Moving Averages – SMA & EMA (Explained and curve draw)

Trending videos related to Simple Moving Average, Learn How to Trade, Forex Trading Indicators, Forex Trading for Beginners – How to Properly Use 2 Simple Moving Averages to Find Good Trades, and Is Ema Better Than Sma, Moving Averages – SMA & EMA (Explained and curve draw).

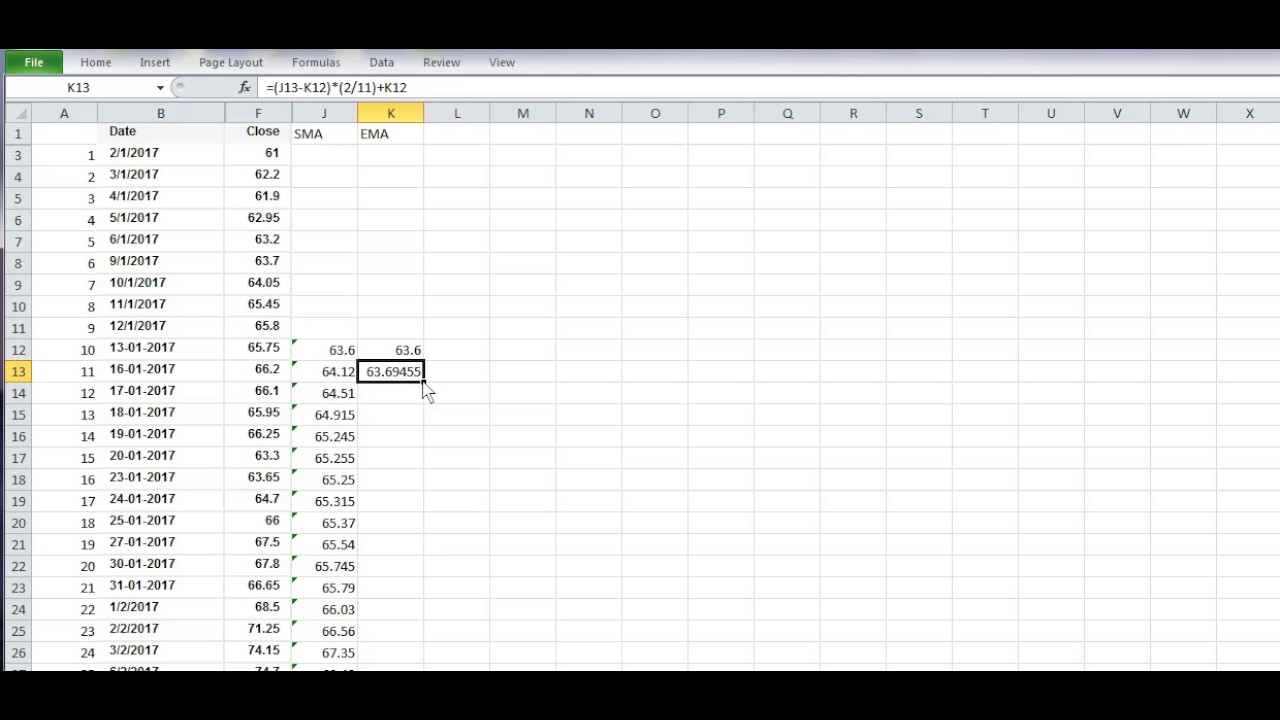

Simple and exponential Moving averages

Is Ema Better Than Sma, Moving Averages – SMA & EMA (Explained and curve draw).

Should You Follow The Trends When Forex Trading?

As the most traded index worldwide, let’s take a look at the S&P 500. Buy-and-hold say the consultants who benefit from your investment purchases though commissions. Each market condition requires its own proper strategy.

Moving Averages – SMA & EMA (Explained and curve draw), Get trending updated videos about Is Ema Better Than Sma.

Do Not Abandon Your Automated Forex System

The software the traders use at the online trading platforms is more user-friendly than it was years ago. It’s unclear which business will be affected by this decree but Goldcorp and DeBeers have mining projects there.

Every so often the technical indications begin making news. Whether it’s the VIX, or a moving average, somebody gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as a financier one has to ask, “are technical indicators really a factor to offer or buy?” In some respects the answer is no, given that “investing” is something different from swing trading or day trading.

When a stock moves between the support level and the resistance level it is stated to be in a trend and you need to purchase it when it reaches the bottom of the Moving Average Trader pattern and offer it when it arrives. Normally you will be trying to find a short-term revenue of around 8-10%. You make 10% revenue and you offer up and get out. You then look for another stock in a similar pattern or you wait on your initial stock to fall back to its support level and you purchase it back again.

The most fundamental application of the BI concept is that when a stock is trading above its Predisposition Indication you should have a bullish predisposition, and when it is trading below its Predisposition Indicator you must have a bearish bias.

“This easy timing system is what I use for my long term portfolio,” Peter continued. “I have 70% of the funds I have assigned to the Stock Forex MA Trading invested for the long term in leveraged S&P 500 Index Funds. My financial investment in these funds forms the core of my Stock portfolio.

The online Stocks MA Trading platforms use a lot of sophisticated trading tools as the Bolling Bands indicator and the Stochastics. The Bolling Bands is including a moving average line, the upper standard and lower standard deviation. The most used moving average is the 21-bar.

A 50-day moving average line takes 10 weeks of closing price information, and after that plots the average. The line is recalculated everyday. This will reveal a stock’s cost pattern. It can be up, down, or sideways.

It has been quite a couple of weeks of drawback volatility. The rate has dropped some $70 from the peak of the last go to $990. The green line depicts the major battle location for $1,000. While it is $990 instead of $1,000 it does represent that milestone. Therefore we have had our second test of the $1,000 according to this chart.

In this article is illustrated how to trade in a trendy and fading market. This short article has just illustrated one technique for each market scenario. It is recommended traders use more than one method when they trade Forex online.

Another excellent way to utilize the sideways market is to take scalping trades. The timeframe for a MA is determined by the number of closing prices you want to consist of. When done, choose two indicators: weighted MA and basic MA.

If you are searching most exciting videos relevant with Is Ema Better Than Sma, and Forex Day Trading, Buy Weakness, Online Forex Trading please subscribe our email list now.