4 NGUỒN TÌM CHIẾN THUẬT GIAO DỊCH FOREX

New reviews related to Day Trading, Trading Indicators, Forex Trading School, and Ema Trading Babypips, 4 NGUỒN TÌM CHIẾN THUẬT GIAO DỊCH FOREX.

Một số nguồn hay ho: learntotradethemarket.com/forex-trading-strategies forums.babypips.com/c/trading-systems/free-forex-trading-systems …

Ema Trading Babypips, 4 NGUỒN TÌM CHIẾN THUẬT GIAO DỊCH FOREX.

Top 3 Reasons That Trading With Indicators Is Overrated

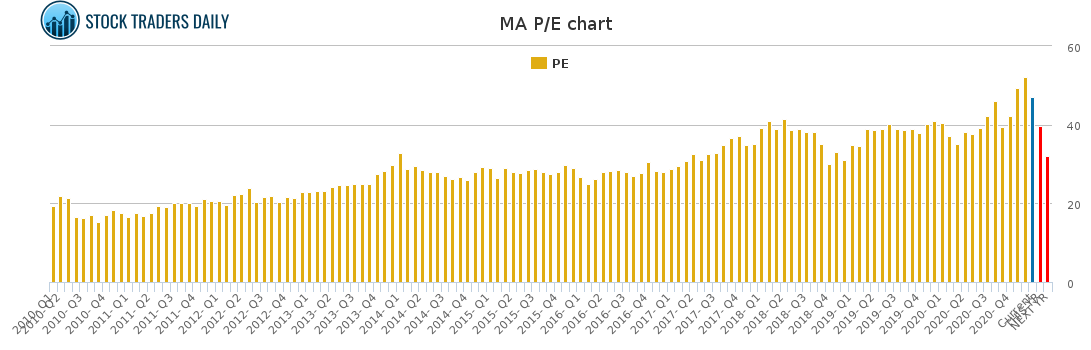

A ‘moving’ average (MA) is the typical closing price of a specific stock (or index) over the last ‘X’ days.

The majority of amateur traders will take out of a trade based on what is occurring.

4 NGUỒN TÌM CHIẾN THUẬT GIAO DỊCH FOREX, Find interesting updated videos related to Ema Trading Babypips.

The Most Typical Forex Mistakes – Part 1

It will take some preliminary work, but when done you will not have to pay anybody else for the service. Another example, let’s say you are brief and your stock has a fast relocation versus you.

In my earlier articles, we have actually discovered indicators, chart patterns, finance and other pieces of successful trading. In this short article, let us evaluate those pieces and puzzle them together in order to discover conditions we choose for entering a trade.

However, if there is a breakout through among the external bands, the price will tend to continue in the very same instructions for a while and robustly so if there is an increase Moving Average Trader in volume.

There are a couple of possible descriptions for this. The very first and most obvious is that I was simply setting the stops too close. This may have allowed the random “sound” of the price movements to activate my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was taking part in “stop searching”. I’ve written a more total article on this subject currently, however essentially this includes market players who attempt to press the cost to a point where they believe a lot of stop loss orders will be set off. They do this so that they can either enter the market at a better rate for themselves or to cause a cumulative relocation in a direction that benefits their existing positions.

There are Forex MA Trading theories on why this sell-off is taking place. Undoubtedly, any genuine strength and even support in the U.S. dollar will generally be bearish for valuable metals like gold and silver. Because the U.S. holds the biggest stockpiles of these metals and they are traded in U.S. dollars internationally, this is mainly. Despite the fact that gold is more of a recognized currency, they both have level of sensitivity to modifications in the U.S. dollar’s worth.

Among the primary signs that can help you establish the way the index is moving is the Moving Average (MA). This takes the index price over the last specified variety of averages and days it. With each new day it drops the first rate utilized in the previous day’s computation. It’s always great to check the MA of a number of periods depending if you are looking to day trade or invest. Then a MA over 5, 15, and 30 minutes are a good idea, if you’re looking to day trade. If you’re searching for long term financial investment then 50, 100, and 200 days might be more what you require. For those who have trades lasting a few days to a few weeks then periods of 10, 20 and 50 days Stocks MA Trading be better.

One of the best ways to break into the world of journalism is to have a specialism or to develop one. Then you have a chance of conveying that interest to an editor, if you are enthusiastic about your subject. Whether this is bee-keeping or the involved world of forex trading if you have the knowledge and know-how then ultimately might be looked for for your remarks and viewpoints.

Shorting isn’t for everyone, but here’s one of my methods for picking stocks to short. Weakness is a stock trading below the 200 day moving average – make a list of all stocks that are trading below that level.

At the day level there are periods also that the rate does not mainly and durations that the rate change mainly. When London stock opens advertisement when U.S.A. stock opens, the dangerous time durations are. Likewise there are large modifications when Berlin stock opens. After each one opens, there are frequently large changes in the prices for a man hours. The most dangerous time durations is the time at which two stocks are overlapped in time.

While it is $990 instead of $1,000 it does represent that milestone. You need to master just these 2 oscillators the Stochastics and the MACD (Moving Average Merging Divergence). You just need to have patience and discipline.

If you are looking most entertaining comparisons about Ema Trading Babypips, and Option Trading, Swing Trading, Stock Trading, Momentum Forex Strategy please join our email subscription DB totally free.