TradingView Tutorial || Best Charting Software || Basics to Advanced | SImple Language| BoomingBulls

New guide about Moving Average, Exponential Moving Average, Forex Candlestick, Chart Stocks, and Sma Tradingview, TradingView Tutorial || Best Charting Software || Basics to Advanced | SImple Language| BoomingBulls.

I have literally explained you Tradingview as I use it.

Open Tradingview Account:

https://bit.ly/tradingviewac

OPEN YOUR DEMAT ACCOUNT IN ZERODHA:

https://bit.ly/3gyhIWN

OPEN YOUR DEMAT ACCOUNT IN UPSTOX:

https://upstox.com/open-account/?f=LPQY

BOOKS I RECOMMEND:

—————————————–

Website: https://www.boomingbulls.com

Enquiry / Suggestions: info@boomingbulls.com

Follow us on Instagram: https://www.instagram.com/boomingbulls/

—————————————–

For more content from Anish Sir,

Check This Channel Out: https://www.youtube.com/channel/UC2sI…

Connect to Anish Singh Thakur:

➤Instagram: https://www.instagram.com/anishsinght…

➤Facebook: https://www.facebook.com/ianishsinght…

➤Twitter: https://twitter.com/anishsthakur

➤LinkedIn: https://www.linkedin.com/in/anishsing…

—————————————–

About:

Booming Bulls is an initiative for the young generation who is interested in making more,

willing to step forward and be free from financial situations.

We provide knowledge that is based on self-learning, experience and theoretical implications on the market.

In general, trading is considered a business not suitable for everyone, but this is just a hoax which we clear by letting you learn about the strategies that can provide a good profit.

Sma Tradingview, TradingView Tutorial || Best Charting Software || Basics to Advanced | SImple Language| BoomingBulls.

Top 10 Stock Market Technical Indicators

In a stock daily price chart, if 50SMA moves up and crosses 200SMA, then the pattern is up. You would have purchased in June 2003 and stuck with the up move until January 2008. A sag is indicated by lower highs and lower lows.

TradingView Tutorial || Best Charting Software || Basics to Advanced | SImple Language| BoomingBulls, Enjoy most searched replays relevant with Sma Tradingview.

Best Stock Sign To Utilize For 2011

Five distribution days throughout March of 2000 indicated the NASDAQ top. The trading platforms are more user-friendly than they were years back. It is invariably used in double format, e.g. a 5 day moving average and a 75 day moving average.

Picking the right finest stock indication in 2011 is more tricky than you might think. However making the ideal decision is an important one, specifically in the current stock exchange conditions.

Out of all the stock trading tips that I’ve been given over the ears, bone helped me on a more useful level than these. Moving Average Trader Use them and utilize them well.

The dictionary quotes an average as “the ratio of any amount divided by the number of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

The chart below is a Nasdaq weekly chart. Nasdaq has actually been producing a rising wedge for about two years. The Forex MA Trading indicator has actually been relocating the opposite direction of the price chart (i.e. unfavorable divergence). The three highs in the wedge fit well. However, it’s uncertain if the third low will also give a good fit. The wedge is compressing, which ought to continue to produce volatility. Numerous intermediate-term technical signs, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, and so on, recommend the marketplace will be higher at some point within the next couple of months.

Can we purchase before the share price reaches the breakout point? In lots of instances we can, but ONLY if the volume increases. Sometimes you will have a high opening rate, followed by a quick retracement. This will sometimes be followed by a fast upsurge with high volume. This can be a buy signal, once again, we must Stocks MA Trading sure that the volume is strong.

When identifying a trade’s appropriateness, the new brief positions will have protective stops put reasonably close to the market given that threat should constantly be the number one consideration. This week’s action plainly showed that the marketplace has run out of people ready to create new brief positions under 17.55. Markets always run to where the action is. The declining ranges integrated with this week’s turnaround bar lead me to think that the next move is greater.

Stochastics is used to determine whether the market is overbought or oversold. When it reaches the resistance and it is oversold when it reaches the assistance, the market is overbought. So when you are trading a range, stochastics is the very best sign to tell you when it is overbought or oversold. It is also called a Momentum Indicator!

