Simple EMA MA cross strategy setup for mobile MT4

Top un-edited videos related to Trading Trends, Foreign Currency Trading, Stock Trading Online, Daily Forex Signals, and 20 50 Ema Trading Rule, Simple EMA MA cross strategy setup for mobile MT4.

Learn how to setup this cross strategy with some confirmations to trade and secure pips on your mobile trading platform…

Make good money with your mobile phone and at the comfort of your home.

#MT4 #Forex #Trading #Strategy #TradingSetup

20 50 Ema Trading Rule, Simple EMA MA cross strategy setup for mobile MT4.

One Technique That Can Bring You Trading Losses

A breakout with very little volume does not tell us much. A ‘moving’ typical (MA) is the average closing price of a particular stock (or index) over the last ‘X’ days. Support-this term explains the bottom of a stock’s trading range.

Simple EMA MA cross strategy setup for mobile MT4, Watch more replays relevant with 20 50 Ema Trading Rule.

The Currency Trading Revolution

OIH major support is at the (rising) 50 day MA, currently just over 108. This system is likewise understood as the “moving average crossover” system. What does that market tell you about the direction it is heading?

You should know how to chart them if you trade stocks. Some individuals search through charts to find buy or offer signals. I discover this wasteful of a stock traders time. You can and require to chart all types of stocks including cent stocks. When to offer or purchase, charting tells you where you are on a stocks rate pattern this suggests it informs you. There are plenty of fantastic companies out there, you don’t want to get captured buying them at their 52 week high and needing to linger while you hope the rate comes back to the cost you paid.

The very best way to make money is purchasing and selling Moving Average Trader breakouts., if you include them in your forex trading technique you can utilize them to stack up substantial gains..

“Once again, I have actually drawn a swing chart over the cost bars on this everyday chart. When you comprehend swing charts, you will have the ability to draw these lines in your mind and you will not need to draw them on your charts any more,” Peter said.

OIH significant support is at the (rising) 50 day MA, presently just over 108. Nevertheless, if OIH closes below the 50 day MA, then next Forex MA Trading support is around 105, i.e. the longer Price-by-Volume bar. Around 105 may be the bottom of the consolidation zone, while a correction may result somewhere in the 90s or 80s. The short-term cost of oil is largely dependent on the rate of worldwide financial development, reflected in month-to-month economic information, and supply disruptions, consisting of geopolitical occasions and cyclones in the Gulf.

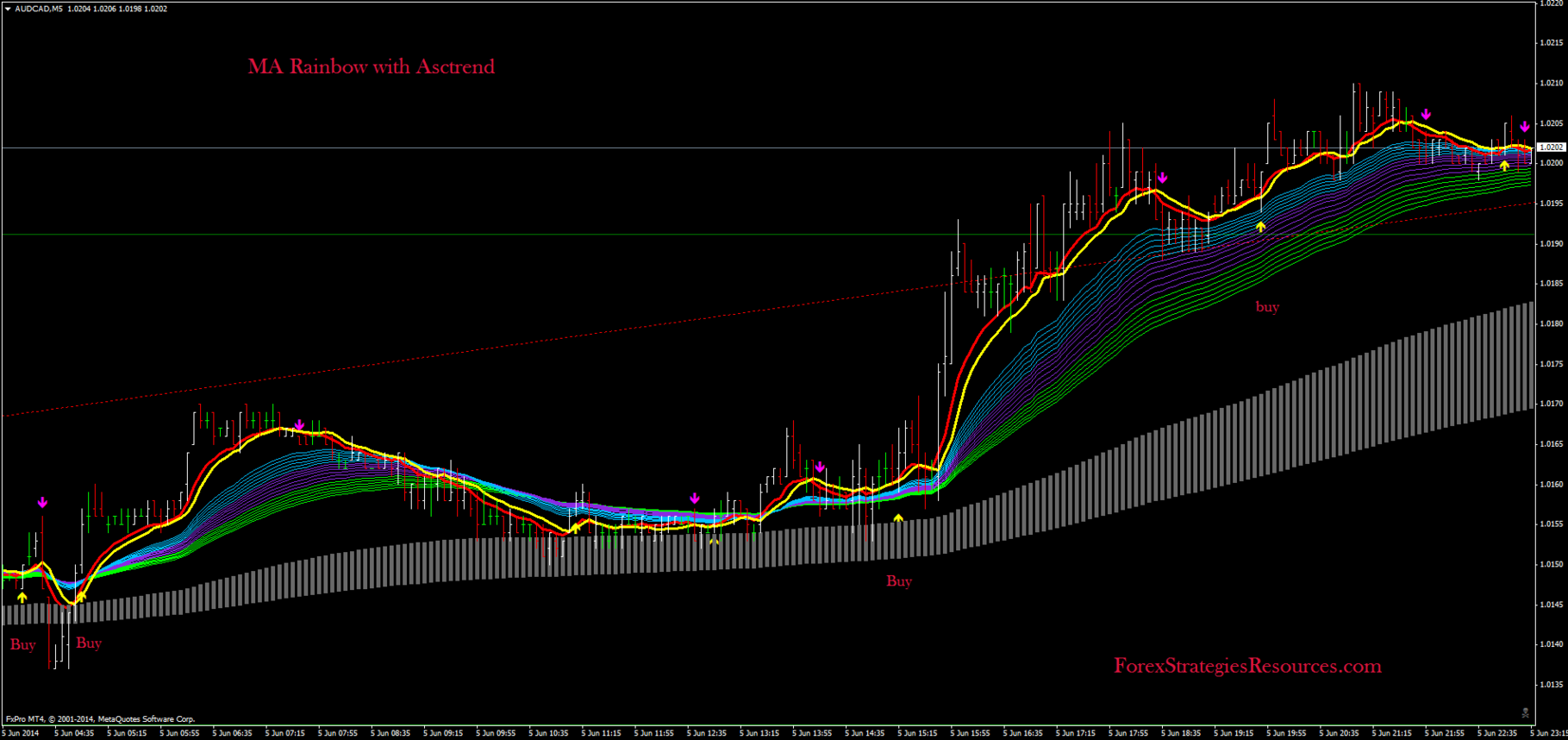

Let us say that we wish to make a short-term trade, between 1-10 days. Do a screen for Stocks MA Trading in a brand-new up trend. Bring up the chart of the stock you have an interest in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and must be bought. But as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that basic.

The best way to earn money is purchasing and offering breakouts. , if you include them in your forex trading strategy you can utilize them to stack up big gains..

Think of the MA as the exact same thing as the cockpit console on your ship. Moving averages can inform you how quickly a pattern is moving and in what direction. Nevertheless, you may ask, what exactly is a moving average indicator and how is it computed? The MA is precisely as it sounds. It is approximately a number of days of the closing price of a currency. Take twenty days of closing costs and calculate an average. Next, you will graph the current cost of the marketplace.

In this post is illustrated how to sell a fading and stylish market. This short article has only illustrated one method for each market circumstance. It is recommended traders use more than one technique when they trade Forex online.

This type of day can likewise takes place on a news day and needs to be approached thoroughly. My favorites are the 20-day and the 50-day moving averages on the S&P 500 index (SPX). In a varying market, heavy losses will occur.

If you are finding rare and exciting comparisons related to 20 50 Ema Trading Rule, and Trading Days, Buy Weakness dont forget to join our email alerts service for free.