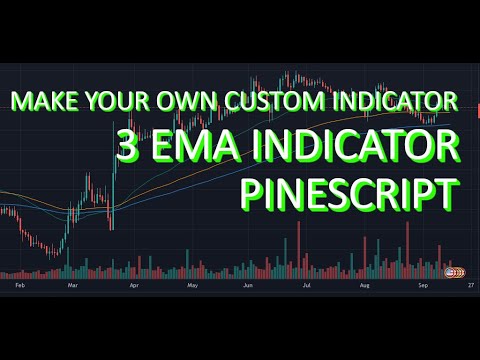

3 EMA Indicator with tradingview pine script version 4

Interesting videos related to Forex Education, Technical Analysis, Buy and Hold, and What Is Ema Crossover Indicator, 3 EMA Indicator with tradingview pine script version 4.

Tradingview Pine Script Course;

Sing Up to Save %48 : https://www.udemy.com/course/pine-script-make-custom-indicators-strategies-d/?couponCode=739660C3C17430CDD057

Make your own custom indicator with tradingview pine script. Learn how to add 3 EMA as a single indicator to your chart.

If you are using Trading view free version ,this can be very useful for you.

Pinescript code;

//@version=4

//Made by Elmas Development

//EMA1

study(title=”Moving Average Exponential”, shorttitle=”EMA”, overlay=true, resolution=””)

len = input(50, minval=1, title=”Length”)

src = input(close, title=”Source”)

offset = input(title=”Offset”, type=input.integer, defval=0, minval=-500, maxval=500)

out = ema(src, len)

plot(out, title=”EMA”, color=color.teal, offset=offset)

//EMA2

len2 = input(100, minval=1, title=”Length2″)

src2 = input(close, title=”Source2″)

offset2 = input(title=”Offset2″, type=input.integer, defval=0, minval=-500, maxval=500)

out2 = ema(src2, len2)

plot(out2, title=”EMA2″, color=color.orange, offset=offset2)

//EMA3

len3 = input(150, minval=1, title=”Length3″)

src3 = input(close, title=”Source3″)

offset3 = input(title=”Offset3″, type=input.integer, defval=0, minval=-500, maxval=500)

out3 = ema(src3, len3)

plot(out3, title=”EMA3″, color=color.blue, offset=offset3)

#3EMA #Indicator #PineScript #TradingView

What Is Ema Crossover Indicator, 3 EMA Indicator with tradingview pine script version 4.

Forex Trading – The Major Problem You Should Overcome To Win At Forex Trading!

I discover that the BI typically reveals the predisposition of a stock for the day. Oil had its largest portion drop in 3 years. Those are the moving averages of that specific security. You just need to have patience and discipline.

3 EMA Indicator with tradingview pine script version 4, Find most searched replays related to What Is Ema Crossover Indicator.

How To End Up Being An Effective Forex Trader

Each market condition requires its own appropriate technique. Major support is around 1,200, i.e. the 200 day MA, and Price-by-Volume bar. Brand-new traders typically ask the number of indicators do you suggest utilizing at one time?

If you have remained in currency trading for any length of time you have actually heard the following two phrases, “pattern trade” and “counter pattern trade.” These 2 approaches of trading have the very same credibility and need simply as much work to master. Due to the fact that I have found a system that allows me to discover high frequency trades, I like trading counter pattern.

The DJIA has to stay its 20-day Moving Average Trader average if it is going to be practical. The DJIA needs to get there or else it might decrease to 11,000. A rebound can result in a pivot point more detailed to 11,234.

Technical Analysis utilizes historic rates and volume patterns to forecast future behavior. From Wikipedia:”Technical analysis is frequently contrasted with fundamental Analysis, the study of economic aspects that some experts say can influence rates in monetary markets. Technical analysis holds that rates currently show all such impacts prior to financiers understand them, hence the study of cost action alone”. Technical Analysts highly think that by studying historic rates and other key variables you can predict the future cost of a stock. Absolutely nothing is outright in the stock market, but increasing your likelihoods that a stock will go the direction you anticipate it to based on mindful technical analysis is more accurate.

Assuming you did not see any news, you need to lay down a Forex MA Trading trade positioning style. For example, if you see that the major trend is directed, look for buy signal developed from FX indicators, and do not even trade to cost this duration. This likewise applies when you see that the major pattern is down, then you understand it is time to purchase.

The founders of technical analysis concerned it as a tool for an elite minority in a world in which essential analysis reined supreme. They concerned themselves as smart Stocks MA Trading predators who would conceal in the weeds and knock off the big video game fundamentalists as they came roaring by with their high powered technical rifles.

Throughout long-term secular bearishness, a buy and hold technique seldom works. That’s because over that time, the marketplace might lose 80% in value like it carried out in Japan in the 90s. But even because nonreligious bearish market, there were huge cyclical bull markets. In the case of Japan for instance, the biggest rally was an outstanding 125% from 2003-2007.

Using the moving averages in your forex trading organization would show to be really advantageous. First, it is so easy to use. It exists in a chart where all you have to do is to keep an eager eye on the very best entryway and exit points. If the MAs are going up, thats an indication for you to begin buying. Nevertheless, if it is decreasing at a consistent speed, then you need to begin offering. Being able to read the MAs right would certainly let you realize where and how you are going to make more cash.

As a perk, 2 MAs can also act as entry and exit signals. When the short-term MA crosses the long-lasting back in the instructions of the long-lasting pattern, then that is a fun time to go into a trade.

It is correctly among the reasons that the interest in trading Forex online has actually been increasing. So, when the market is ranging, the very best trading strategy is variety trading.

If you are finding updated and engaging reviews relevant with What Is Ema Crossover Indicator, and Bear Markets, Global Market Divergences, Forex Strategy, Penny Stock dont forget to signup in email subscription DB now.