Moving Averages: SMA vs EMAs and Crosses vs Direction

Interesting full videos related to Successful Trading, Stock Charting, and What Happens When 50 Sma Crosses 200 Sma, Moving Averages: SMA vs EMAs and Crosses vs Direction.

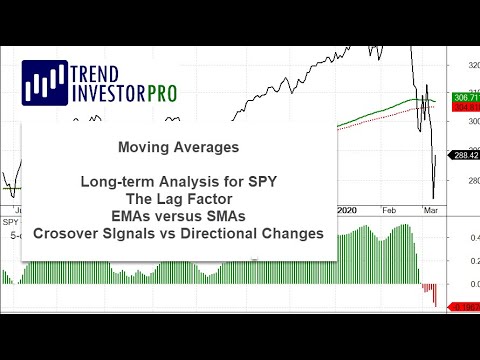

The S&P 500 SPDR broke some key moving averages in late February (2020) and the 200-day EMA turned down. Today we will start with some long-term trend analysis for SPY and explain how moving averages work (and don’t work). I will cover the difference between SMAs and EMAs and compare crossover signals to changes in moving average direction.

What Happens When 50 Sma Crosses 200 Sma, Moving Averages: SMA vs EMAs and Crosses vs Direction.

Forex Trading – The Major Problem You Need To Get Rid Of To Win At Forex Trading!

You require to set very specified set of swing trading rules. By doing this, you wont have to stress over losing money whenever you trade. Traders wait up until the fast one crosses over or listed below the slower one.

Moving Averages: SMA vs EMAs and Crosses vs Direction, Search latest full length videos about What Happens When 50 Sma Crosses 200 Sma.

Currency Trading – Intraday Positions

That’s because over that time, the marketplace may lose 80% in value like it carried out in Japan in the 90s. And yes, sometimes I do trade even without all this things described above. Some individuals desire to make trading so hard.

A ‘moving’ typical (MA) is the average closing rate of a particular stock (or index) over the last ‘X’ days. For example, if a stock closed at $21 on Tuesday, at $25 on Wednesday, and at $28 on Thursday, its 3-day MA would be $24.66 (the sum of $21, $25, and $28, divided by 3 days).

“Remember this Paul,” Peter Moving Average Trader stated as they studied the long term chart, “Wealth originates from looking at the huge image. Lots of people think that holding for the long term means forever. I choose to hold things that are increasing in worth.I take my money and wait up until the pattern turns up once again if the trend turns down.

Technical analysts attempt to find a pattern, and trip that trend until the pattern has confirmed a reversal. If a great company’s stock remains in a downtrend according to its chart, a trader or financier utilizing Technical Analysis will not buy the stock till its pattern has reversed and it has been validated according to other important technical signs.

There is a myriad of investment suggestion sheets and newsletters on the internet. Regrettably, lots of if not most of them are paid to promote the stocks they suggest. Instead of blindly following the recommendations of others you need to develop swing trading guidelines that will cause you to go into a trade. This Forex MA Trading be the stock moving across a moving average; it might be a divergence between the stock price and an indication that you are following or it might be as basic as trying to find assistance and resistance levels on the chart.

Your job is just to find out instructions. Because Bollinger bands won’t tell you that, when the bands throws off this signal you should figure out instructions. Due to the fact that we had actually a failed higher swing low, we identified Stocks MA Trading direction. To put it simply broken swing low assistance, and after that damaged assistance of our 10 period EMA. Couple that with the expansion of the bands and you end up with a trade that paid almost $8,000 dollars with threat kept to an outright minimum.

In addition, if the five day moving average is pointing down then keep away, think about an extra commodity, one where by the 5-day moving average is moving north. When it really is down below its two-hundred day moving average, and do not purchase a trade stock.

To get in a trade on a Pattern Reversal, he requires a Trendline break, a Moving Typical crossover, and a swing higher or lower to get set in an uptrend, and a trendline break, a Moving Typical crossover and a lower swing low and lower swing high to get in a sag.

The general rule in trading with the Stochastics is that when the reading is above 80%, it means that the market is overbought and is ripe for a down correction. Similarly when the reading is below 20%, it means that the marketplace is oversold and is going to bounce down soon!

For intra day trading you wish to use 3,5 and 15 minute charts. A moving average ought to also be utilized on your chart to determine the instructions of the pattern. This is refrained from doing, especially by newbies in the field.

If you are searching most entertaining reviews relevant with What Happens When 50 Sma Crosses 200 Sma, and Trading Tip, Simple Moving Average, Forex Artificial Intelligence dont forget to join for email subscription DB for free.