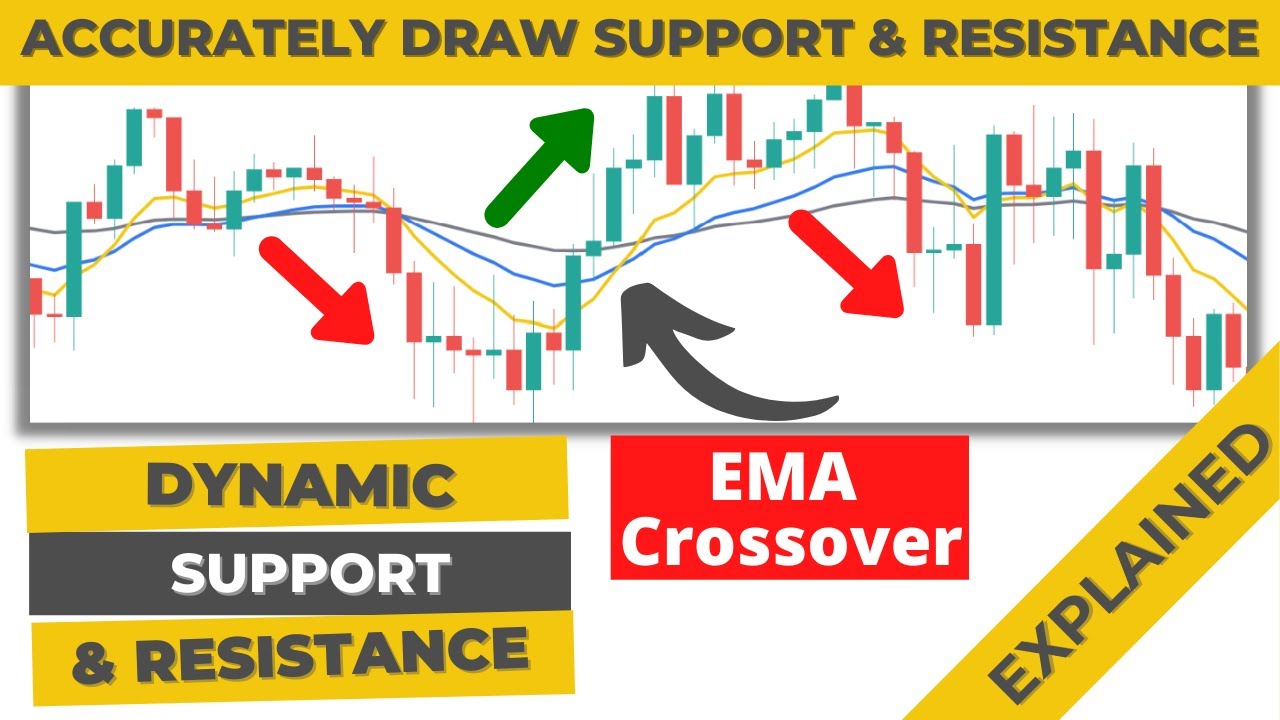

What is Dynamic Support and Resistance in trading | Best Moving average crossover Settings

Latest full length videos about Online Forex Trading, Swing Trading, and What Is Ema Crossover, What is Dynamic Support and Resistance in trading | Best Moving average crossover Settings.

