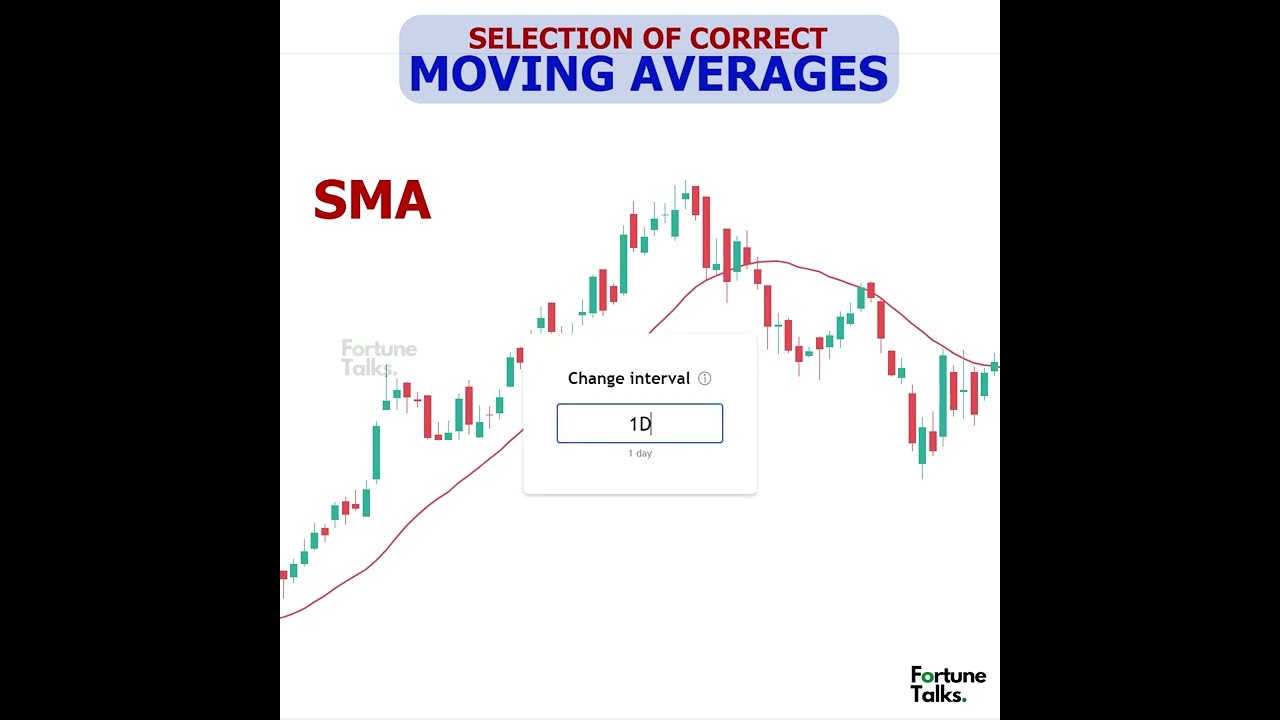

Select the right Moving Averages | SMA vs EMA vs WMA | Which is the better Moving Average ||

Interesting updated videos related to Online Forex Trading, Swing Trading, and What Is Ema in Trading in Hindi, Select the right Moving Averages | SMA vs EMA vs WMA | Which is the better Moving Average ||.

Select the right Moving Averages for analysis and trading | SMA vs EMA vs WMA | | Which is the better Moving Average …

What Is Ema in Trading in Hindi, Select the right Moving Averages | SMA vs EMA vs WMA | Which is the better Moving Average ||.

Mastering Trading Strategies – The Essential To Forex Day Trading Success

Complex indications will likely stop working to operate in the long-term. Since they are lagging signs. They right away abandon such a trade without waiting for a couple of hours for it to turn rewarding.

Select the right Moving Averages | SMA vs EMA vs WMA | Which is the better Moving Average ||, Explore more high definition online streaming videos related to What Is Ema in Trading in Hindi.

