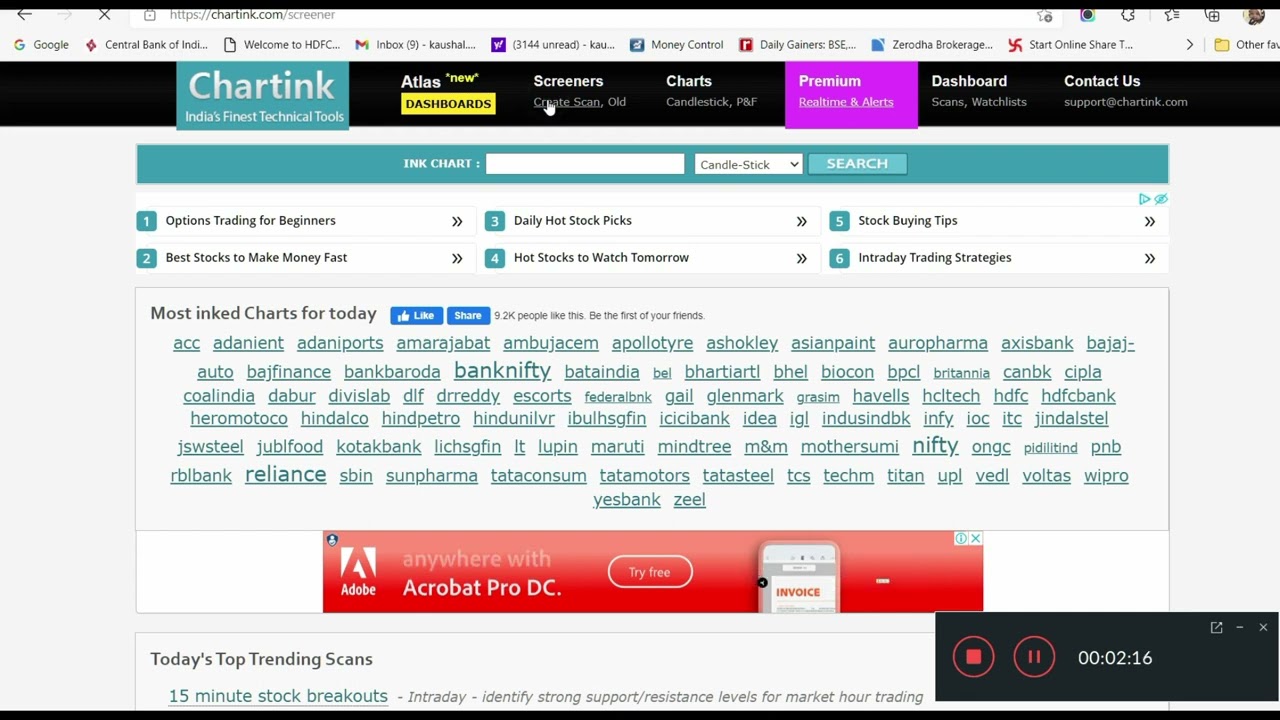

SMA 20 Stock Screener

Top overview top searched Range Trading, Buying Conditions, Disciplined Trader, Swing Trading for Beginners, and What Is Sma In Trading, SMA 20 Stock Screener.

About Video : how to select stocks for intraday, apply Moving average 20 Strategy and take profit, become profitable.

Nifty And Bank nifty analysis videos are uploaded in this channel link.- https://www.youtube.com/channel/UCiqQ8Ecga8hSL60TFCOiu4g

Hi, I am Kaushal Rakesh, Kindly open Trading account using below link,

Upstox:- https://upstox.com/open-account/?f=2CABJN

Zerodha:- https://zerodha.com/?c=YQ2038&s=CONSOLE

Small Case: – https://link.smallcase.com/mfX6TqAtRkb

https://link.smallcase.com/5DvpxBxtRkb

Ticker tape:- https://www.tickertape.in/stocks/chambal-fertilisers-and-chemicals-CHMB?checklist=basic

#Profit

#TradingStrategies

#tradingview

#beststocktotrade

What Is Sma In Trading, SMA 20 Stock Screener.

Trading Forex – Finest Currencies To Trade

Another example of a basic timing system might be revealed as follows. What this means is that trading a strong trend can be highly lucrative. However how does it work, what it indicates and how can you utilize for trading?

SMA 20 Stock Screener, Play trending explained videos about What Is Sma In Trading.

How To Discover Success In Forex

Rather of signing up for an advisory letter you may decide to make up your own timing signal. Market timing is based on the “reality” that 80% of stocks will follow the direction of the broad market.

You must understand how to chart them if you trade stocks. Some individuals explore charts to find buy or offer signals. I find this wasteful of a stock traders time. You can and need to chart all kinds of stocks consisting of cent stocks. When to sell or purchase, charting tells you where you are on a stocks rate pattern this suggests it informs you. There are a lot of fantastic business out there, you do not wish to get captured purchasing them at their 52 week high and having to wait around while you hope the rate returns to the rate you paid.

Nasdaq has actually rallied 310 points in 3 months, and struck a new four-year high at 2,201 Fri Moving Average Trader early morning. The financial data recommend market pullbacks will be restricted, although we’ve gotten in the seasonally weak period of Jul-Aug-Sep after a huge run-up. Subsequently, there may be a combination duration rather than a correction over the next few months.

Buy-and-hold say the professionals. Buy-and-hold say the advisors who benefit from your investment purchases though commissions. Buy-and-hold state most mutual fund business who profit from load charges so various in range it would take too much space to note them all here. Buy-and-hold say TELEVISION analysts and newsletter publishers who’s customers currently own the stock.

Now when we utilize 3 MAs, the moving average with the least variety of durations is defined as quick while the other 2 are characterized as medium and sluggish. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being quickly, 10 medium and 15 the sluggish.

This suggests that you need to understand how to deal with the trade prior to you take an entry. In a trade management technique, you should have drawn up exactly how you will manage the trade after it is participated in the Stocks MA Trading so you know what to do when things show up. Dominating trade management is extremely crucial for success in trading. This part of the system should consist of details about how you will react to all kinds of conditions one you enter the trade.

While the year-end rally tends to be quite reliable, it doesn’t take place every year. And this is something stock market financiers and traders might wish to focus on. In the years when the markets signed up a loss in the last days of trading, we have often seen a bearishness the next year.

This is where the typical closing points of your trade are calculated on a rolling bases. State you wish to trade a per hour basis and you desire to outline an 8 point chart. Merely collect the last 8 hourly closing points and divide by 8. now to making it a moving average you move back one point and take the 8 from their. Do this three times or more to develop a trend.

Combining these two moving averages offers you a good foundation for any trading plan. If you await the 10-day EMA to concur with the 200-day SMA, then possibilities are great that you will have the ability to generate income. Simply use good money management, do not run the risk of too much on each trade, and you should be great.

An uptrend is suggested by greater highs and greater lows. In this step, you may increase your money and gold allowances even more. The first and most apparent is that I was just setting the stops too close.

If you are finding most entertaining comparisons relevant with What Is Sma In Trading, and Forex Charts, Stocks Cycle, Day Forex Signal Strategy Trading, Forex Day Trading Strategy you are requested to list your email address for email list for free.