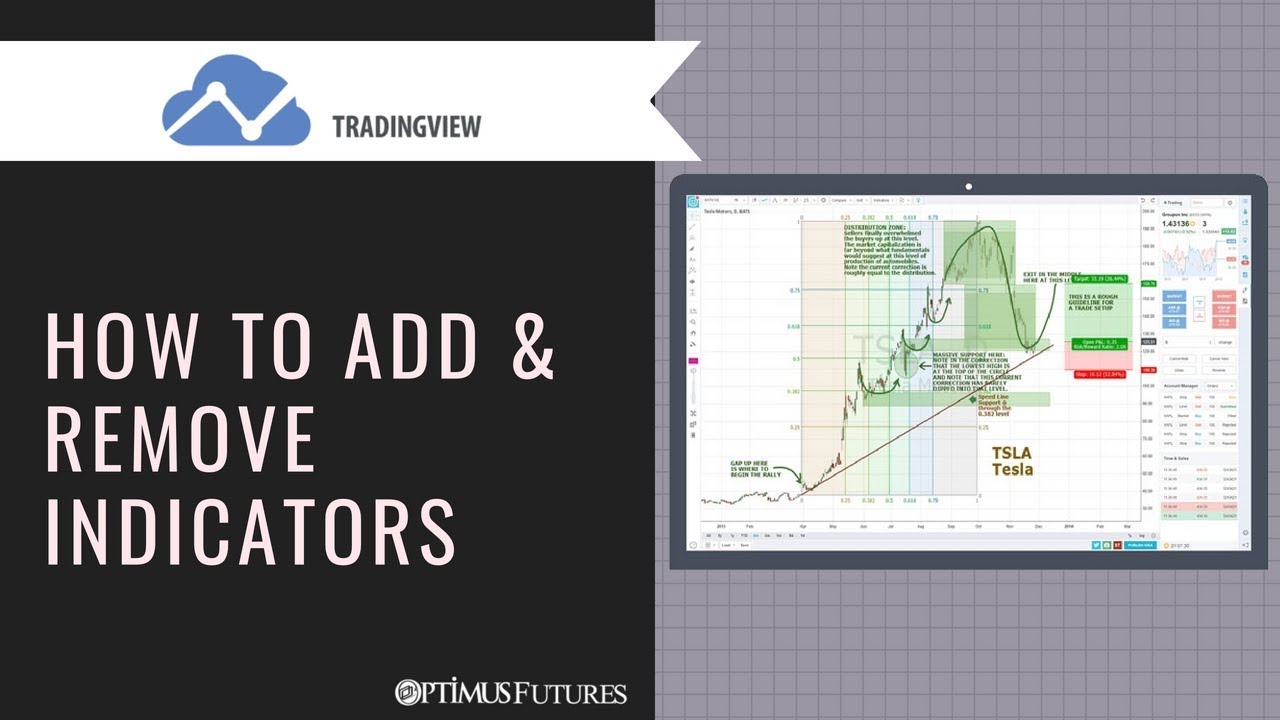

Tradingview – How to Add and Remove Indicators

Best vids top searched Day Trading, Trading Indicators, Forex Trading School, and How To Add Sma Tradingview, Tradingview – How to Add and Remove Indicators.

This video shows us how to add and remove indicators to and from our charts.

for a free download, please go to https://optimusfutures.com/TradingView.php

Questions? general@optimusfutures.com

TRADING FUTURES AND OPTIONS INVOLVES A SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

How To Add Sma Tradingview, Tradingview – How to Add and Remove Indicators.

3 Reasons To Begin Trading Online Today

A relocation away from the BI suggests that one side is stronger than the other. They are very advantageous in revealing trends by eliminating cost noise. We only want the average to help us find the pattern.

Tradingview – How to Add and Remove Indicators, Search more videos relevant with How To Add Sma Tradingview.

Forex Leading Indicators: Is There A Real Leading Indicator?

The technical analysis must also be figured out by the Forex trader. Currently, SPX is oversold enough to bounce into the Labor Day holiday. The 2nd line is the signal line represented as %D. %D is an easy moving average of %K.

I can’t tell you how much cash you are going to require when you retire. If the quantity is insufficient it is not ‘when’, however ‘if’. You might need to keep working and hope one of those greeter jobs is readily available at Wal-Mart.

Constantly utilize stop losses. You need to always secure your trades with a stop loss. If you are trading part time and you do not keep track of the market all day long, this is absolutely needed Moving Average Trader . It likewise assists to reduce your stress levels as you know ahead just how much you are likely to loss if the trade does not enter your favour.

Accomplishing success in currency trading involves a high level of discipline. It can not be treated as a side business. It not just requires knowledge about the trends but also about the direction the patterns will move. There are lots of software application offered to know the pattern and follow a system but in reality to achieve success in currency trading a trader ought to develop their own system for trading and above all to follow it consistently.

The chart below is a Nasdaq weekly chart. Nasdaq has actually been developing a rising wedge for about two years. The Forex MA Trading sign has been moving in the opposite direction of the cost chart (i.e. negative divergence). The three highs in the wedge fit well. However, it doubts if the 3rd low will likewise provide a great fit. The wedge is compressing, which should continue to create volatility. Many intermediate-term technical indications, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, and so on, recommend the marketplace will be greater at some point within the next few months.

Taking the high, low, open and close values of the previous day’s price action, tactical levels can be recognized which Stocks MA Trading or may not have an impact on rate action. Pivot point trading puts emphasis on these levels, and uses them to assist entry and exit points for trades.

During long-term secular bearish market, a buy and hold technique seldom works. That’s because over that time, the market may lose 80% in worth like it carried out in Japan in the 90s. However even in that nonreligious bearish market, there were huge cyclical bull markets. When it comes to Japan for example, the most significant rally was a remarkable 125% from 2003-2007.

I have actually discussed this a number of times, but I think it deserves mentioning again. The most common moving average is the 200-day SMA (simple moving average). Extremely basically, when the market is above the 200-day SMA, traders say that the market is in an uptrend. When price is listed below the 200-day SMA, the marketplace is in a downtrend.

At the day level there are durations also that the price does not mainly and durations that the price change mainly. The dangerous period are when London stock opens ad when U.S.A. stock opens. Likewise there are big changes when Berlin stock opens. After every one opens, there are frequently large changes in the costs for a man hours. The most dangerous period is the time at which two stocks are overlapped in time.

Another great way to use the sideways market is to take scalping trades. The timeframe for a MA is figured out by the number of closing prices you want to consist of. When done, select two signs: weighted MA and simple MA.

If you are looking most engaging reviews relevant with How To Add Sma Tradingview, and Forex Day Trading Strategy, Momentum Indicators dont forget to subscribe for email list now.