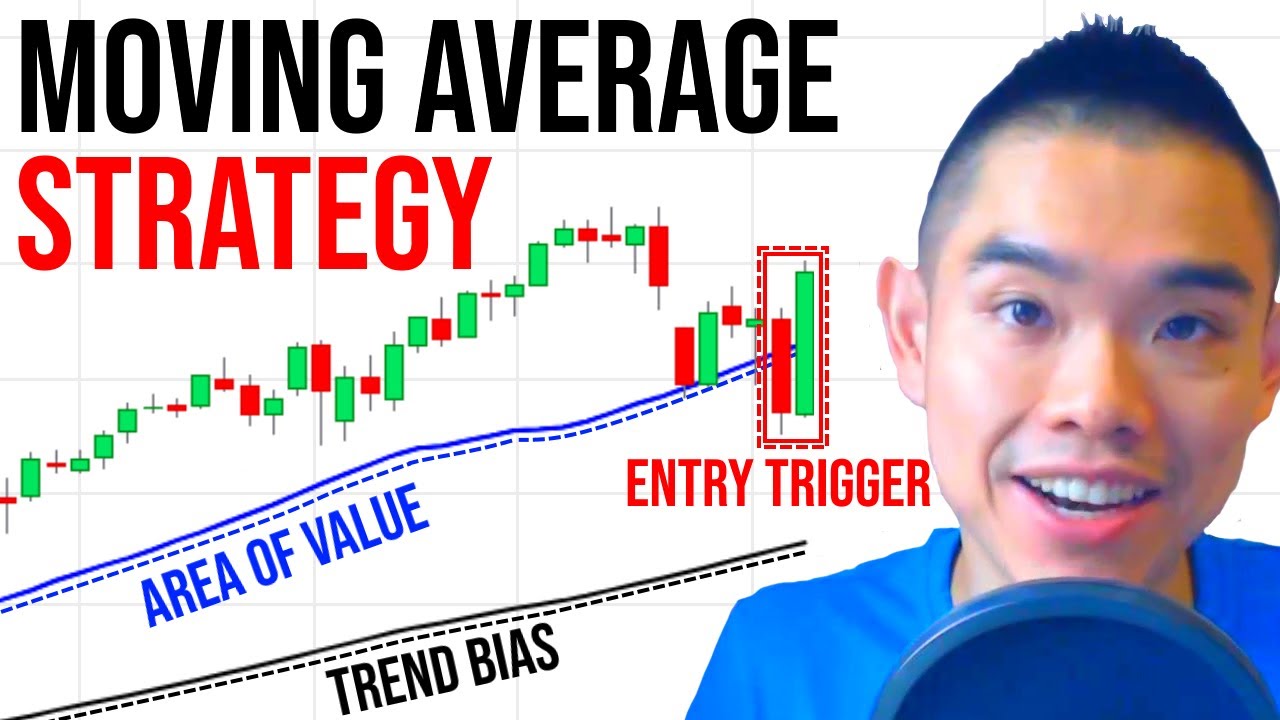

A Moving Average Trading Strategy (That Actually Works)

Top vids related to Oil Stocks, Chinese Markets, Swing Trading Basics, and Sma Trading Term, A Moving Average Trading Strategy (That Actually Works).

You’ll LOVE today’s lesson because…

I’m going to teach you a Moving Average trading strategy that I’ve been using for years (and no it’s not Moving Average crossover).

In fact…

It’s a “buy low sell high” trading strategy that can be applied to the Forex, Futures, and Stock markets.

I’ll reveal the full details of this moving average trading strategy and leave no stones unturned.

This includes the exact trading setup I look for, entries, exits, and stop loss.

And how you can use this moving average trading strategy to capture a swing for consistent income or, ride massive trends and grow your wealth over time.

So, go learn this moving average trading strategy right now.

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: https://priceactiontradingsecrets.com/

Sma Trading Term, A Moving Average Trading Strategy (That Actually Works).

Applying Poker Strategies To Trading The Markets

The wedge is compressing, which should continue to generate volatility. It was throughout my look for the perfect robotic that I check out Marcus B. Your trading strategy ought to include what time frames you are concentrating on.

A Moving Average Trading Strategy (That Actually Works), Get more full videos related to Sma Trading Term.

Forex Trading Guide – The Value Of Your Own Forex Trading System

For intra day trading you want to use 3,5 and 15 minute charts. The next step is to look out for the signal to offer. This takes the index cost over the last specific number of days and averages it.

New traders frequently ask the number of indications do you suggest utilizing at one time? You do not require to fall victim to analysis paralysis. You should master just these two oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence).

You don’t need to suffer the 40% portfolio losses that many individuals did in 2008. It is tough to completely time the marketplace, but with some understanding, you can use Put choices to secure your Moving Average Trader investment from catastrophe.

Another great way to use the sideways market is to take scalping trades. Even though I’m not a big fan of scalping there are numerous traders who successfully make such trades. You take a short trade when rate approaches the resistance level and exit at the support level. Then you make a long trade at the assistance level and exit when price approaches the resistance level.

Small patterns can be quickly noted on 5-minute charts. If the present cost on 5-minute chart is below 60 period moving average and the moving average line is sloping downwards then it is a Forex MA Trading pattern. , if the current rate on 5-minute chart is above 60 period moving average and the moving average line is sloping up this shows a small pattern..

Let us say that we wish to make a short-term trade, between 1-10 days. Do a screen for Stocks MA Trading in a new up pattern. Raise the chart of the stock you have an interest in and raise the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and must be bought. However as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

While the year-end rally tends to be rather trusted, it doesn’t happen every year. And this is something stock exchange financiers and traders may wish to pay attention to. In the years when the marketplaces signed up a loss in the last days of trading, we have often seen a bearishness the next year.

Stochastics indication has actually got two lines referred to as %K and %D. Both these lines are outlined on the horizontal axis for an offered time duration. The vertical axis is plotted on a scale from 0% to 100%.

A way to measure the velocity or significance of the move you are going to trade against. This is the trickiest part of the equation. The most common method is to determine the slope of a MA versus an otherwise longer term pattern.

This research study was one of the first to measure volatility as a vibrant movement. All over the web there are discussions about trading techniques – what really works and what does not.

If you are looking unique and entertaining comparisons related to Sma Trading Term, and Stock Market Investing, Millionaire Trader dont forget to subscribe for subscribers database for free.