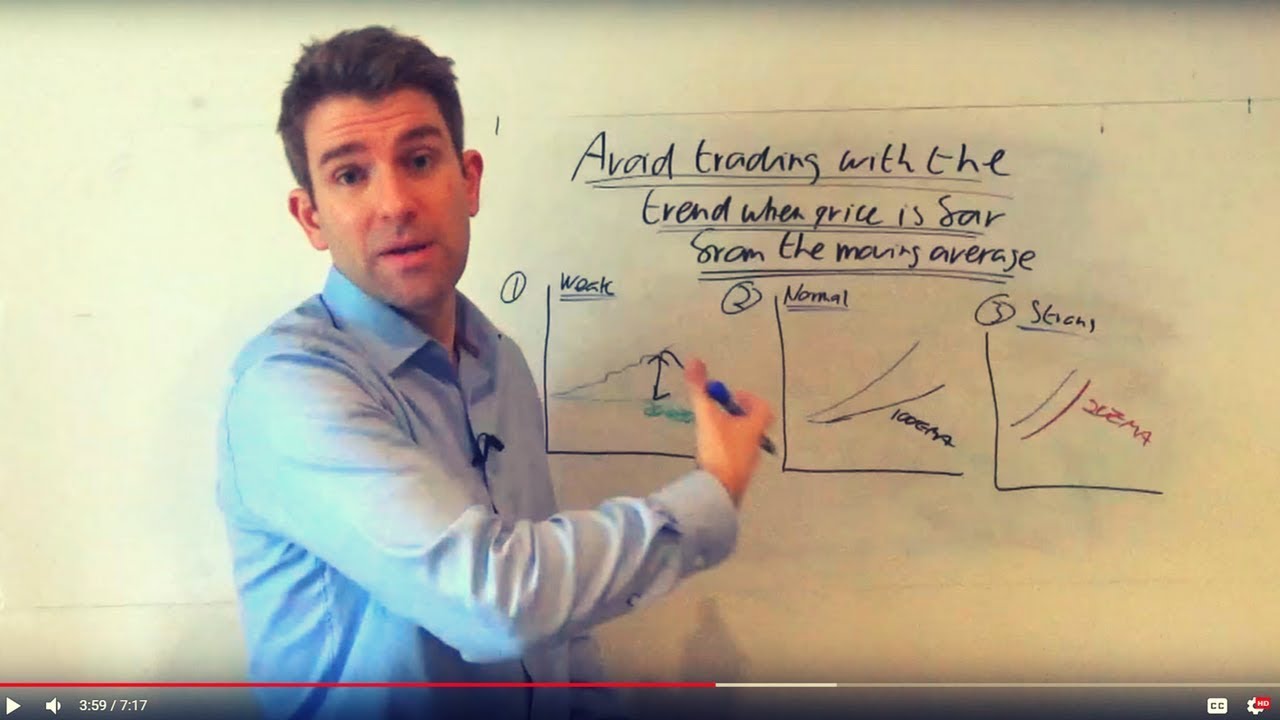

Trend Trading Rule: Avoid Trading with the Trend when Price is TOO Far Away from a Moving Average 👍

Top full length videos relevant with Swing Trading Strategy, Fading Market, and 50 Day Ema Trading Rule, Trend Trading Rule: Avoid Trading with the Trend when Price is TOO Far Away from a Moving Average 👍.

Trend Trading Rule: Avoid Trading with the Trend when Price is TOO Far Away from the Moving Average. http://www.financial-spread-betting.com/academy/trading-with-the-trend.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! Trend Trading with Moving Averages. Trading with the trend, we’ve talked about this many times before. Most of the times we want to align ourselves with the underlying trend of the market; this can be weak or strong but ultimately we are trying to do that. If we are on higher timeframes where the market is trending strongly we’re waiting for a pullback to get long…

Generally speaking there are three types of trends

– Weak trend – this would almost be range-bounding and you don’t want to trade too weak a trend.

