Simple 1-Minute Forex Scalping Strategy: 3 EMA Scalping Trading Strategy (For Forex & Stock Trading)

Top full length videos about Forex Day Trading, Online Forex Trading, Small Cap Stocks, and Ema Trading Scalping, Simple 1-Minute Forex Scalping Strategy: 3 EMA Scalping Trading Strategy (For Forex & Stock Trading).

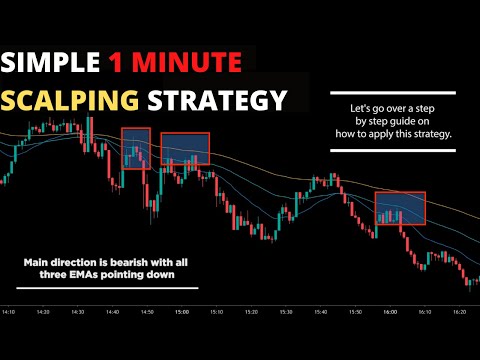

In this video, I teach you a simple 1-minute forex scalping strategy that involves using the 3 EMAs. EMAs refer to the exponential moving averages and this scalping trading strategy involves using three of them.

👉FREE Day Trading Guide here: https://bit.ly/fmwdaytradingguide

👉FREE Telegram Signal channel here: https://t.me/financialmarketwizards

👉Open an Account & Receive Bonuses here: https://bit.ly/3ePlha9

Trying to learn forex? Here at Financial Market Wizards, we do plenty of live forex trading videos such as this. In our live trading telegram channel, you can see how we do forex trading live.

Watching us day trading live is the best way to learn regardless of whether you are into swing trading or day trading. Live day trading signals are sent in our telegram channel so you can follow our forex live signals.

Make sure to hit the subscribe and turn on the notification bell for more videos like this: http://bit.ly/fmwsubscribe

#forextrading #forextips #forexstrategy Playlist to Watch:

🔥 Best Uploads: https://www.youtube.com/watch?v=H4vdlk_LlBs&list=PLc9g3IsRIdiTbqdDJZoweyXRzGoVjBdzb

🔥 Forex Trading Tips & Tricks: https://www.youtube.com/watch?v=S98PIDI6FUs&list=PLc9g3IsRIdiR_Za5SpShzt7N-hm8ywqHr

🔥 Forex Trading Basics: https://www.youtube.com/watch?v=fMHlVTi0pRI&list=PLc9g3IsRIdiS0zzYt8wLDgWQ-Y4NWEY18

🔥 Book Summary Videos: https://www.youtube.com/watch?v=cmNm7R6eTNw&list=PLc9g3IsRIdiSJuYYS52Z6bKX6HCMINZZY

Top Videos to Watch:

👉 Winning Forex Trading Formula – Beat Your Brokerage Market Maker With This Trading Strategy: https://www.youtube.com/watch?v=bxTq1pGkXKo&list=PU3c7MdJDcqKaqIIPnsTbchA&index=1

👉 How to Identify Institutional Buying and Selling in Forex | Trading in 2020

: https://www.youtube.com/watch?v=NoRR2XTVACA&list=PU3c7MdJDcqKaqIIPnsTbchA&index=2

👉 Day Trade Using Finviz for Forex Traders: Find the Best Forex Signals When Forex Trading Live: https://www.youtube.com/watch?v=Ic3u5ZgGQbg&list=PU3c7MdJDcqKaqIIPnsTbchA&index=5

👉 Day Trading Strategy for Beginners: Predicting Day High & Low in Forex: https://www.youtube.com/watch?v=GkoMoLmh9oM&list=PU3c7MdJDcqKaqIIPnsTbchA&index=6

👉 How to Use Finviz to Find the NEXT Currency that Can Move Massively: https://www.youtube.com/watch?v=oZa-oQwV0D8&list=PU3c7MdJDcqKaqIIPnsTbchA&index=7

👉 How Institutional Traders Combine Leading & Lagging Indicators to Find High Probability Trades: https://www.youtube.com/watch?v=MRPw77g3NkE&list=PU3c7MdJDcqKaqIIPnsTbchA&index=8

Ema Trading Scalping, Simple 1-Minute Forex Scalping Strategy: 3 EMA Scalping Trading Strategy (For Forex & Stock Trading).

Why Does The Stock Exchange Hate Me – The Psychology Of Trading

Chart: A chart is a graph of rate over an amount of time. Now, this thesis is to assist individual traders with specifications that have proven to be quite reliable. A duration of 5 in addition to 13 EMA is generally used.

Simple 1-Minute Forex Scalping Strategy: 3 EMA Scalping Trading Strategy (For Forex & Stock Trading), Enjoy new replays about Ema Trading Scalping.

Trading Trends – Knowing When To Get In And Exit

They did this by correctly examining the daily rate and volume action of the NASDAQ. There are lots of technical signs out there. Throughout these times, the marketplace consistently breaks assistance and resistance.

Every now and then the technical indicators begin making news. Whether it’s the VIX, or a moving average, somebody chooses up the story and soon it’s on CNBC or Bloomberg as the news of the day. So, as a financier one needs to ask, “are technical indicators really a reason to purchase or sell?” In some respects the response is no, since “investing” is something various from swing trading or day trading.

When a stock relocations between the assistance level and the resistance level it is stated to be in a trend and you need to buy it when it reaches the bottom of the Moving Average Trader trend and offer it when it arrives. Usually you will be searching for a short-term revenue of around 8-10%. You make 10% profit and you offer up and go out. You then try to find another stock in a similar trend or you wait on your initial stock to fall back to its support level and you buy it back once again.

Technical analysts try to identify a trend, and trip that pattern until the pattern has confirmed a turnaround. If an excellent company’s stock is in a drop according to its chart, a trader or financier using Technical Analysis will not purchase the stock until its pattern has actually reversed and it has been validated according to other crucial technical indications.

While there is no chance to predict what will happen, it does suggest that you should be prepared in your financial investments to act if the Forex MA Trading begins to head south.

Now that you have actually identified the daily trend, drop down to the lower timeframe and take a look at the Bollinger bands. You are trying to find the Stocks MA Trading cost to strike the severe band that is against the everyday pattern.

Another forex trader does care too much about getting a roi and experiences a loss. This trader loses and his wins are on average, much bigger than losing. When he wins the game, he wins double what was lost. This shows a balancing in losing and winning and keeps the investments open up to get an earnings at a later time.

Entering the marketplace at this phase is the most aggressive technique due to the fact that it does not permit any form of verification that the stock’s break above the resistance level will continue. Maybe this strategy needs to be booked for the most appealing stocks. However it has the advantage of supplying, in lots of circumstances, the most inexpensive entry point.

Don’t just purchase and hold shares, at the very same time active trading is not for everybody. When to be in or out of the S&P 500, use the 420 day SMA as a line to decide. When the market falls below the 420 day SMA, traders can also look to trade brief.

This is an evaluation on the easy moving average (SMA). As your stock goes up in price, there is a crucial line you wish to see. They immediately desert such a trade without waiting for a couple of hours for it to turn profitable.

If you are finding more entertaining reviews about Ema Trading Scalping, and Forex Training, Currency Trading, Stock Investing, Currency Exchange Rate dont forget to list your email address in email subscription DB for free.