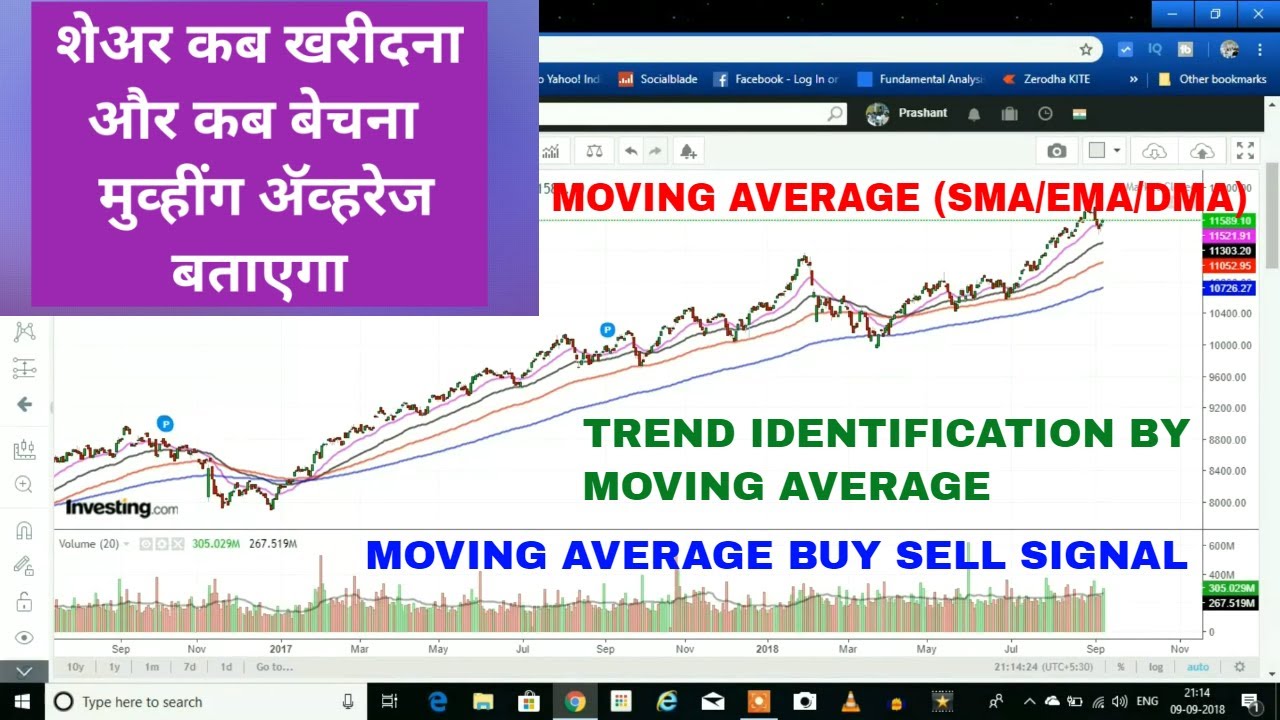

Moving Average | DMA | EMA | SMA | Moving Average Buy Sell Signals | How to Use EMA Buy Sell Signals

Top YouTube videos highly rated Forex for Beginners – a Simple 1-2-3 Step Strategy for Making Money, Forex Moving Averages, Pivot Point Trading, and What Is Sma In Trading, Moving Average | DMA | EMA | SMA | Moving Average Buy Sell Signals | How to Use EMA Buy Sell Signals.

In this video you will learn about Moving Averages (EMA, SMA, DMA). How to use moving averages for trend identification for short/medium/long term. Also how buy and sell signals generates on moving averages.

#movingaverage

#simplemovingaverage

#SMA

#exponentialmovingaverage

#EMA

#DMA

#buysellsignal

#movingaveragebuysellsignal

Playlist Link

Basics of share market & fundamental analysis

Playlist Link

Technical analysis

Playlist Link –

Derivative Market | Future and Option Market

Follow us on YouTube –

https://www.youtube.com/c/IESShareMarketTrainingInstitute

Visit our website-

https://www.purensuremoney.com/

Visit our blog –

https://sharemarket-training.blogspot.in/

You can follow us on Facebook -https://www.facebook.com/IesShareMarketTrainingInstitute/

You can follow us on Twitter-

https://twitter.com/sarsarode

IES Share Market Training Institute established in 2004 by Mr Prashant Sarode with a basic idea to equip common man to earn money from share market even without any investment by working part or full time professionally. He has a rich experience in share market since 2002. He has trained more than 3500 individuals.

