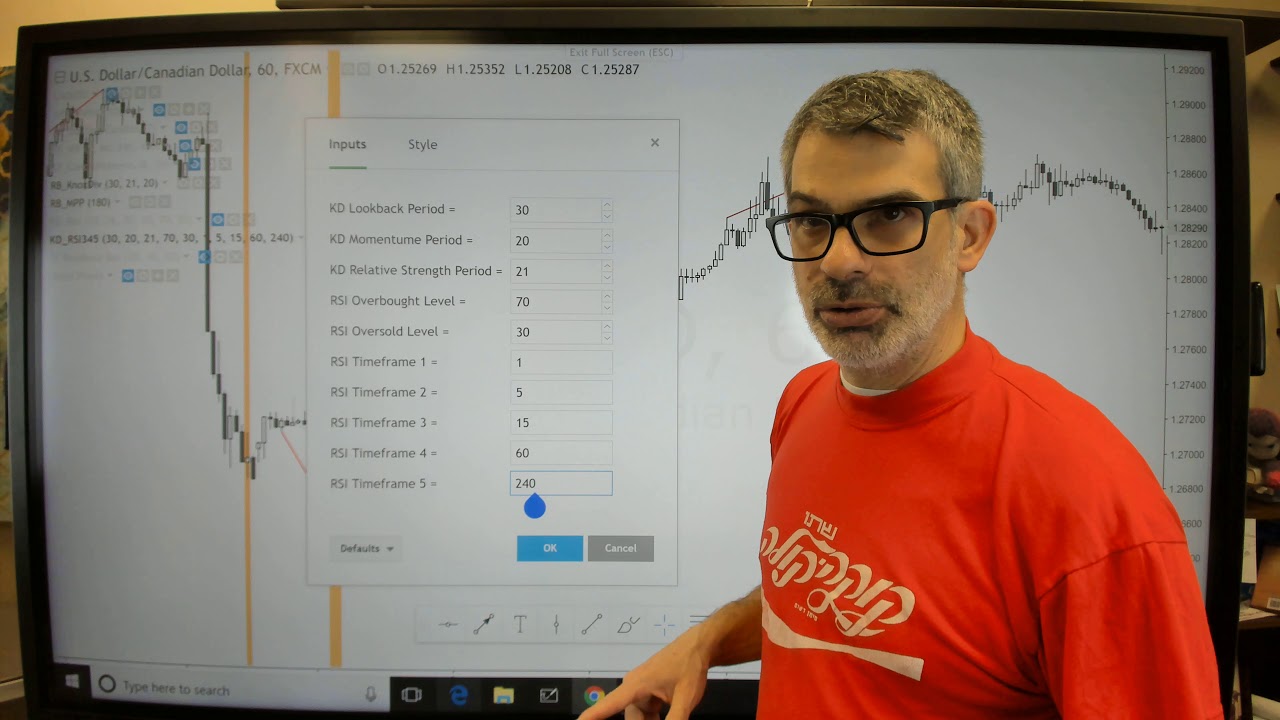

The Multi Time Frame RSI Indicator on TradingView by Rob Booker

Latest complete video related to Forex for Beginners – a Simple 1-2-3 Step Strategy for Making Money, Forex Moving Averages, Pivot Point Trading, and How To Add Sma Tradingview, The Multi Time Frame RSI Indicator on TradingView by Rob Booker.

My Gear: My favorite trading computer: https://amzn.to/2Lj37AA My giant monitor: https://amzn.to/2EwfPuU My favorite computer of all time: …

How To Add Sma Tradingview, The Multi Time Frame RSI Indicator on TradingView by Rob Booker.

Forex Trading Signs – Cliffsnotes On Moving Averages

There are lots of technical indicators out there. So which ones will respond quicker to the marketplace and be more apt to offer incorrect signals? I have actually found that this system gives a 70%-75% success rate.

The Multi Time Frame RSI Indicator on TradingView by Rob Booker, Watch interesting high definition online streaming videos about How To Add Sma Tradingview.

Revealed – Billion Dollar Hedge Fund Trading Secrets

Moving average is one of numerous technical analysis indicators. But even because secular bearish market, there were big cyclical bull markets. The wedge is compressing, which need to continue to produce volatility.

Would not it be great if you were just in the stock exchange when it was going up and have everything transferred to cash while it is going down? It is called ‘market timing’ and your broker or financial organizer will tell you “it can’t be done”. What that person just told you is he does not know how to do it. He does not understand his task.

Nevertheless, if there is a breakout through one of the external bands, the price will tend to continue in the same direction for a while and robustly so if there is a boost Moving Average Trader in volume.

Grooved variety can likewise hold. If the selling is extreme, it may push the stock right past the grooved location – the longer a stock remains at a level, the stronger the support.

There is a variety of financial investment tip sheets and newsletters on the internet. Unfortunately, many if not most of them are paid to advertise the stocks they recommend. Instead of blindly following the recommendations of others you need to develop swing trading guidelines that will cause you to go into a trade. This Forex MA Trading be the stock moving across a moving average; it might be a divergence in between the stock cost and an indication that you are following or it may be as simple as trying to find assistance and resistance levels on the chart.

Taking the high, low, close and open worths of the previous day’s price action, tactical levels can be identified which Stocks MA Trading or may not have an influence on price action. Pivot point trading puts emphasis on these levels, and uses them to guide entry and exit points for trades.

Let’s suppose you remain in the same camp as we are and you think the long term outlook on gold is really positive. So, each time it dips below a particular worth level, you add more to your portfolio, essentially “purchasing on the dips”. This may be rather various from somebody else who looked at a roll over as a factor to sell out. Yet, both traders are taking a look at the very same technical levels.

Shorting isn’t for everybody, however here is among my approaches for choosing stocks to brief. Weakness is a stock trading listed below the 200 day moving average – make a list of all stocks that are trading beneath that level.

Long as the stock holds above that breakout level. That gives the stock assistance at that level. Institutions are huge purchasers on breakouts, and they will often action in and purchase stocks at support levels to keep the stock moving as well.

The gain each day was just 130 pips and the highest loss was a drop of over 170 points. There are a fantastic range of forex indications based on the moving average (MA). Intricately created methods do not constantly work.

If you are finding instant engaging videos relevant with How To Add Sma Tradingview, and Trading Days, Buy Weakness you should subscribe our newsletter now.