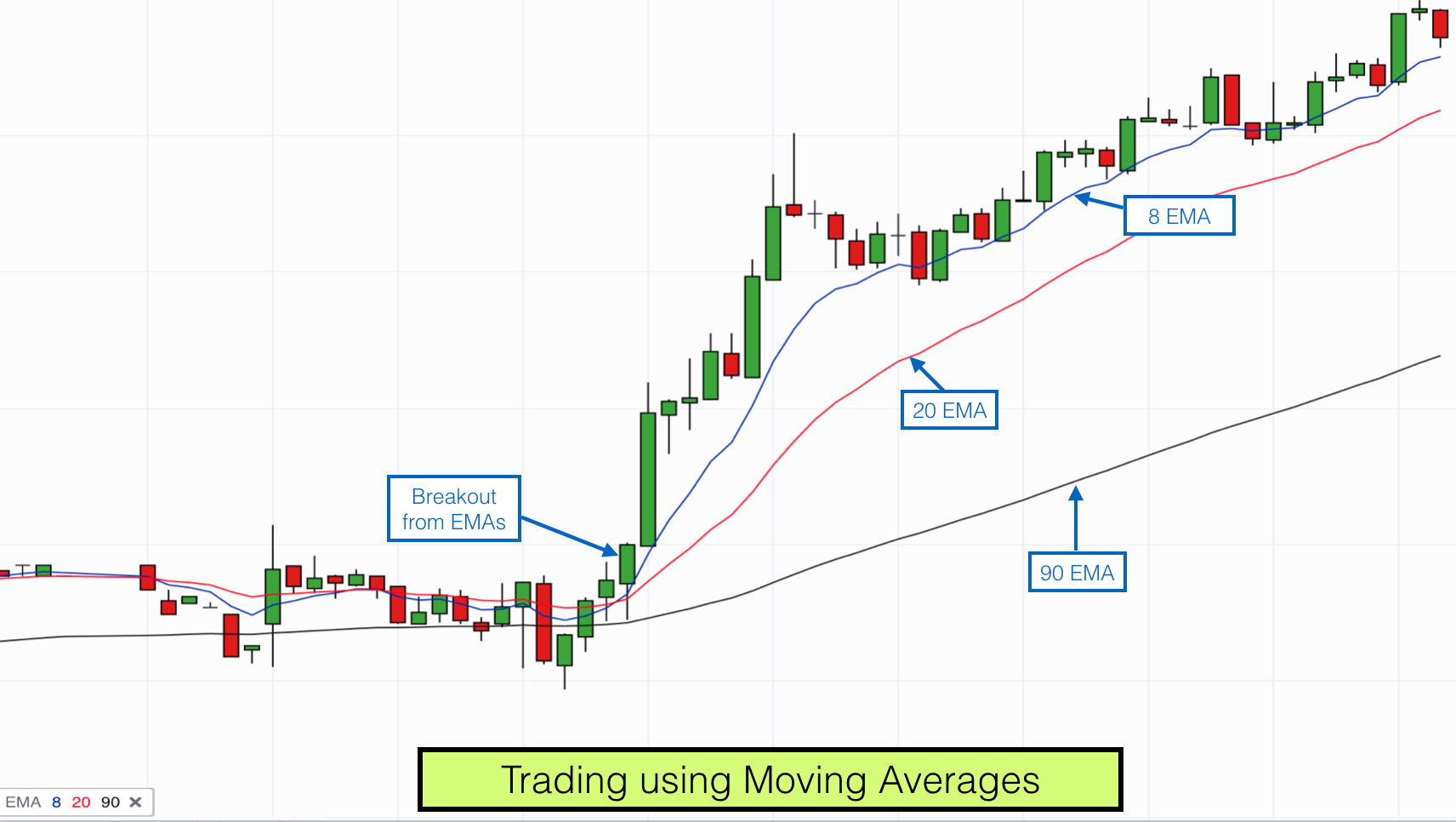

Daily Moving Averages: There are numerous moving averages which is just the typical cost of a stock over a long period of time, on an annual chart I like to use 50, 100 and 200 daily moving averages. They offer a long ravelled curve of the average cost. These lines will likewise become support and resistance points as a stock trades above or listed below its moving averages.

The 2 most popular moving averages are the simple moving typical and the rapid moving average. The declining ranges combined with this week’s reversal bar lead me to think that the next move is higher.

If you are finding rare and exciting comparisons related to Sma Tradingview, and How to Buy Stocks, Forex Tips, Trade Stocks, Learning Forex you are requested to list your email address for newsletter totally free.