If any trader or investor wants to earn money then, they have to predict the prices of shares, index, commodity or currency. This is possible in two ways one is fundamental analysis and other is technical analysis. We analyse company’s prices by studying its fundamental through various ratios, global and domestic economic issues. But many times we found fundamentally it’s all right but the prices are going exactly opposite to the fundamentals. This is due to sentiments of traders and investors. If sentiments are positive prices will go up and if it is negative prices will go down. So it is important to analyse market technically then, only you can earn money while trading or investing. That’s why we want to equip traders and investors with this kind of knowledge to trade successfully in the market.

Improve financial literacy in the fastest growing INDIA is the mandate for our Institute. Subscribe us on YouTube –

http://www.youtube.com/c/StockMarketinHindi

You can follow us on Facebook –

https://www.facebook.com/SirSarode

You can follow us on Twitter-

Tweets by SirSarode

You can follow us on Instagram-

https://www.instagram.com/sirsarode

What Is Sma In Trading, Moving Average | DMA | EMA | SMA | Moving Average Buy Sell Signals | How to Use EMA Buy Sell Signals.

Forex Trading – Basic Actions To Creating Your Own Lucrative Trading System

You require to set very specified set of swing trading rules. By doing this, you wont have to fret about losing cash whenever you trade. Traders wait until the fast one crosses over or below the slower one.

Moving Average | DMA | EMA | SMA | Moving Average Buy Sell Signals | How to Use EMA Buy Sell Signals, Enjoy most searched explained videos relevant with What Is Sma In Trading.

Rsi Turnarounds Are A Standalone Trading Signal For Learning Forex Successfully

A normal forex rate chart can look extremely erratic and forex candlesticks can obscure the pattern even more. Those 3 things are the structure for a good trading system. Ensure you turn into one of that minority.

In less than four years, the rate of oil has actually risen about 300%, or over $50 a barrel. The Light Crude Continuous Contract (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil prices will eventually slow economic development, which in turn will cause oil rates to fall, ceritus paribus.

However, if there is a breakout through one of the outer bands, the rate will tend to continue in the very same direction for a while and robustly so if there is a boost Moving Average Trader in volume.

Buy-and-hold say the experts. Buy-and-hold say the consultants who benefit from your financial investment purchases though commissions. Buy-and-hold state most shared fund companies who benefit from load fees so numerous in variety it would take too much area to list them all here. Buy-and-hold say TELEVISION analysts and newsletter publishers who’s customers already own the stock.

There is a myriad of investment tip sheets and newsletters on the web. Sadly, numerous if not the majority of them are paid to promote the stocks they advise. Instead of blindly following the suggestions of others you need to establish swing trading guidelines that will cause you to enter a trade. This Forex MA Trading be the stock moving across a moving average; it might be a divergence in between the stock rate and an indicator that you are following or it may be as basic as looking for assistance and resistance levels on the chart.

The frequency is very important in choice. For instance, offered 2 trading systems, the first with a greater earnings factor but a low frequency, and the 2nd a higher frequency in trades but with a lower revenue aspect. The second system Stocks MA Trading have a lower earnings aspect, however due to the fact that of its higher frequency in trading and taking little earnings, it can have a greater overall profit, than the system with the lower frequency and greater earnings factor on each private trade.

As bad as things can feel in the rare-earth elements markets these days, the reality that they can’t get excessive worse has to console some. Gold particularly and silver are looking great technically with gold bouncing around strong support after its second run at the venerable $1,000. Palladium looks to be holding while platinum is anyone’s guess at this point.

This is where the typical closing points of your trade are computed on a rolling bases. State you wish to trade a hourly basis and you wish to outline an 8 point chart. Merely gather the last 8 per hour closing points and divide by 8. now to making it a moving average you move back one point and take the 8 from their. Do this three times or more to develop a pattern.

Individual tolerance for threat is a great barometer for choosing what share rate to short. If new to shorting, try decreasing the quantity of capital generally applied to a trade till becoming more comfy with the technique.

Moving averages can tell you how fast a trend is moving and in what instructions. In many circumstances we can, however ONLY if the volume boosts. Once again another fantastic system that nobody really discusses.

If you are searching instant entertaining reviews relevant with What Is Sma In Trading, and Stock Analysis, Fading Market, Strategic Investing, Foreign Currency Trading dont forget to join for newsletter for free.