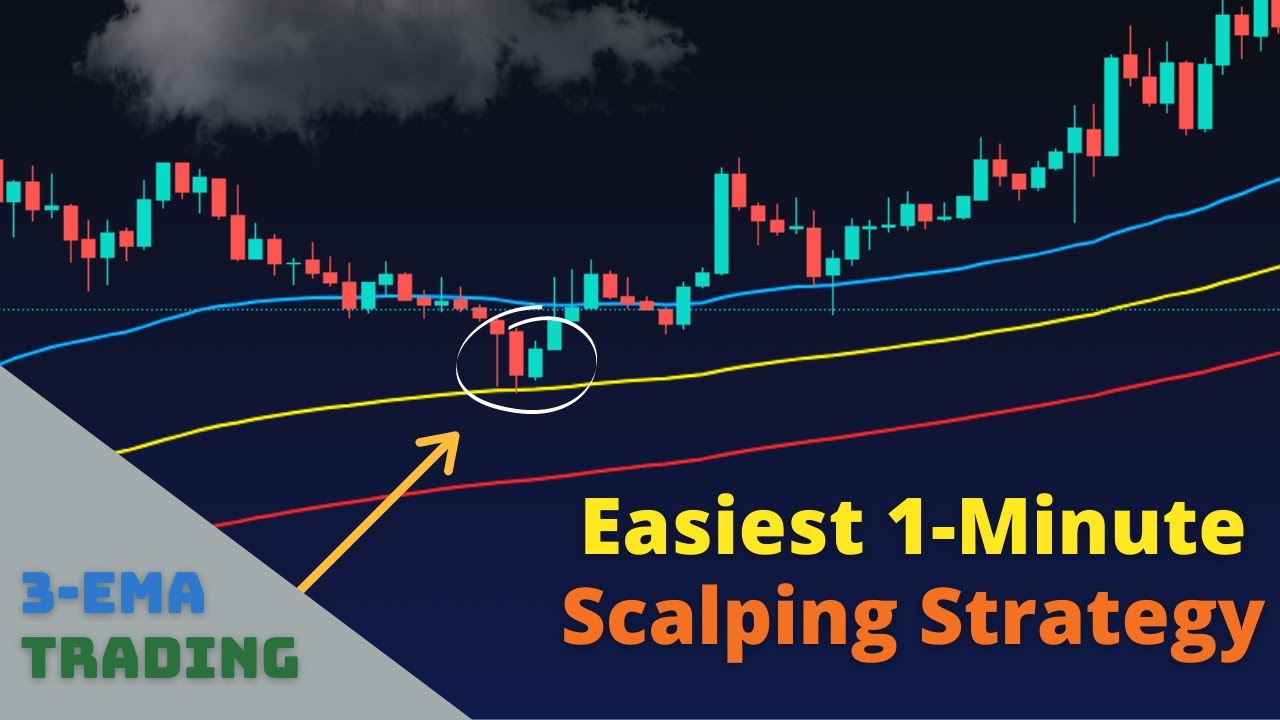

The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy

Latest complete video related to Trading Stocks, Trade Stocks, Stock Market for Beginners, and Ema Trading Algorithm, The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy.

In today’s video, I reveal one of the easiest scalping strategies ever. We will use just 3 moving averages. I hope that at the end of the video, even a beginner trader will be able to trade with this strategy. We will use a 1-minute time frame, so it may be not suitable for you if you are not a scalper.

Highly Profitable Day Trading Strategy: Heikin Ashi + Parabolic Sar + EMA: https://youtu.be/kfOOr5oQkBk

Most Profitable Supertrend Strategy for Daytrading: https://youtu.be/298smPYwVFM

Binance Tutorial 2021: https://youtu.be/1buG2j9C3qI

If you have any questions please leave a comment.

Also, please leave a comment about any video you want me to make.

Binance referral with %10 discount: https://www.binance.com/en/register?ref=FTR9BIDH

Click to buy the best cryptocurrency wallet ever: https://shop.ledger.com/?r=060174241c06

The easiest way to buy cryptocurrencies with your credit card: https://cex.io/r/0/up110275514/0/

THIS IS NOT INVESTMENT ADVICE. I am not a financial advisor, videos in this channel are just for educational purposes.

Ema Trading Algorithm, The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy.

Forex Scalping Trading Systems

They expect that is how successful traders make their cash. The SPX everyday chart listed below shows an organized pullback in August. In lots of instances we can, however ONLY if the volume increases.

The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy, Find more full videos relevant with Ema Trading Algorithm.

News Trading (Part Ii)

The very first point is the strategy to be followed while the second pint is the trading time. You’ve probably lost a great deal of trades and even lost a great deal of money with bad trades.

Here I am going to show you how to accomplish forex trading success with a simple method which is sensible, proven and you can use quickly for huge revenues. Let’s take an appearance at it.

Using the very same 5% stop, our trading system went from losing nearly $10,000 to acquiring $4635.26 over the exact same 10 years of information! The efficiency is now a positive 9.27%. There were 142 profitable trades with 198 unprofitable trades with the Moving Average Trader revenue being $175.92 and average loss being $102.76. Now we have a far better trading system!

Achieving success in currency trading includes a high level of discipline. It can not be dealt with as a side company. It not only requires knowledge about the patterns but also about the direction the patterns will move. There are numerous software available to know the trend and follow a system but in reality to attain success in currency trading a trader should develop their own system for trading and above all to follow it religiously.

There is a myriad of investment idea sheets and newsletters on the internet. Regrettably, lots of if not the majority of them are paid to market the stocks they recommend. Instead of blindly following the suggestions of others you need to develop swing trading rules that will cause you to enter a trade. This Forex MA Trading be the stock crossing a moving average; it may be a divergence between the stock price and a sign that you are following or it may be as simple as searching for assistance and resistance levels on the chart.

Since we are using historic data, it is worth noting that moving averages are ‘lag Stocks MA Trading signs’ and follow the actual duration the greater the responsiveness of the chart and the close it is to the actual price line.

You will be able to see the trend amongst traders of forex if you utilize info offered by FXCM. Day-to-day profit and loss changes show there is a big loss and this suggests traders do not benefit and end up losing money rather. The gain each day was only 130 pips and the highest loss was a drop of over 170 points.

The second action is the “Ready” step. In this step, you may increase your money and gold allocations further. You may likewise begin to move cash into bear ETFs. When the market goes down, these funds go up. Funds to think about include SH, the inverse of the S&P 500, PET DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

18 bar moving typical takes the existing session on open high low close and compares that to the open high low close of 18 days ago, then smooths the typical and puts it into a line on the chart to give us a pattern of the existing market conditions. Breaks above it are bullish and breaks below it are bearish.

Moving averages – These are like pattern lines, except that they stream and recede with the rate of the instrument. In this action, you might increase your cash and gold allocations even more. You desire to generate income in the forex, right?

If you are searching best ever engaging reviews about Ema Trading Algorithm, and What Are the Best Indicators to Use, Demarker Indicator you should join our email subscription DB totally free.