Forex Account Management – How To Protect Your Account From The Risks You Take

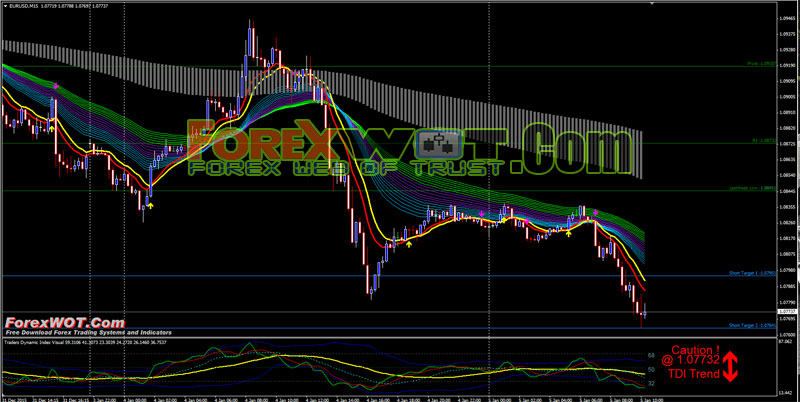

The way in which the stock breaks above and trades above the BI will show the strength of the bullish belief. A moving average needs to likewise be utilized on your chart to determine the direction of the trend.

In less than 4 years, the cost of oil has actually risen about 300%, or over $50 a barrel. The Light Crude Constant Contract (of oil futures) struck an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Constantly high oil rates will ultimately slow financial development, which in turn will trigger oil costs to fall, ceritus paribus.

3) Day trading indicates quick earnings, do not hold stock for more than 25 minutes. You can constantly sell with profit if it begins to fall from leading, and after that purchase it back later if it Moving Average Trader turn out going upward again.

Technical Analysis uses historic prices and volume patterns to anticipate future behavior. From Wikipedia:”Technical analysis is regularly contrasted with basic Analysis, the study of financial elements that some analysts state can affect rates in financial markets. Technical analysis holds that rates already show all such influences before investors understand them, hence the study of rate action alone”. Technical Experts highly believe that by studying historic rates and other essential variables you can anticipate the future price of a stock. Absolutely nothing is outright in the stock market, however increasing your possibilities that a stock will go the instructions you expect it to based on careful technical analysis is more accurate.

What does that Forex MA Trading inform you about the direction it is heading? Is it in an upward or a downward pattern? Charts of the primary index can inform you this by a fast glimpse. If the line is heading downward then it’s in a down trend, but with the chaotic nature of the index cost, how do you understand if today’s down is not just a problem and tomorrow it will return up once again?

Can we buy prior to the share cost reaches the breakout point? In numerous circumstances we can, however ONLY if the volume boosts. In some cases you will have a high opening price, followed by a fast retracement. This will sometimes be followed by a fast upsurge with high volume. This can be a buy signal, once again, we need to Stocks MA Trading sure that the volume is strong.

If you make 4 or more day sell a rolling five-trading-day period, you will be considered a pattern day trader no matter you have $25,000 or not. If your account equity falls listed below $25,000, a day trading minimum equity call will be provided on your account requiring you to deposit additional funds or securities.

This trading tool works better on currency pair rate history than on stocks. With stocks, price can gap up or down which triggers it to provide incorrect readings. Currency set’s rate action hardly ever gaps.

18 bar moving average takes the present session on open high low close and compares that to the open high low close of 18 days back, then smooths the average and puts it into a line on the chart to give us a pattern of the present market conditions. Breaks above it are bullish and breaks below it are bearish.

This does not take place daily, but this occurs pretty frequently to mention it. It has been rather a number of weeks of drawback volatility. I don’t believe this will choice will hold up over time.

If you are looking best ever entertaining reviews related to What Is Ema in Trading in Hindi, and Three Moving Averages, Disciplined Trader you should signup in email list totally free.