks MA Trading or might not have an impact on cost action. Pivot point trading puts focus on these levels, and uses them to assist entry and exit points for trades.

Another forex trader does care too much about getting a roi and experiences a loss. This trader loses and his wins are on average, much bigger than losing. He wins double what was lost when he wins the video game. This reveals a balancing in winning and losing and keeps the financial investments available to get an earnings at a later time.

When the hype calms down and the CME completes its margin boost on Monday, we should see silver prices stabilize. From my viewpoint, I see $33 as a level I might meticulously start to buy. I think support will be around $29 up until the Fed decides it’s time to cool inflation if silver breaks below that level.

There you have the two most crucial lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can generally be done longer up to two months, using stops along the method, one doesn’t even truly require to view it, naturally one can as they ca-ching in one those safe revenues. The other pattern is fish lips, they are normally held for less than a month, and are exited upon upper band touches, or mare precisely retreats from upper band touches. When the cost touches the upper band and then retreats), (. Fish lips that re formed out of a flat pattern can often turn into ‘riding the wave,’ and then are held longer.

Buy-and-hold state TV commentators and newsletter publishers who’s customers already own the stock. It is properly one of the reasons that the interest in trading Forex online has actually been increasing.

If you are looking best ever engaging comparisons relevant with Sma Tradingview, and Prevailing Trend, Simple Moving Average Forex, Safe Investing please join for email subscription DB now.