The FX BIble LIVE GBPJPY Trade and watchlist 2019 10 08 #18

Best vids relevant with Trading Strong Trend, Momentum Indicators, and Sma Trading Egypt, The FX BIble LIVE GBPJPY Trade and watchlist 2019 10 08 #18.

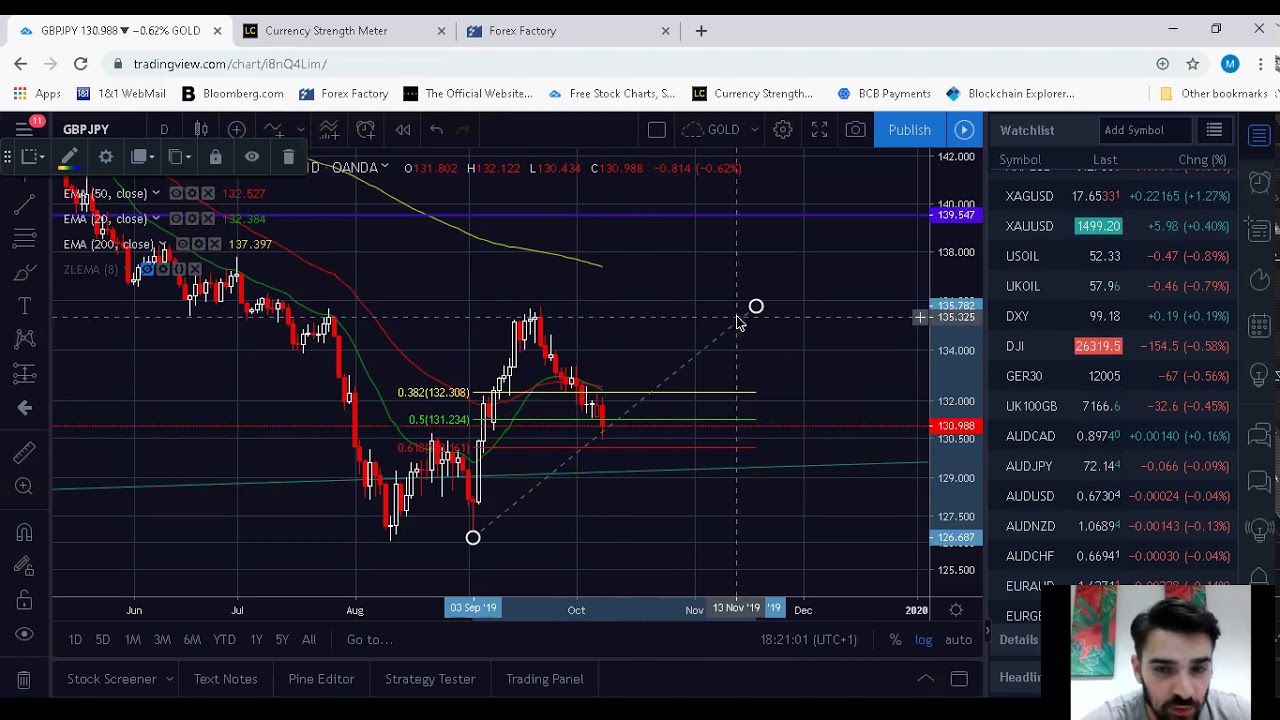

In this webinar we broke down the markets and checked our current watchlists. We were also able to catch a live GBPJPY trade which looks be profitable! See how we analyze the market and execute trades.

Sma Trading Egypt, The FX BIble LIVE GBPJPY Trade and watchlist 2019 10 08 #18.

Forex Trading Signs – Cliffsnotes On Moving Averages

Minor patterns can be quickly noted on 5-minute charts. So, when you utilize MAs, they drag the rate action and whatever trading signals that you get are always late. Likewise active trading can affect your tax rates.

The FX BIble LIVE GBPJPY Trade and watchlist 2019 10 08 #18, Search new updated videos about Sma Trading Egypt.

Forex Trading System – Following The Trend

Individual tolerance for risk is an excellent barometer for choosing what share rate to brief. Do this three times or more to establish a pattern. Traders wait until the fast one crosses over or below the slower one.

Brand-new traders often ask the number of signs do you suggest utilizing at one time? You do not need to come down with analysis paralysis. You need to master only these two oscillators the Stochastics and the MACD (Moving Average Convergence Divergence).

“Remember this Paul,” Peter Moving Average Trader stated as they studied the long term chart, “Wealth comes from taking a look at the big photo. Many individuals think that holding for the long term suggests permanently. I prefer to hold things that are rising in worth.I take my money and wait until the trend turns up again if the pattern turns down.

Technical Analysis uses historic rates and volume patterns to predict future behavior. From Wikipedia:”Technical analysis is regularly contrasted with fundamental Analysis, the study of financial aspects that some analysts state can influence costs in financial markets. Technical analysis holds that rates currently reflect all such impacts prior to investors are mindful of them, hence the research study of price action alone”. Technical Experts strongly think that by studying historical rates and other key variables you can predict the future cost of a stock. Nothing is absolute in the stock exchange, but increasing your likelihoods that a stock will go the instructions you anticipate it to based upon mindful technical analysis is more precise.

Forex MA Trading She wrote a higher strike cost this time around due to the fact that the pattern seemed accelerating and she didn’t want to lose out on too much capital development if it continued to rally.

Let us state that we wish to make a short-term trade, in between 1-10 days. Do a screen for Stocks MA Trading in a new up trend. Bring up the chart of the stock you are interested in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and must be purchased. But as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

When identifying a trade’s suitability, the brand-new brief positions will have protective stops placed fairly close to the market given that threat need to always be the number one factor to consider. Today’s action plainly showed that the market has actually lacked people ready to develop brand-new short positions under 17.55. Markets always go to where the action is. The declining varieties integrated with this week’s reversal bar lead me to believe that the next relocation is greater.

If the cost of my stock or ETF falls to the 20-day SMA and closes below it, I like to include a couple of Put choices– maybe a third of my position. If the stock then continues down and heads towards the 50-day SMA, I’ll include another 3rd. If the price closes below the 50-day SMA, I’ll include another third.

There you have the 2 most important lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can normally be done longer approximately two months, utilizing stops along the method, one does not even truly need to see it, obviously one can as they ca-ching in one those safe revenues. The other pattern is fish lips, they are typically held for less than a month, and are exited upon upper band touches, or mare precisely retreats from upper band touches. (When the rate touches the upper band and after that retreats). Fish lips that re formed out of a flat pattern can typically turn into ‘riding the wave,’ and after that are held longer.

A technique that is reasonably popular with traders is the EMA crossover. Simply divide the everyday average Trading Variety (ATR) by the share cost to get a percentage. They offer a long smoothed out curve of the typical cost.

If you are searching most entertaining comparisons relevant with Sma Trading Egypt, and Forex Candlestick, Stochastics Indicator, Stocks Swing in Cycles please join for email subscription DB for free.