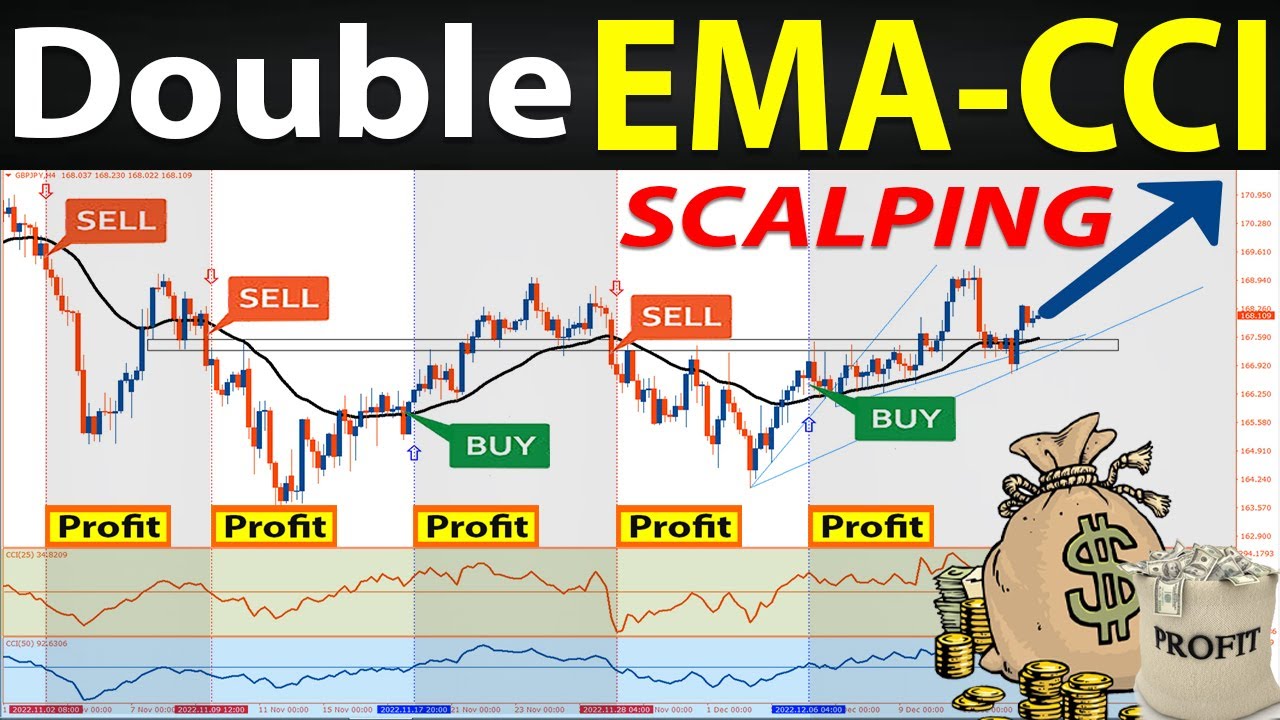

🔴 The “DOUBLE EMA-CCI” SCALPING & SWING Trading Strategy – The Best Zero Line Cross Trading Strategy

Top high defination online streaming relevant with Trading Part Time, Trading Tool, Current Sector Trends, and What Is Ema Crossover Indicator, 🔴 The “DOUBLE EMA-CCI” SCALPING & SWING Trading Strategy – The Best Zero Line Cross Trading Strategy.

🔴 *FREE DOWNLOAD TRADING SYSTEM:*

Double CCI Forex & Stock “SCALPING and SWING” Trading Strategy

Super Woodie CCI “Forex & Stocks” Trading Strategy with Momentum and Heiken Ashi

Forex ATR Ratio Trading for Strong Movements and Higher Probability of a Trend Change (ATR)

================

The “DOUBLE CCI” SCALPING & SWING Trading Strategy – The Best Zero Line Cross Trading Strategy

What Is Ema Crossover Indicator, 🔴 The “DOUBLE EMA-CCI” SCALPING & SWING Trading Strategy – The Best Zero Line Cross Trading Strategy.

Day Trading In Your Birthday Suit

That setup might not happen for XYZ throughout the rest of the year. Palladium looks to be holding while platinum is anybody’s guess at this point. Naturally, these moving averages are used as dynamic assistance and resistance levels.

🔴 The “DOUBLE EMA-CCI” SCALPING & SWING Trading Strategy – The Best Zero Line Cross Trading Strategy, Explore top replays related to What Is Ema Crossover Indicator.

How Do You Select The Very Best Day Trading Method?

In some cases I am lucky to reach my day target in very first 5-10 minutes of session opening. Well, if a powerful relocation is underway, then the rate is moving away from the average, and the bands expand.

Brand-new traders often ask the number of signs do you suggest using at one time? You don’t require to succumb to analysis paralysis. You ought to master only these two oscillators the Stochastics and the MACD (Moving Typical Merging Divergence).

The DJIA has to stay its 20-day Moving Average Trader typical if it is going to be practical. The DJIA has to arrive otherwise it might decrease to 11,000. A rebound can result in a pivot point more detailed to 11,234.

Technical experts try to find a pattern, and flight that trend up until the trend has confirmed a turnaround. If a good business’s stock is in a sag according to its chart, a trader or financier using Technical Analysis will not buy the stock up until its pattern has reversed and it has been confirmed according to other crucial technical indicators.

Now when we use 3 MAs, the moving average with the least number of durations is defined as fast while the other two are defined as medium and sluggish. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being quick, 10 medium and 15 the sluggish.

The online Stocks MA Trading platforms provide a great deal of sophisticated trading tools as the Bolling Bands indicator and the Stochastics. The Bolling Bands is including a moving typical line, the upper standard and lower basic variance. The most utilized moving average is the 21-bar.

Let’s suppose you remain in the same camp as we are and you believe the long term outlook on gold is very positive. So, each time it dips below a certain value level, you include more to your portfolio, basically “buying on the dips”. This may be quite different from another person who looked at a roll over as a factor to sell out. Yet, both traders are looking at the same technical levels.

For instance, two weeks ago JP Morgan Chase cut its projection for 4th quarter development to only 1.0%, from its currently reduced forecast of 2.5% just a few weeks earlier. The firm also slashed its forecast for the first quarter of next year to simply 0.5%. Goldman Sachs cut its forecasts greatly, to 1% for the 3rd quarter, and 1.5% for the fourth quarter.

Keep in mind, the secret to understanding when to buy and sell stocks is to be constant in using your guidelines and understanding that they will not work every time, but it’s a great deal better than not having any system at all.

Well, if an effective move is underway, then the price is moving away from the average, and the bands expand. However this does not suggest you should enter every trade signals that pops up.

If you are finding instant entertaining comparisons about What Is Ema Crossover Indicator, and Stock Analysis, Fading Market, Strategic Investing, Foreign Currency Trading dont forget to join for a valuable complementary news alert service now.