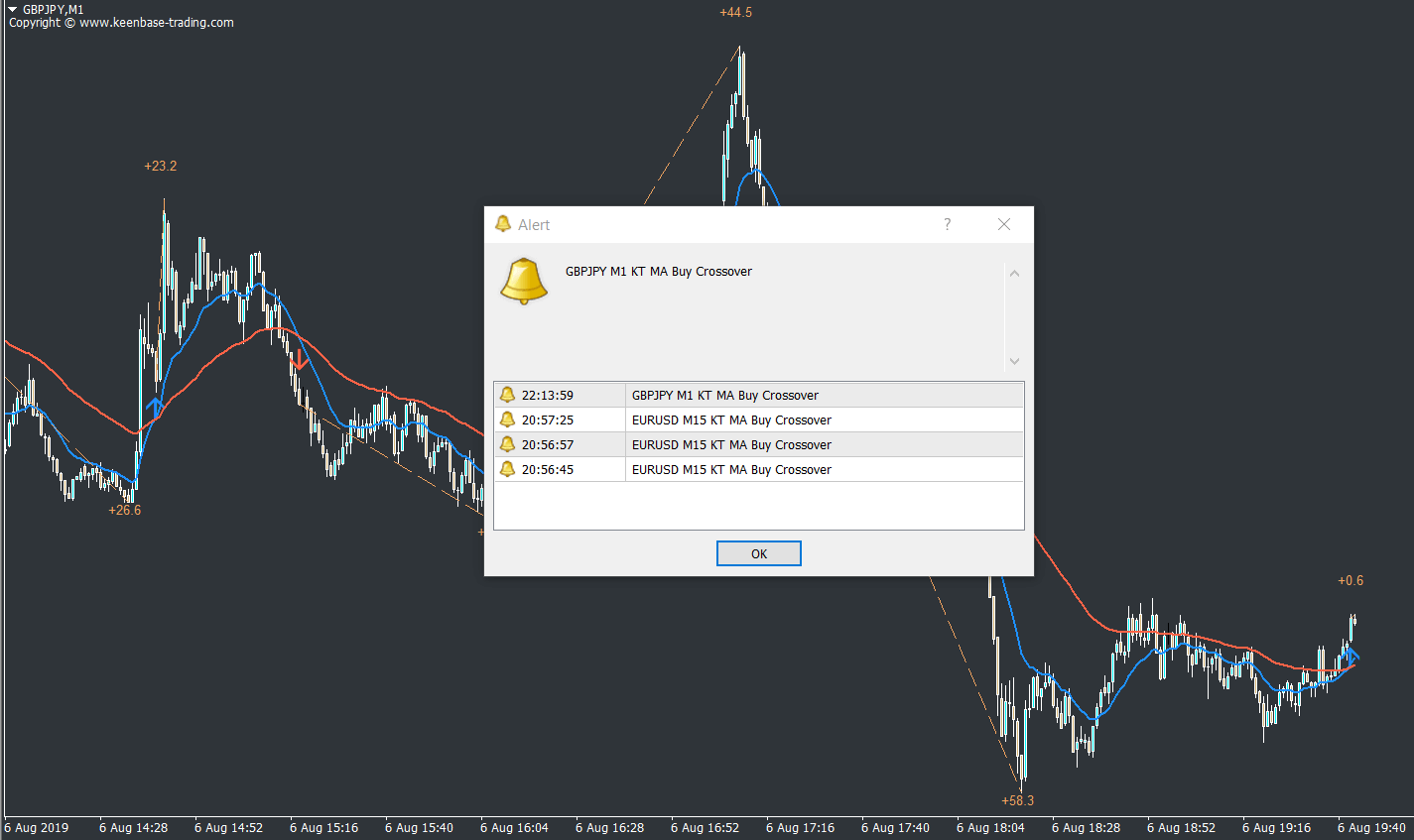

– Normal trend – using a 100 period EMA (exponential moving average) this will be steeper following the market up.

– Strong trend – using a 20 EMA this will be tightly ‘hugging’ the price.

I like to keep things simple and trading a trend is a great adage to use. But generally we don’t want to be chasing the market too tightly as the market could simply reverse to the mean before resuming the trend.

