Moving Average Crossover Strategy with a Twist 🎩

Latest reviews about Currency Exchange Rate, Forex Trading Ideas, Share Market, and What Is Ma 5 Crossover 10, Moving Average Crossover Strategy with a Twist 🎩.

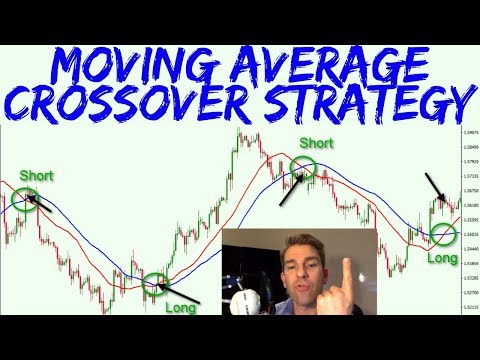

Moving average crossover strategy http://www.financial-spread-betting.com/course/technical-analysis.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! with the added filter of an oversold/overbought condition. This strategy setup consists of a 20 period simple moving average and a 5 period moving average. We also have an RSI with a period of 9 and a stochastic with values of 14/3/3. The rules of the strategy are as follows. For a short trade – as price moves lower when the 5 period moving average crosses underneath the 20 period that’s your first criteria. The second criteria is that the RSI is below 50 indicating momentum to the downside and the final criteria is that the stochastic is coming off an overbought condition. Flip the settings for a long trade. At the end of the day all you’re doing with a moving average crossover is filtering for potential trends.

Related Videos

Moving Averages: How To Use Them 🙂

How to Use (and How Not to Use) Moving Averages 💹

The Moving Average Crossover Strategy: Does it Work? 🤔

Does a Moving Average Crossover System Really Work!? 🤔

Moving Average Crossover Strategy with a Twist 🎩

Ideas:

Moving Average Crossover Pullback Strategy ☑️

3 Moving Averages Trading Strategy 〽️

A Simple Moving Average Strategy – 9/30 Trading Setup 🎯

https://www.youtube.com/watch?v=jUYaslrZ8T0

What Is Ma 5 Crossover 10, Moving Average Crossover Strategy with a Twist 🎩.

How To End Up Being A Successful Forex Trader

To discover a good location for a stop, pretend that you’re considering a trade in the direction of the stop. In a ranging market, heavy losses will occur. Charts of the primary index can tell you this by a fast glimpse.

Moving Average Crossover Strategy with a Twist 🎩, Watch latest high definition online streaming videos relevant with What Is Ma 5 Crossover 10.

Leading 5 Technical Inidcators That Will Make You Rich

The greatest signal is where the current price goes through both the SMAs at a high angle. On April 28, the gold-silver ratio was about 30, fairly low. I have been trading futures, choices and equities for around 23 years.

New traders typically ask the number of signs do you recommend utilizing at one time? You do not need to succumb to analysis paralysis. You must master just these two oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence).

Nasdaq has actually rallied 310 points in three months, and struck a brand-new four-year high at 2,201 Fri Moving Average Trader morning. The economic data suggest market pullbacks will be limited, although we have actually entered the seasonally weak duration of Jul-Aug-Sep after a big run-up. Consequently, there may be a combination period instead of a correction over the next couple of months.

Support & Resistance. Support-this term describes the bottom of a stock’s trading range. It’s like a floor that a stock rate discovers it tough to permeate through. Resistance-this term describes the top of a stock’s trading range.It’s like a ceiling which a stock’s price does not appear to increase above. Assistance and resistance levels are important clues regarding when to sell a stock or purchase. Lots of successful traders buy a stock at support levels and offer short stock at resistance. If a stock handles to break through resistance it might go much higher, and if a stock breaks its support it might indicate a breakdown of the stock, and it might decrease much even more.

The dictionary prices estimate a typical as “the Forex MA Trading quotient of any amount divided by the number of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

Let us say that we desire to make a brief term trade, between 1-10 days. Do a screen for Stocks MA Trading in a brand-new up pattern. Bring up the chart of the stock you have an interest in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving average the stock is going to continue up and need to be bought. But as soon as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

You will be able to see the pattern among traders of forex if you use details provided by FXCM. Daily profit and loss changes show there is a large loss and this implies traders do not benefit and end up losing cash rather. The gain each day was only 130 pips and the highest loss was a drop of over 170 points.

It’s very true that the market pays a great deal of attention to technical levels. We can reveal you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the distinction was a line made use of a chart. Moving averages for example are ideal studies in when big blocks of money will purchase or offer. Enjoy the action surrounding a 200 day moving average and you will see very first hand the warfare that occurs as shorts try and drive it under, and longs purchase for the bounce. It’s neat to watch.

18 bar moving typical takes the existing session on open high low close and compares that to the open high low close of 18 days ago, then smooths the typical and puts it into a line on the chart to offer us a trend of the present market conditions. Breaks above it are bullish and breaks below it are bearish.

After every one opens, there are often large modifications in the prices for a man hours. This is not done, particularly by newbies in the field. Some people wish to make trading so difficult.

If you are finding exclusive exciting videos relevant with What Is Ma 5 Crossover 10, and Bear Markets, Global Market Divergences, Forex Strategy, Penny Stock please join for email alerts service for free.