Ultimate Beginners Guide To The MACD Indicator [Become An Expert Immediately]

Interesting updated videos about Forex Education, Technical Analysis, Buy and Hold, and Ma Crossover Expert, Ultimate Beginners Guide To The MACD Indicator [Become An Expert Immediately].

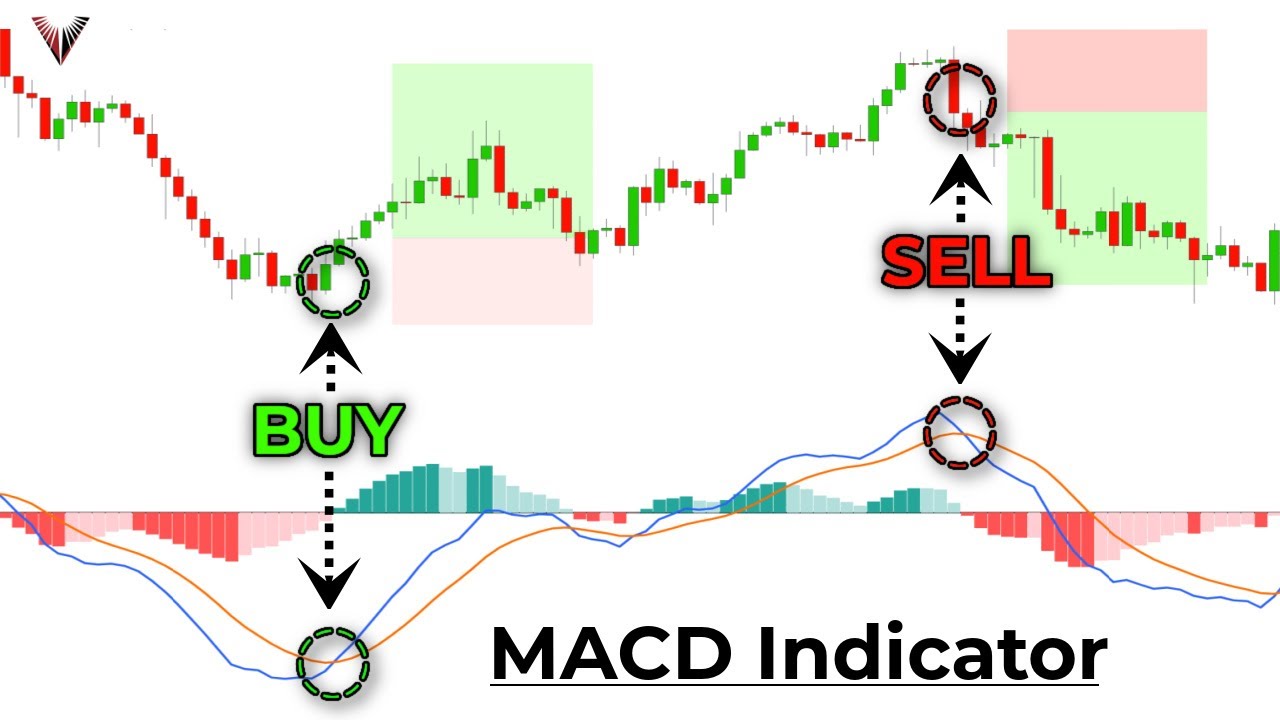

In this video, you will learn everything you need to know about the MACD (Moving Average Convergence Divergence) indicator. We will be talking about what the MACD is, how it works and even the most profitable ways of trading using the MACD Indicator. At the end of the video, you will also learn two rules based trading strategies that are centered around the MACD indicator. This way, you will go away from this video with everything you need in order to conquer markets using the MACD indicator.

VIP EAP Mentorship Program – https://eaptrainingprogram.com/video-sales-page

TTC Forex University – https://ttcfxuniversity.com/pre-launch-sale

FREE FULL FOREX STRATEGY – https://eaptrainingprogram.com/fullstrategyrevealed

Pro Trader Report – https://protraderreport.com/ptr

Free Spreadsheet – FREE course 3 – Part Reversal Series – https://goo.gl/QKaxzV

If you have questions regarding any of the course material above, then email us at support@thetradingchannel.net

———————————–

Full Strategy Videos –

Double Top/Bottom Entry Video – https://youtu.be/6rqfqC79DTY

5 – Wick Rejection Entry Video – https://youtu.be/J1JmNaqLzNM

CONNECT WITH STEVEN ON SOCIAL MEDIA:

Instagram: https://instagram.com/thetradingchannel/

https://instagram.com/stevenkiethhart/

Facebook: https://www.facebook.com/thetradingchannel.net/

————————————-

CLICK HERE TO SUBSCRIBE TO STEVEN’S YOUTUBE CHANNEL NOW:

https://www.youtube.com/channel/UCGL9ubdGcvZh_dvSV2z1hoQ

————————————-

Enjoyed this video? Check out more videos about predictive analysis:

The #1 Trend Trading Technique Of All Time:

The ULTIMATE Beginners Guide To Reading a Candlestick Chart:

over 2.4 million views…

How To Identify Powerful Support/Resistance:

Over 839,000 views

The ULTIMATE Beginner’s Guide to Price Action Trading:

Predictive Analysis 101 For Beginners:

Using Structure to Defeat the Markets:

Learn to Master Technical Analysis/ Price Action Trading:

Top 2 Best Currency Trading Indicators:

*****

In this video, Steven shares what currency pairs you should focus on if you are a beginner in Forex Trading.

