Simple Moving Average Stock Trading Strategy Using Python

Latest updated videos related to Biotech Stocks, How to Trade Trends, and Ma Crossover Alert, Simple Moving Average Stock Trading Strategy Using Python.

Simple Moving Average Stock Trading Strategy Using Python:

A strategy to know when to buy and sell shares of a stock using python

Disclaimer: The material in this video is purely for educational purposes and should not be taken as professional investment advice. Invest at your own discretion.

⭐Please Subscribe !⭐

⭐Get the code and data sets or just support the channel by becoming a supporter on Patreon:

https://www.patreon.com/computerscience

⭐Website:

http://everythingcomputerscience.com/

⭐Helpful Programming Books

► Python (Hands-Machine-Learning-Scikit-Learn-TensorFlow):

https://amzn.to/2AD1axD

► Learning Python:

https://amzn.to/3dQGrEB

►Head First Python:

https://amzn.to/3fUxDiO

Ma Crossover Alert, Simple Moving Average Stock Trading Strategy Using Python.

Earn Money In Forex Without The $3,000 Software Package

Usually, the higher the durations the more earnings the trader can gain and also the more threats. Then you require to use the indications that professional traders use. Some individuals want to make trading so hard.

Simple Moving Average Stock Trading Strategy Using Python, Search latest replays relevant with Ma Crossover Alert.

The Stock Trading Strategy – Why You Must Have One To Trade Successfully

Not simply commission however the spread (distinction in between trading rate). When the for 4 day crosses over the 9 day moving average the stock is going to continue up and ought to be purchased.

In less than 4 years, the rate of oil has increased about 300%, or over $50 a barrel. The Light Crude Constant Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil prices will eventually slow financial growth, which in turn will trigger oil prices to fall, ceritus paribus.

Nasdaq has rallied 310 points in 3 months, and struck a brand-new four-year high at 2,201 Fri Moving Average Trader morning. The economic data suggest market pullbacks will be limited, although we’ve gone into the seasonally weak duration of Jul-Aug-Sep after a big run-up. Subsequently, there may be a consolidation period instead of a correction over the next couple of months.

Buy-and-hold say the professionals. Buy-and-hold say the consultants who make money from your investment purchases though commissions. Buy-and-hold state most shared fund business who benefit from load costs so numerous in variety it would take too much area to list them all here. Buy-and-hold state TV commentators and newsletter publishers who’s customers currently own the stock.

While there is no method to predict what will happen, it does recommend that you ought to be prepared in your financial investments to act if the Forex MA Trading starts to head south.

Now that you have actually identified the everyday pattern, fall to the lower timeframe and look at the Bollinger bands. You are trying to find the Stocks MA Trading price to strike the severe band that protests the daily pattern.

While the year-end rally tends to be quite reliable, it doesn’t take place every year. And this is something stock market financiers and traders may desire to take note of. In the years when the markets registered a loss in the last days of trading, we have actually typically witnessed a bear market the next year.

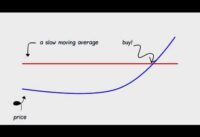

Think about the MA as the same thing as the instrument panel on your ship. Moving averages can tell you how fast a pattern is moving and in what direction. Nonetheless, you may ask, what exactly is a moving typical indication and how is it determined? The MA is exactly as it sounds. It is approximately a number of days of the closing cost of a currency. Take twenty days of closing costs and calculate an average. Next, you will chart the current cost of the marketplace.

The trader who gets a signal from his/her trading system that is trading on a medium based timeframe is allowing the information to be absorbed into the marketplace prior to taking a position and likewise to determine their risk. This trader whether he believes prices are random or not believes that info is gathered and reacted upon at various rates therefore offering opportunity to get in along with The Wizard.

Naturally, these moving averages are used as vibrant support and resistance levels. The 2 charts listed below show SPX began the current rally about a month before OIH. You must develop your own system of day trading.

If you are searching best ever exciting videos about Ma Crossover Alert, and Learn About Stock Market, Strong Trend, Stock Market Works, Trading Channel please subscribe our email subscription DB now.