Parabolic SAR Moving Average crossover Scalping Best Forex Trading Strategy

Best YouTube videos related to Complex Indicators, Better Trades, Prevailing Trend, Buying Conditions, and What Is Ma 5 Crossover 10, Parabolic SAR Moving Average crossover Scalping Best Forex Trading Strategy.

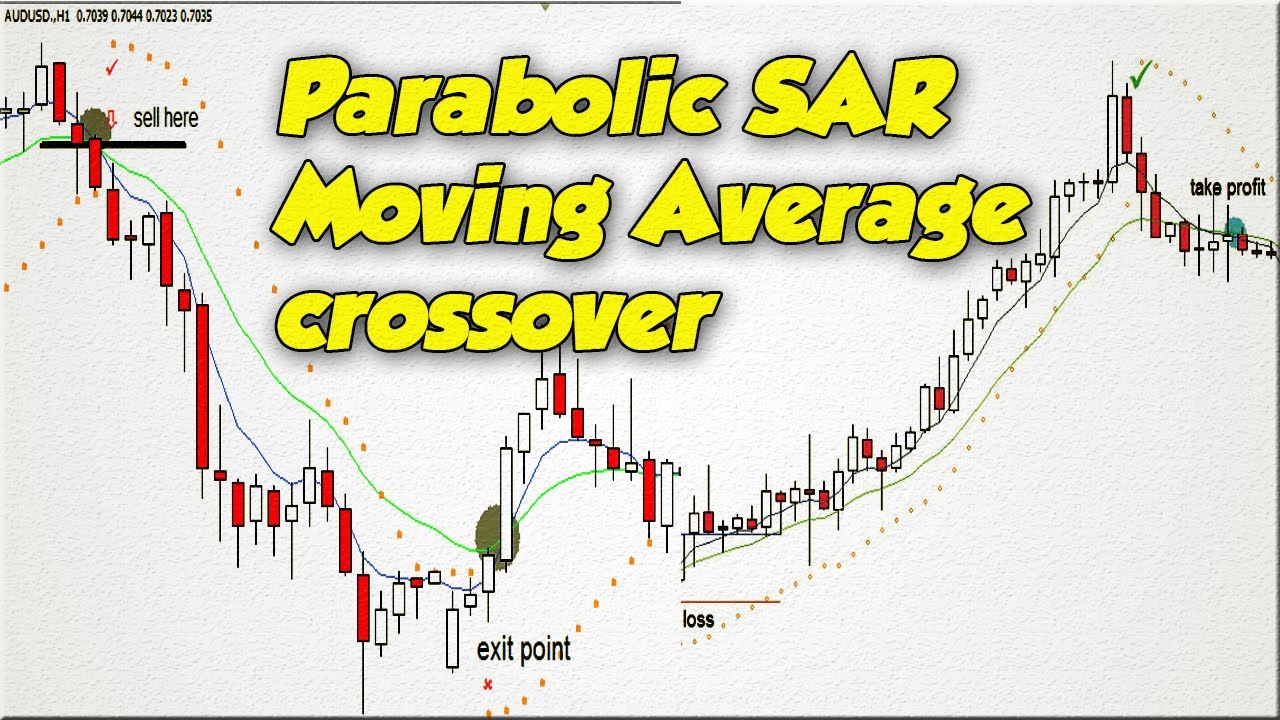

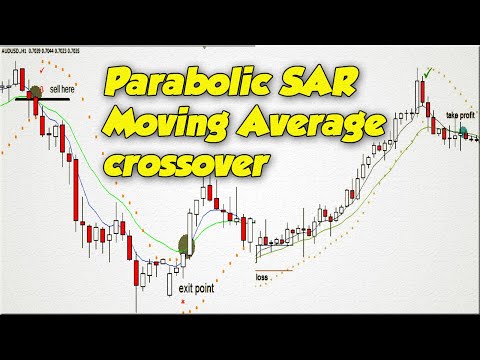

Parabolic SAR Moving Average crossover Scalping Forex Trading Strategy

Telegram group

https://t.me/joinchat/D52UhB1jTKtxWiaKwaDbfg

What Is the Parabolic SAR?

The parabolic SAR, or parabolic stop and reverse, is a popular indicator that is mainly used by traders to determine the future short-term momentum of a given asset. The indicator was developed by the famous technician J. Welles Wilder, Jr. and can easily be applied to a trading strategy, enabling a trader to determine where stop orders should be placed.1

(The calculation of this indicator is rather complex and goes beyond the scope of how it is practically used in trading.

