simple moving average formula|best moving average crossover strategy|forex trading strategy

Latest complete video about Trading Trends, Market Tops, Stock Trading Tips, Trading Time, and Best Ma Crossover Settings, simple moving average formula|best moving average crossover strategy|forex trading strategy.

simple moving average formula|best moving average crossover strategy|forex trading strategy

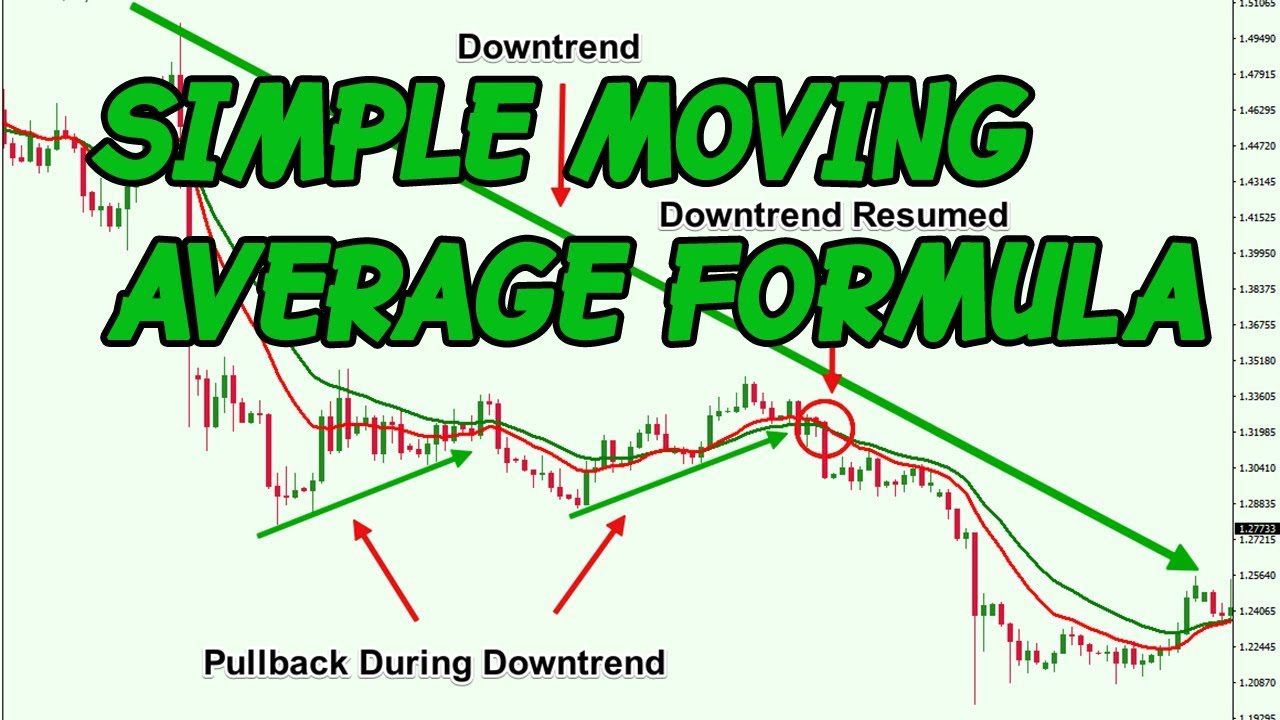

Crossovers are one of the main moving average strategies. The first type is a price crossover, which is when the price crosses above or below a moving average to signal a potential change in trend. Another strategy is to apply two moving averages to a chart: one longer and one shorter.

best moving average crossover trading strategy,best moving average crossover strategy,best moving average crossover,moving average crossover trading strategy,moving average crossover strategy,death cross,golden cross,david moadel,moving average crossover,moving average strategy,moving average trading strategy,moving average crossover backtest,moving averages tutorial,moving averages strategy,moving averages,moving average,EMA vs SMA,SMA vs EMA

How to Trade 100% profitable trading moving average crossover forex trading strategy,How to Trade,100% profitable trading,moving average crossover,forex trading strategy,how to use best moving averages forex trading strategies,moving averages,forex,Daytrading,FX Trading,Swing Trading,Technical Analysis,Price Action Trading,How To Trade Forex,Forex Trading For Beginners,What is Moving Average,Legging Indicator,shoaib khan,fxforever,moving ave,SMA,EMA

Best Ma Crossover Settings, simple moving average formula|best moving average crossover strategy|forex trading strategy.

Learn How To Utilize Moving Typical Successfully To Make Your Trade Decision

There are numerous strategies that can be used to market time, however the easiest is the Moving Average. Now if you look at a moving average, you see it has no spikes, as it smooths them out due to its averaging.

simple moving average formula|best moving average crossover strategy|forex trading strategy, Explore latest videos related to Best Ma Crossover Settings.

Your Forex Trading System – How To Select One That Isn’t Going To Drive You Nuts

The second line is the signal line represented as %D. %D is a basic moving average of %K. Intricately created strategies do not always work. What you likewise need to comprehend is that there is no ideal system out there.

If you have remained in currency trading for any length of time you have heard the following two expressions, “pattern trade” and “counter trend trade.” These two methods of trading have the very same credibility and require just as much work to master. I like trading counter trend because I have found a system that permits me to discover high frequency trades.

Every trade you open ought to be opened in the direction of the everyday trend. Despite the timeframe you use (as long as it is less than the day-to-day timeframe), you should trade with the general direction of the marketplace. And the great news is that discovering the daily trend Moving Average Trader is not hard at all.

Technical analysts attempt to spot a trend, and ride that pattern until the pattern has verified a reversal. If a good company’s stock remains in a downtrend according to its chart, a trader or investor using Technical Analysis will not purchase the stock up until its pattern has actually reversed and it has actually been validated according to other important technical indicators.

What does that Forex MA Trading tell you about the direction it is heading? Is it in an upward or a downward pattern? Charts of the main index can inform you this by a fast look. If the line is heading downward then it remains in a down pattern, however with the chaotic nature of the index cost, how do you understand if today’s down is not simply a glitch and tomorrow it will return up again?

There are lots of strategies and indications to identify the trend. My favorite ones are the most easy ones. I like to use a moving average indicator with the large number of averaging durations. Rising Stocks MA Trading shows the uptrend, falling MA suggests the sag.

While the year-end rally tends to be rather reliable, it doesn’t take place every year. And this is something stock market investors and traders might wish to focus on. In the years when the markets signed up a loss in the last days of trading, we have actually typically witnessed a bearishness the next year.

If the rate of my stock or ETF falls to the 20-day SMA and closes listed below it, I like to add a couple of Put choices– perhaps a third of my position. If the stock then continues down and heads toward the 50-day SMA, I’ll include another 3rd. I’ll add another third if the rate closes listed below the 50-day SMA.

Combining these 2 moving averages gives you a good structure for any trading strategy. If you await the 10-day EMA to concur with the 200-day SMA, then chances are excellent that you will have the ability to make money. Simply utilize excellent finance, don’t risk excessive on each trade, and you must be great.

While it is $990 rather of $1,000 it does represent that milestone. This research study was one of the first to measure volatility as a dynamic movement. The 5 being fast, 10 medium and 15 the sluggish.

If you are searching rare and exciting comparisons relevant with Best Ma Crossover Settings, and What Are the Best Indicators to Use, Forex Signals, Good Trading System you are requested to subscribe in email subscription DB for free.