Related Videos

A Trend Trading Strategy Gives You More Opportunities to Profit ✌

5 Trend Following Rules to Follow 🖐️

How to Trade Trends and Build a Trend-Based Trading Strategy! 👊

Guide to Trading Pullbacks within a Trend Part 1 👍

How to Profit from Trading Pullbacks within a Trend Part 2 👍

PullBack Day Trading Strategies Part 3 👍

How Can You Determine the Strength of a Trend? Part 1

How Strong is the Trend? Pullbacks: The Trend Strength Indicator Part 2

Powerful Techniques to Determine Trend Strength: Analysing Past Levels of Support/Resistance Part 3

Tactics for Buying Pullbacks In Strong Trends 👊

Measuring Retracements/Pullbacks in Trends 👍

Trend Trading Rule: Avoid Trading with the Trend when Price is TOO Far Away from a Moving Average 👍

Trend Trading Tips and Rules from Richard Donchian ✌

Missed an Entry in a Trending Market? How to Get On Board a Trend You Missed? 💹

3 Trend Day Trading Traps That Every Trader Must Avoid

https://www.youtube.com/watch?v=KDlIwSbCpWU

50 Day Ema Trading Rule, Trend Trading Rule: Avoid Trading with the Trend when Price is TOO Far Away from a Moving Average 👍.

What Forex Timeframe Do You Trade And Why?

Note that the previous indicators can be used in combination and not just one. Specific tolerance for risk is a good barometer for picking what share rate to short. They do not understand proper trading strategies.

Trend Trading Rule: Avoid Trading with the Trend when Price is TOO Far Away from a Moving Average 👍, Watch more explained videos related to 50 Day Ema Trading Rule.

Management Stocks And Lagging Stocks

During long-lasting nonreligious bear markets, a buy and hold technique hardly ever works. A 50-day moving average line takes 10 weeks of closing price information, and then plots the average.

I have actually been trading futures, alternatives and equities for around 23 years. Along with trading my own cash I have traded money for banks and I have been a broker for personal customers. For many years I have been interested to find the distinction between winners and losers in this organization.

Utilizing the very same 5% stop, our trading system went from losing practically $10,000 to gaining $4635.26 over the exact same ten years of information! The efficiency is now a favorable 9.27%. There were 142 rewarding trades with 198 unprofitable trades with the Moving Average Trader profit being $175.92 and typical loss being $102.76. Now we have a better trading system!

Once the trend is broken, get out of your trade! Cut your losses, and let the long flights offset these small losses. You can re-enter your trade once the pattern has been restored.

Presuming you did not see any news, you require to put down a Forex MA Trading trade putting style. For circumstances, if you see that the significant trend is directed, search for buy signal developed from FX indicators, and do not even trade to offer at this duration. This also applies when you see that the major pattern is down, then you understand it is time to buy.

The online Stocks MA Trading platforms use a great deal of advanced trading tools as the Bolling Bands sign and the Stochastics. The Bolling Bands is including a moving typical line, the upper requirement and lower standard deviation. The most utilized moving average is the 21-bar.

The best way to earn money is buying and selling breakouts. , if you integrate them in your forex trading method you can use them to stack up substantial gains..

NEVER anticipate and try ahead of time – act upon the reality of the modification in momentum and you will have the odds in your favour. Anticipate and try and you are actually just thinking and hoping and will lose.

There you have the two most vital lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can generally be done longer as much as two months, using stops along the method, one doesn’t even actually require to see it, of course one can as they ca-ching in one those safe earnings. The other pattern is fish lips, they are normally held for less than a month, and are left upon upper band touches, or mare precisely retreats from upper band touches. (When the rate touches the upper band and then retreats). Fish lips that re formed out of a flat pattern can often turn into ‘riding the wave,’ and after that are held longer.

Long as the stock holds above that breakout level. The very first and most obvious is that I was simply setting the stops too close. Very first take a look at the last couple of days, then the last few weeks, months and after that year.

If you are finding most entertaining comparisons related to 50 Day Ema Trading Rule, and Stock Sell Signals, Forex Trading Softwa, Chart Stocks please signup for email subscription DB totally free.