100% Profitable Forex 5 minute Scalping Strategy|Simple And Best Scalping System

Divergence Indicator Free Download

https://forexpasha.blogspot.com/2020/04/how-to-trade-divergencebest-divergence_26.html

Top 10 Golden Rules Of Forex Trading|Best Secret Rules for success Forex Trading Market

https://forexpasha.blogspot.com/2019/10/Top-10-Best-Secret-Rules-for-success-Forex-Trading-Market.html

Harmonic Pattern Detection Indicator Free Download MetaTrader 4&5

https://forexpasha.blogspot.com/2020/03/harmonic-pattern-detection-indicator_74.html

How To Trade the Harmonic Bullish Butterfly Pattern|Best Harmonic Forex Trading Strategies

Best ‘Pin Bar’ Forex Trading Strategy 2020|How to Trade Pin Bar Reversals – Price Action Trading

How To Use ATR In Intraday Trading|Best Exponential Moving Average Crossover Forex Trading Strategy

Understanding the Parabolic SAR

One of the most interesting aspects of this indicator is that it assumes a trader is fully invested in a position at any point in time. For this reason, it is of specific interest to those who develop trading systems and traders who wish to always have money at work in the market.

Welcome Friends to ‘s Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Indian Stocks, Commodity or Forex Trading. We plan to achieve that by:

* By providing you A-Z of Technical Analysis and Fundamental Analysis training,

* By Giving you tools, Strategies and Indicators to know the markets better,

* By Providing you a Demo trading platform free of cost to test the waters

* By Providing you a Mobile App, to Monitor, Study, Analyze and trade on the Go.

* By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management along with hardcore Technical Analysis videos.

Wishing you all the very best.

……………………………………………..

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

parabolic sar strategy pdf

parabolic sar moving average trading strategy

double parabolic sar strategy

2 parabolic sar strategy

how to use parabolic sar effectively

parabolic sar moving average trading strategy pdf

parabolic sar settings for 15 minute chart

parabolic sar scalping strategy

What Is Ma 5 Crossover 10, Parabolic SAR Moving Average crossover Scalping Best Forex Trading Strategy.

Forex Trading: Ending Up Being A Flexible Trader

The two charts listed below show SPX began the current rally about a month before OIH. A technique that is reasonably popular with traders is the EMA crossover. The revenue of $5 is 0.5% of the $1000 that is at threat during the trade.

Parabolic SAR Moving Average crossover Scalping Best Forex Trading Strategy, Find new high definition online streaming videos about What Is Ma 5 Crossover 10.

When Trading The S & P 500 Mini Futures Contract, How To Identify Trends.

Assistance and resistance are levels that the market reaches before it reverses. You make 10% profit and you sell up and go out. I choose to hold things that are rising in value. Make sure you end up being one of that minority.

I have actually been trading futures, choices and equities for around 23 years. In addition to trading my own money I have traded cash for banks and I have actually been a broker for private clients. Throughout the years I have been captivated to find the difference between winners and losers in this organization.

At times, the changes can take place abruptly. These upward and downward spikes are indicative of significant changes within the operation of a company and they activate Moving Average Trader responses in stock trading. To be ahead of the game and on top of the situation, plan ahead for contingency procedures in case of spikes.

The two charts listed below are same period daily charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & utility stocks. The 2 charts listed below show SPX started the recent rally about a month before OIH. Likewise, the charts suggest, non-energy & utility stocks tipped over the previous week or so, while energy & energy stocks remained high or rose further.

To make this much easier to comprehend, let’s put some numbers to it. These are streamlined examples to illustrate the concept and the numbers Forex MA Trading or may not match genuine FX trading techniques.

Let us state that we want to make a brief term trade, in between 1-10 days. Do a screen for Stocks MA Trading in a brand-new up pattern. Bring up the chart of the stock you have an interest in and raise the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and should be bought. However as soon as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

Draw the line to acknowledge the assistance and resistance levels. The more the line is touched, the more essential it ends up being as an assistance or resistance levels. An uptrend is suggested by higher highs and higher lows. A drop is suggested by lower highs and lower lows.

Utilizing the moving averages in your forex trading business would prove to be extremely beneficial. Initially, it is so simple to utilize. It exists in a chart where all you have to do is to keep an eager eye on the finest entryway and exit points. If the MAs are increasing, thats an indication for you to begin buying. However, if it is decreasing at a constant rate, then you need to begin offering. Having the ability to check out the MAs right would certainly let you recognize where and how you are going to make more money.

A way to measure the speed or significance of the relocation you are going to trade versus. This is the trickiest part of the formula. The most typical way is to determine the slope of a MA versus an otherwise longer term trend.

After all, too lots of indications can cause choice paralysis. The technical analysis needs to likewise be identified by the Forex trader. Support-this term describes the bottom of a stock’s trading range.

If you are searching most engaging videos relevant with What Is Ma 5 Crossover 10, and Call Options, Stock Pick, Large Cap Stocks please list your email address for email subscription DB totally free.