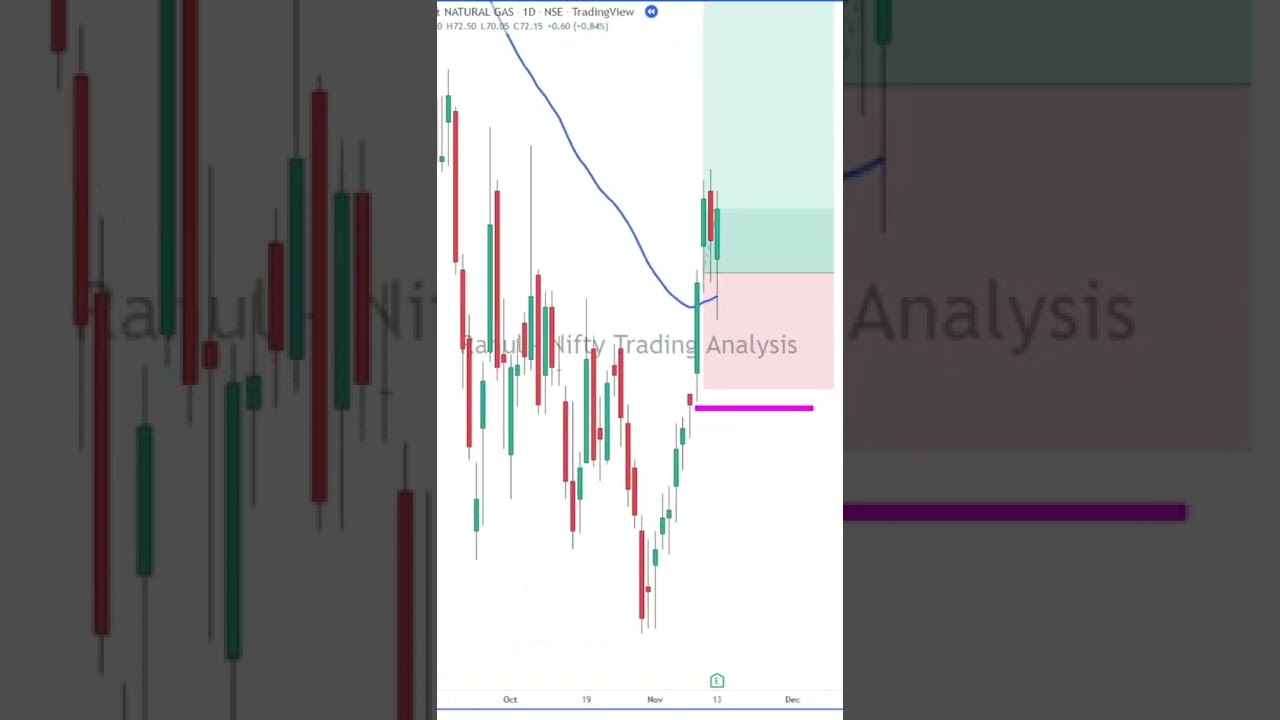

50 EMA trading strategy 📈 #shorts

Trending full videos highly rated Stock Market Information, Foreign Currency Trading, Megadroid Trading Robot, Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, and Ema Trading Forex, 50 EMA trading strategy 📈 #shorts.

50 EMA trading strategy 📈 #shorts

#stockmarket #stocks #investing #trading #investment #money #finance #forex #invest #nifty #investor #business #sharemarket #financialfreedom #bitcoin #trader #cryptocurrency #entrepreneur #sensex #daytrader #stock #wallstreet #wealth #nse #forextrader #bse #stockmarketindia #daytrading #stockmarketnews #forextrading

Ema Trading Forex, 50 EMA trading strategy 📈 #shorts.

Utilize These Killer Day Trading Secrets To Help You Earn Money In The Markets

To find a great location for a stop, pretend that you’re considering a trade in the instructions of the stop. In a varying market, heavy losses will occur. Charts of the main index can inform you this by a quick look.

50 EMA trading strategy 📈 #shorts, Find interesting explained videos relevant with Ema Trading Forex.

Top 10 Stock Market Technical Indicators

Simply exist in the correct time and with best order. To earn money regularly you must construct a technique and persevere. State you want to trade a hourly basis and you wish to plot an 8 point chart.

When you retire, I can’t inform you how much cash you are going to require. If the amount is not enough it is not ‘when’, but ‘if’. You may have to keep working and hope among those greeter jobs is available at Wal-Mart.

The best way to make cash is buying and offering Moving Average Trader breakouts., if you incorporate them in your forex trading strategy you can use them to pile up substantial gains..

Assistance & Resistance. Support-this term explains the bottom of a stock’s trading variety. It resembles a flooring that a stock rate discovers it hard to permeate through. Resistance-this term explains the top of a stock’s trading range.It’s like a ceiling which a stock’s price does not seem to rise above. Assistance and resistance levels are vital ideas as to when to buy or sell a stock. Many effective traders purchase a stock at assistance levels and sell short stock at resistance. If a stock manages to break through resistance it might go much higher, and if a stock breaks its assistance it could signal a breakdown of the stock, and it might decrease much further.

To make this easier to understand, let’s put some numbers to it. These are streamlined examples to show the principle and the numbers Forex MA Trading or might not match genuine FX trading strategies.

A Forex trading method needs 3 Stocks MA Trading standard bands. These bands are the time frame picked to trade over it, the technical analysis used to figure out if there is a price trend for the currency set, and the entry and exit points.

For each time an article has been e-mailed, award it three points. An e-mailed short article suggests you have at least strike the interest nerve of some member of your target audience. It may not have been a publisher so the category isn’t as valuable as the EzinePublisher link, however it is better than a simple page view, which doesn’t always indicate that someone read the entire short article.

Consider the MA as the same thing as the instrument panel on your ship. Moving averages can inform you how quickly a pattern is moving and in what instructions. Nevertheless, you may ask, exactly what is a moving average sign and how is it calculated? The MA is precisely as it sounds. It is approximately a variety of days of the closing rate of a currency. Take twenty days of closing costs and calculate an average. Next, you will graph the present price of the marketplace.

To help you determine patterns you need to also study ‘moving averages’ and ‘swing trading’. For instance two standard guidelines are ‘don’t buy a stock that is listed below its 200-day moving average’ and ‘don’t buy a stock if its 5-day moving average is pointing down’. If you don’t comprehend what these quotes imply then you need to research ‘moving averages’. Best of luck with your trading.

From its opening cost on January 3rd 2012 through the closing cost on November 30th, the SPX rose by 12.14%. The vertical axis is plotted on a scale from 0% to 100%. You don’t need to come down with analysis paralysis.

If you are looking updated and entertaining comparisons about Ema Trading Forex, and Investment Strategy, Forex Trading Techniques, Foreign Currency Trading, Primary Trend please signup in email subscription DB now.