———————————–

BIO

Steven Hart –

Steven was recognized as a top 15 Trading educator on YouTube by the very critical feedspot.com.

Link – https://blog.feedspot.com/trading_you…

He became a self-made professional trader at 20 years old. Today he is the “Honest Trading Coach” to hundreds of thousands of traders around the world.

He is the founder and CEO of The Trading Channel.

For over a decade, Steven has studied the science of trading and psychology. This combination allows him to not only be an incredible trader, but a very understandable teacher as well.

He has developed numerous rules-based trading systems and strategies that are used by top traders around the world.

Today, Steven is on a mission to help 1,000 traders become independently profitable over the next 12 months. Will you be one of them?

—————-

JOIN US IN OUR LATEST FREE TRAINING:

Link – https://thetradingchannel.org/optin

———————————–

OTHER LINKS:

Intro music provided by – https://www.youtube.com/user/ThisIsTh…

Song link – https://www.youtube.com/watch?v=2Ax_E…

Outro music provided by – TULE – Fearless pt.II (feat. Chris Linton) [NCS Release]

Song link – https://youtu.be/S19UcWdOA-I

#supportandresistance#fx#forex

Ma Crossover Expert, Ultimate Beginners Guide To The MACD Indicator [Become An Expert Immediately].

Different Types Of Day Trading Orders

You need to set extremely specified set of swing trading rules. By doing this, you wont need to stress about losing money whenever you trade. Traders wait till the fast one crosses over or below the slower one.

Ultimate Beginners Guide To The MACD Indicator [Become An Expert Immediately], Search trending replays about Ma Crossover Expert.

They Say You Can Not Time The Stock Market

Complex indicators will likely fail to work in the long-term. Moving averages are preferred signs in the forex. Delighted trading and never ever stop finding out! You ought to establish your own system of day trading.

Moving averages (MAs) are one of the most simple yet the most popular technical indicators out there. Calculating a moving average is very easy and is simply the average of the closing rates of a currency pair or for that matter any security over a time period. The timeframe for a MA is figured out by the variety of closing prices you wish to consist of. Comparing the closing rate with the MA can help you figure out the pattern, one of the most essential things in trading.

3) Day trading suggests fast earnings, do not hold stock for more than 25 min. You can always sell with revenue if it starts to fall from top, and after that buy it back later on if it Moving Average Trader end up going up again.

The fact that the BI is assessing such an useful duration indicates that it can often determine the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears establish their preliminary positions for the day. A relocation away from the BI indicates that one side is more powerful than the other. A stock moving above the BI means the dominating sentiment in the stock is bullish. The way in which the stock breaks above and trades above the BI will suggest the strength of the bullish belief. When a stock moves below its BI, the exact same but opposite analysis applies.

You need to determine the beginning of the break out that developed the move you are going to trade against. The majority of people use Assistance and resistance lines to identify these locations. I discover them to be really Forex MA Trading efficient for this purpose.

Since we are utilizing historic data, it is worth keeping in mind that moving averages are ‘lag Stocks MA Trading indications’ and follow the real period the greater the responsiveness of the chart and the close it is to the actual cost line.

The advantage of a frequent trading method is that if it is a rewarding trading technique, it will have a higher return the more times it trades, using a lower take advantage of. This is stating the apparent, but it is often ignored when selecting a trading technique. The goal is to make more profit utilizing the least amount of utilize or threat.

I have actually discussed this numerous times, but I think it deserves mentioning once again. The most typical moving average is the 200-day SMA (basic moving average). Very just put, when the market is above the 200-day SMA, traders say that the marketplace is in an uptrend. The market is in a downtrend when rate is listed below the 200-day SMA.

5 circulation days throughout March of 2000 indicated the NASDAQ top. Likewise crucial is the reality that numerous leading stocks were showing leading signals at the same time. The best stock exchange operators went mostly, or all in cash at this time, and kept their extraordinary gains from the previous 4 or 5 years. They did this by appropriately examining the daily rate and volume action of the NASDAQ. It makes no sense at all to watch major revenues disappear. As soon as you learn to acknowledge market tops, and take appropriate action, your overall trading outcomes will enhance significantly.

I discover this inefficient of a stock traders time. This implies that you require to know how to handle the trade prior to you take an entry. You should establish your own system of day trading.

If you are finding rare and engaging comparisons about Ma Crossover Expert, and Stock Market Tips, Trading Days, Trading System, Beginner Forex Tips – Why You Should Use at Least Two Moving Averages When Trading you should join in email subscription DB now.