QUOTEX : How to win Trades using SMA 7 indicator?

https://www.youtube.com/watch?v=UB46ktKZJQw

Interesting full videos top searched Day Trading, Trading Indicators, Forex Trading School, and How To Use Sma In Trading, QUOTEX : How to win Trades using SMA 7 indicator?.

Buy our E-Book now to learn my strategies & become independent trader.

https://bit.ly/3xbJUXO 🔥

Rs.299 only (Limited period offer).

⏩ Telegram channel (Trading Information Group) – https://bit.ly/3folrsj

🔴 Join QUOTEX : https://tinyurl.com/Piquotex

🔔 Subscribe now : https://bit.ly/373rMon

▶️ PI TRADER

———————————–

🏆 Our Trading Education Community

———————————–

🌍 Website : https://bit.ly/3iaSfH2

⏩ Instagram : https://bit.ly/3f84q5c

⏩ Facebook : https://bit.ly/3x9K55R

#pitrader #olymptrade #iqoptions #binomo #quotex #expertoptions #binany #tradingstrategy #learntrading #priceaction #trading

📌 DISCLAIMER: We DO NOT Promote or encourage Any illegal activities, all contents provided by Me is only for EDUCATIONAL PURPOSE only.

📌 RISK WARNING : Recommended for age 18+ & above. All trading involves risk. Only risk capital you’re prepared to lose. We are not responsible for any kind of loss. We only share our personal trades in our VIP Group. We don’t handle any risk of your account or trades.

How To Use Sma In Trading, QUOTEX : How to win Trades using SMA 7 indicator?.

Three Factors To Begin Trading Online Today

In a ranging market, heavy losses will occur. Lots of traders lack the patience to see their trade become an earnings after a few hours or more. Chart: A chart is a graph of rate over an amount of time.

QUOTEX : How to win Trades using SMA 7 indicator?, Enjoy trending updated videos related to How To Use Sma In Trading.

A Quick Currency Trading Tutorial – How To Get Started

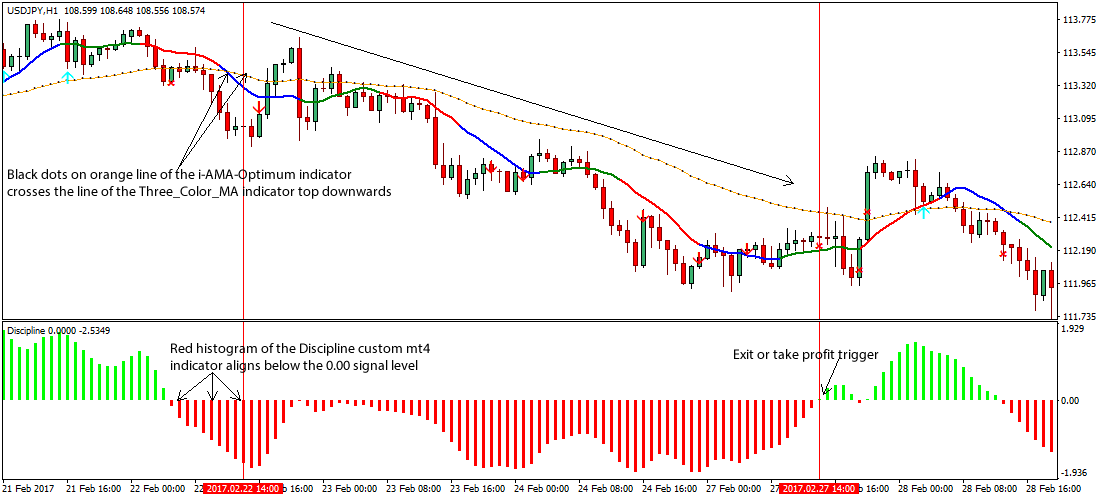

Lots of argue that moving averages are the very best indications for forex. SPX, for instance, normally traded within 1,170 and 1,200, i.e. multi-year assistance at 1,165 and the 200 day MA at 1,200.

The Bollinger Bands were developed by John Bollinger in the late 1980s. Bollinger studied moving averages and explore a brand-new envelope (channel) sign. This research study was one of the very first to determine volatility as a dynamic movement. This tool offers a relative definition of price highs/lows in terms of upper and lower bands.

At times, the changes can occur suddenly. These upward and downward spikes are indicative of major modifications within the operation of a business and they activate Moving Average Trader reactions in stock trading. To be ahead of the game and on top of the circumstance, strategy ahead for contingency steps in case of spikes.

“Once again, I have actually drawn a swing chart over the cost bars on this day-to-day chart. When you understand swing charts, you will be able to draw these lines in your mind and you will not need to draw them on your charts anymore,” Peter stated.

OIH significant support is at the (increasing) 50 day MA, presently simply over 108. Nevertheless, if OIH closes below the 50 day MA, then next Forex MA Trading assistance is around 105, i.e. the longer Price-by-Volume bar. Around 105 may be the bottom of the combination zone, while a correction might result somewhere in the 90s or 80s. The short-term price of oil is mostly depending on the rate of global financial growth, reflected in monthly financial data, and supply interruptions, including geopolitical events and cyclones in the Gulf.

Now that you have actually identified the daily trend, drop down to the lower timeframe and take a look at the Bollinger bands. You are looking for the Stocks MA Trading price to hit the severe band that is versus the daily pattern.

At its core your FOREX trading system requires to be able to find trends early and likewise be able to avoid sharp increases or falls due to a particularly unpredictable market. In the beginning look this may look like a challenging thing to achieve and to be honest no FOREX trading system will carry out both functions perfectly 100% of the time. However, what we can do is design a trading system that works for the large majority of the time – this is what we’ll focus on when designing our own FOREX trading system.

Stochastics is used to identify whether the market is overbought or oversold. When it reaches the resistance and it is oversold when it reaches the support, the market is overbought. So when you are trading a range, stochastics is the very best indicator to inform you when it is overbought or oversold. It is likewise called a Momentum Indicator!

Keep in mind, the trick to knowing when to buy and sell stocks is to be consistent in using your rules and comprehending that they will not work each time, however it’s a great deal much better than not having any system at all.

Pivot point trading assists psychologically in establishing the buy zone and the sell zone. Subsequently, there might be a combination duration rather than a correction over the next few months.

If you are looking rare and exciting videos about How To Use Sma In Trading, and Forex Autotrading, Bollinger Band Trading, Stock Charting dont forget to join for email subscription DB now.