TradingView Resolutions/Timeframes/Periods – TradingView Pine Script Tutorial 7

Top YouTube videos relevant with Perfect Systems, Moving Average Crossover, and How To Add Sma Tradingview, TradingView Resolutions/Timeframes/Periods – TradingView Pine Script Tutorial 7.

🔻🔻🔻🔻 IMPORTANT LINKS BELOW 🔻🔻🔻🔻

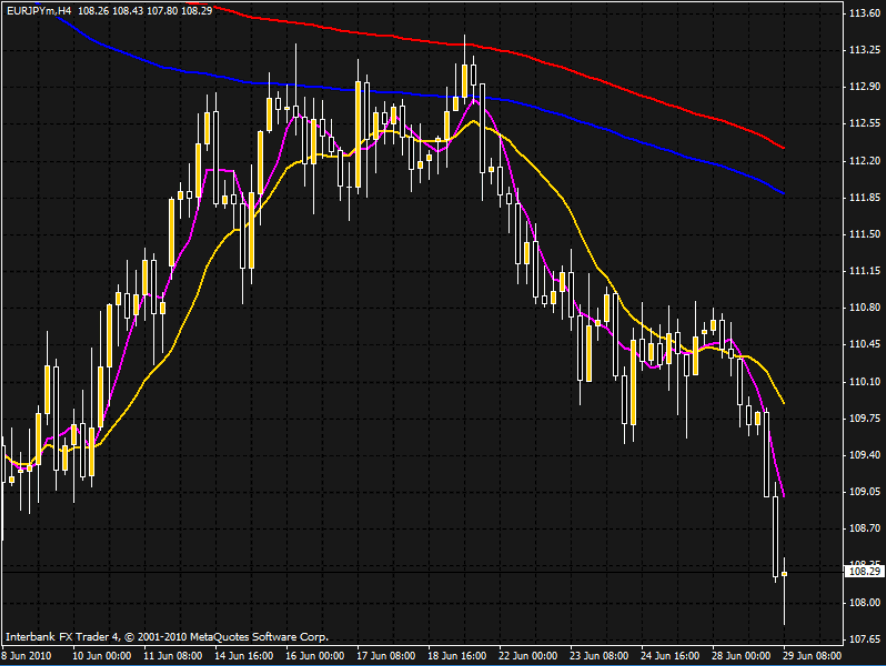

TradingView Resolutions/Timeframes/Periods: In this TradingView Pine Script Tutorial we discuss how to use different resolutions than the current resolution selected with the chart. Resolutions are oftentimes referred to as Timeframes or Periods in trading. An example of using different resolutions is to calculate a moving average on the daily timeframe and plot it on a chart that is currently looking at the 4-hour resolution. With Pine Script it is very easy for even beginners to create their own indicators that have many other indicators within them. Once we have completed the script, we can see our results immediately and begin working with more functions and indicators before eventually moving on to creating our own strategies.

🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️

Social and other public profiles

🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️🙋🏼♂️

💻 Website: https://www.bigbits.io

🎮 Discord: https://discord.gg/rapMn4z

🐦 Twitter: https://twitter.com/BigBitsIO

📔 Facebook: https://www.facebook.com/BigBitsIO/

👨💻GitHub: https://github.com/BigBitsIO

📈TradingView: https://www.tradingview.com/u/BigBitsIO

💰💰💰💰💰💰💰💰💰💰💰

Referral links

💰💰💰💰💰💰💰💰💰💰💰

📈 Buy, Sell and Trade Crypto on Binance.US with LOW fees: https://www.binance.us/?ref=35105151

🙋♂️ Want to buy crypto? Get $10 of bitcoin w/ your first purchase over $100: https://www.coinbase.com/join/johnso_dxz

📈 Sign up for a paid plan at TradingView and receive a $30 credit: https://www.tradingview.com/gopro/?share_your_love=BigBitsIO

💻 Browse privately and get rewarded with Brave Browser: https://brave.com/big406

🕹 Receive bonus perks when purchasing Lightnite Game: https://lightnite.io/ref=BigBits

VIEW ALL HERE: https://bigbits.io/bigbits-referrals/

❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️

DISCLAIMER: All my videos are for educational and entertainment purposes only. Nothing in this or any of my videos should be interpreted as financial advice or a recommendation to buy or sell any sort of security or investment including all types of crypto coins and tokens. Consult with a professional financial advisor before making any financial decisions. Investing in general and particularly with crypto trading especially is risky and has the potential for one to lose most or all of the initial investment. In simple terms, you are responsible for your actions when trading.

❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️❗️

#bitcoin #crypto #cryptocurrencies #tradingview #binance #binanceUS #coinbase

This channel focuses on Bitcoin, Ethereum, LiteCoin, Ripple, Link, Basic Attention Token and almost all cryptocurrencies that demand attention. Please like the video if you liked the video, and subscribe if you like these types of videos. David from BigBits is an experienced Software Engineer, but no one is perfect, If you find any issues with any of the open-source, free code, or code shown in videos please comment to let us know what to fix, we listen to our viewers!

How To Add Sma Tradingview, TradingView Resolutions/Timeframes/Periods – TradingView Pine Script Tutorial 7.

Trading Forex – Finest Currencies To Trade

There are dozens of technical signs out there. So which ones will respond quicker to the market and be more apt to offer false signals? I have discovered that this system gives a 70%-75% success rate.

TradingView Resolutions/Timeframes/Periods – TradingView Pine Script Tutorial 7, Enjoy interesting explained videos about How To Add Sma Tradingview.

Stock Trading Courses – 7 Tips To Selecting The Ideal Course!

After all, a lot of indicators can result in choice paralysis. To discover a great place for a stop, pretend that you’re thinking about a sell the instructions of the stop. A sag is suggested by lower highs and lower lows.

In less than four years, the price of oil has risen about 300%, or over $50 a barrel. The Light Crude Constant Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Constantly high oil rates will eventually slow economic growth, which in turn will trigger oil prices to fall, ceritus paribus.

The down pattern in sugar futures is well established due to the expectations of a big 2013 harvest that ought to be led by a record Brazilian harvest. This is news that everybody understands and this basic information has actually brought in excellent traders to the sell side of the market. Technical traders have also had a simple go of it considering that what rallies there have actually been have been topped well by the 90 day moving average. In reality, the last time the 30-day Moving Average Trader average crossed under the 90-day moving average was in August of last year. Lastly, technical traders on the short side have gathered revenues due to the organized decline of the market thus far rather than getting stopped out on any spikes in volatility.

The two charts listed below are very same period daily charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & utility stocks. The 2 charts below show SPX began the recent rally about a month prior to OIH. Also, the charts indicate, non-energy & energy stocks tipped over the previous week or two, while energy & energy stocks stayed high or rose even more.

The chart below is a Nasdaq weekly chart. Nasdaq has actually been producing a rising wedge for about 2 years. The Forex MA Trading indicator has actually been relocating the opposite direction of the cost chart (i.e. negative divergence). The three highs in the wedge fit well. However, it’s unpredictable if the third low will likewise give an excellent fit. The wedge is compressing, which should continue to create volatility. Many intermediate-term technical indicators, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, etc., suggest the marketplace will be greater sometime within the next few months.

You have actually most likely heard the phrase that “booming Stocks MA Trading climb a wall of worry” – well there doesn’t appear to be much of a wall of worry left anymore. At least as far as the retail investor is concerned.

If you make four or more day trades in a rolling five-trading-day period, you will be considered a pattern day trader no matter you have $25,000 or not. A day trading minimum equity call will be provided on your account requiring you to deposit extra funds or securities if your account equity falls below $25,000.

If the price of my stock or ETF falls to the 20-day SMA and closes listed below it, I like to include a couple of Put choices– possibly a third of my position. I’ll add another third if the stock then continues down and heads toward the 50-day SMA. If the cost closes listed below the 50-day SMA, I’ll add another 3rd.

The basic rule in trading with the Stochastics is that when the reading is above 80%, it means that the marketplace is overbought and is ripe for a down correction. Similarly when the reading is below 20%, it implies that the marketplace is oversold and is going to bounce down quickly!

Moving averages can inform you how fast a pattern is moving and in what instructions. In lots of circumstances we can, however ONLY if the volume boosts. Again another fantastic system that nobody truly discusses.

If you are finding best ever engaging reviews related to How To Add Sma Tradingview, and Penny Stock, Learn Forex Trading, Forex Tools, Macd Day Trading please signup in newsletter totally free.