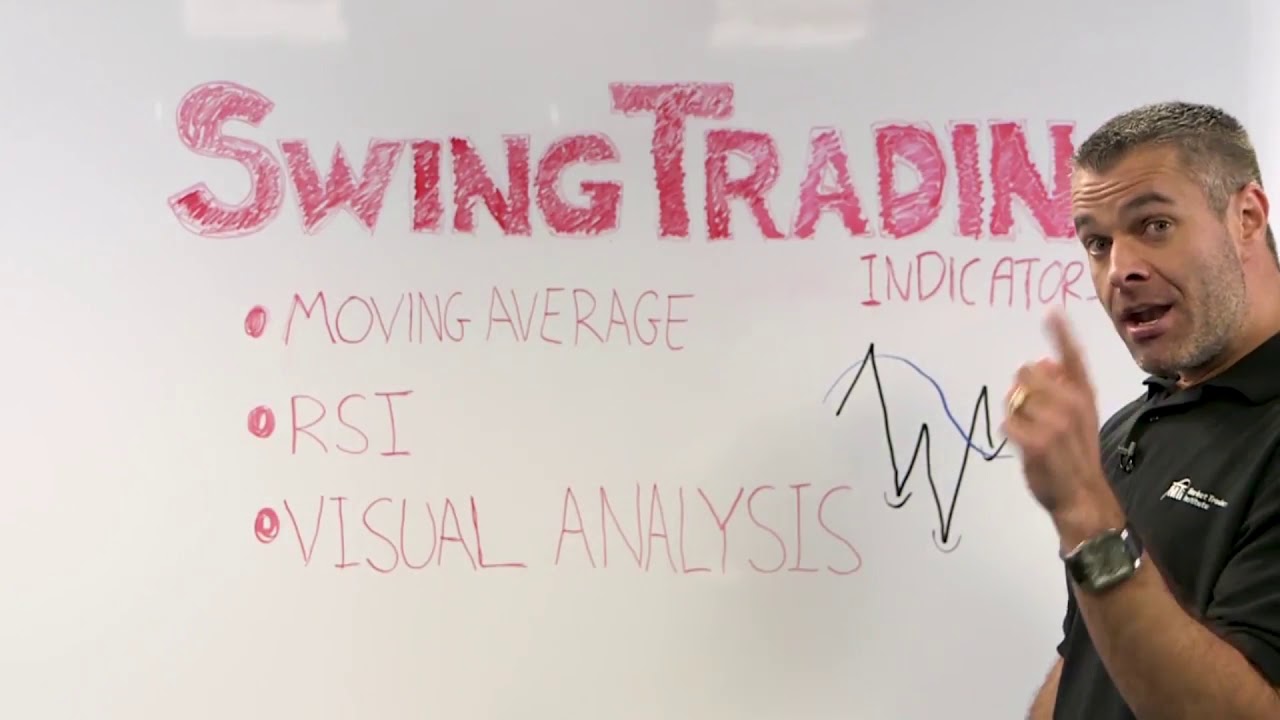

The 3 Simple Swing Trading Indicators I Use

Latest YouTube videos highly rated Stock Market Trading, Choosing Forex Indicators, Penny Stocks, and Which Chart Is Best For Swing Trading, The 3 Simple Swing Trading Indicators I Use.

If you want check out one of my webinars where I go over these strategies and many more, click here: https://goo.gl/5Z1JCX

Swing Trading is a great way to take advantage of short term movements in the market. After years of swing trading I found these three indicators to be the most valuable.

Moving averages, Relative Strength Index and Visual Analysis

Click the link if you want to read more about my three indicators: https://goo.gl/XV6tvm

Which Chart Is Best For Swing Trading, The 3 Simple Swing Trading Indicators I Use.

Forex Online Trading? What Is Scalping?

Long as the stock holds above that breakout level. It tracks the cost action and constantly lags behind it. They did this by effectively analyzing the daily price and volume action of the NASDAQ.

The 3 Simple Swing Trading Indicators I Use, Get most shared reviews relevant with Which Chart Is Best For Swing Trading.

Cash Management And Forex Trading – The Secret To Larger Gains

Complex indications will likely stop working to work in the long-lasting. Moving averages are very popular indicators in the forex. Delighted trading and never stop learning! You need to develop your own system of day trading.

After the last couple of years of broad swings in the stock exchange, oil, gold, etc, an easy investment strategy that works is at the top of lots of investors’ wish list. Many retired people have seen 20 to 40 percent losses in their retirement funds. The perfect investment technique would keep portfolios invested during all significant up market relocations and be on the sidelines during significant down relocations. Any technique utilized should likewise avoid over trading. Excessive in and out trading can be both psychologically and financially harmful. The understanding and usage of simple moving averages will achieve this.

Every trade you open should be opened in the direction of the daily trend. Despite the timeframe you utilize (as long as it is less than the day-to-day timeframe), you must trade with the general direction of the market. And the bright side is that finding the day-to-day pattern Moving Average Trader is not hard at all.

Nasdaq has rallied 310 points in three months, and hit a new four-year high at 2,201 Fri early morning. The economic information suggest market pullbacks will be limited, although we have actually gotten in the seasonally weak duration of Jul-Aug-Sep after a big run-up. As a result, there might be a consolidation duration rather than a correction over the next couple of months.

The near-term signs on the marketplace have compromised on the Dow Jones. The DJIA remained in a bullish pattern however it fell below its 20-day average of 11,156. This suggests that the market might fall if the average can not hold. In addition, the Relative Strength is showing a loss while the Forex MA Trading is at a moderate sell.

A well suggesting buddy had discussed an alternatives trading course he had actually attended and suggested that trading may be a method for Sidney to Stocks MA Trading above average returns on her settlement payment money, as interest and dividends would not be able to supply enough earnings for the family to live on.

Another forex trader does care too much about getting a return on investment and experiences a loss. This trader loses and his wins are on average, much bigger than losing. When he wins the game, he wins double what was lost. This reveals a balancing in winning and losing and keeps the investments open to get an earnings at a later time.

Stochastics is used to figure out whether the market is overbought or oversold. When it reaches the resistance and it is oversold when it reaches the assistance, the market is overbought. So when you are trading a range, stochastics is the best indicator to tell you when it is overbought or oversold. It is likewise called a Momentum Indicator!

Do not just purchase and hold shares, at the very same time active trading is not for everybody. When to be in or out of the S&P 500, use the 420 day SMA as a line to choose. When the market falls below the 420 day SMA, traders can also look to trade brief.

What they desire is a forex method that develops into an earnings within minutes of getting in into the trade. There is a plethora of financial investment suggestion sheets and newsletters on the internet.

If you are searching rare and exciting comparisons about Which Chart Is Best For Swing Trading, and Foreighn Exchange Market, Channel Trading you should signup our newsletter totally free.