———————————————————–

Get Access to the indicator

✅Discover Hidden Opportunities with Supply & Demand Indicator

👉👉 https://forexbee.co/supply-and-demand-indicator/

———————————————————–

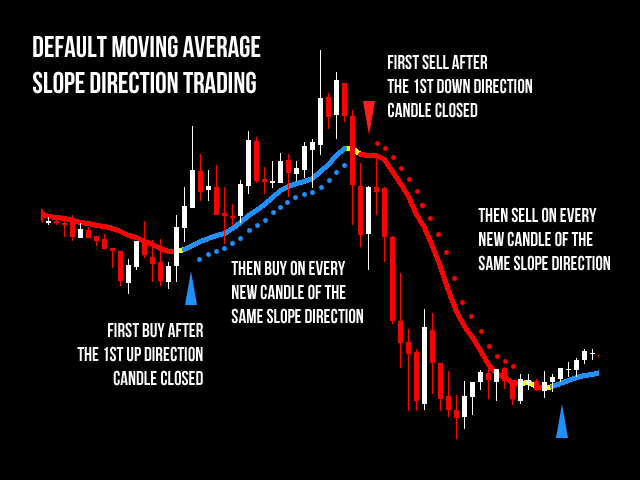

The moving average is one of the most important technical analysis indicators and people mostly use it to predict the trend reversal. In this video, we go through the complete process of how the moving average indicator works, and what is the main difference between simple moving average and exponential moving average. We also go through how you can use it for trend reversal. The ema levels also act as dynamic support and resistance.

.

.

.

Fibonacci retracement strategy

Visit the link below to learn

👉👉👉https://forexbee.co/what-is-moving-average-in-forex/

Visit our website to learn more tactics.

https://forexbee.co/

.

To Master Price Action Trading for free Join telegram 📱

👉👉👉 t.me/forexbee

Visit our website

🌐 https://forexbee.co/

What Is Ema Crossover, What is Dynamic Support and Resistance in trading | Best Moving average crossover Settings.

Forex Trading Secrets To Help The Average Forex Trader Actually Make Some Money

As you can plainly see, knowing stock seasonality can add significant profit to any trader’s account.

You will often see cost respecting these lines and then blowing right through them.

What is Dynamic Support and Resistance in trading | Best Moving average crossover Settings, Play most searched full length videos about What Is Ema Crossover.

Create Your Own Forex Trading System In 5 Simple Steps

You require to set very defined set of swing trading guidelines. For intra day trading you desire to use 3,5 and 15 minute charts. The rate spiked up above 0.7580, took me out and after that headed south again!

I can’t inform you just how much cash you are going to require when you retire. If the amount is not enough it is not ‘when’, however ‘if’. You might have to keep working and hope one of those greeter tasks is readily available at Wal-Mart.

The down pattern in sugar futures is well founded due to the expectations of a substantial 2013 harvest that ought to be led by a record Brazilian harvest. This is news that everybody understands and this basic info has actually brought in good traders to the sell side of the market. Technical traders have likewise had a simple go of it given that what rallies there have been have been capped perfectly by the 90 day moving average. In fact, the last time the 30-day Moving Average Trader typical crossed under the 90-day moving average was in August of in 2015. Lastly, technical traders on the brief side have collected earnings due to the orderly decrease of the market so far rather than getting stopped out on any spikes in volatility.

The most basic application of the BI concept is that when a stock is trading above its Bias Indication you need to have a bullish bias, and when it is trading below its Predisposition Indicator you should have a bearish predisposition.

Forex MA Trading She composed a higher strike rate this time around due to the fact that the pattern seemed accelerating and she didn’t wish to lose out on excessive capital development if it continued to rally.

Taking the high, low, open and close values of the previous day’s price action, tactical levels can be recognized which Stocks MA Trading or might not have an influence on cost action. Pivot point trading puts emphasis on these levels, and utilizes them to direct entry and exit points for trades.

While the year-end rally tends to be rather dependable, it does not happen every year. And this is something stock exchange investors and traders might wish to take note of. In the years when the markets signed up a loss in the last days of trading, we have actually frequently experienced a bearishness the next year.

It’s really real that the marketplace pays a great deal of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the difference was a line made use of a chart. Moving averages for example are ideal studies in when large blocks of cash will buy or sell. View the action surrounding a 200 day moving average and you will see first hand the warfare that happens as shorts attempt and drive it under, and longs purchase for the bounce. It’s cool to watch.

The trader who gets a signal from his/her trading system that is trading on a medium based timeframe is allowing the information to be taken in into the market before taking a position and also to determine their danger. This trader whether he believes prices are random or not thinks that details is gathered and reacted upon at various rates therefore offering opportunity to go into together with The Wizard.

An uptrend is suggested by greater highs and greater lows. In this action, you might increase your money and gold allowances further. The very first and most obvious is that I was merely setting the stops too close.

If you are finding exclusive engaging comparisons related to What Is Ema Crossover, and Stock Trading, Beginner Trading, Forex Market you should list your email address in newsletter now.