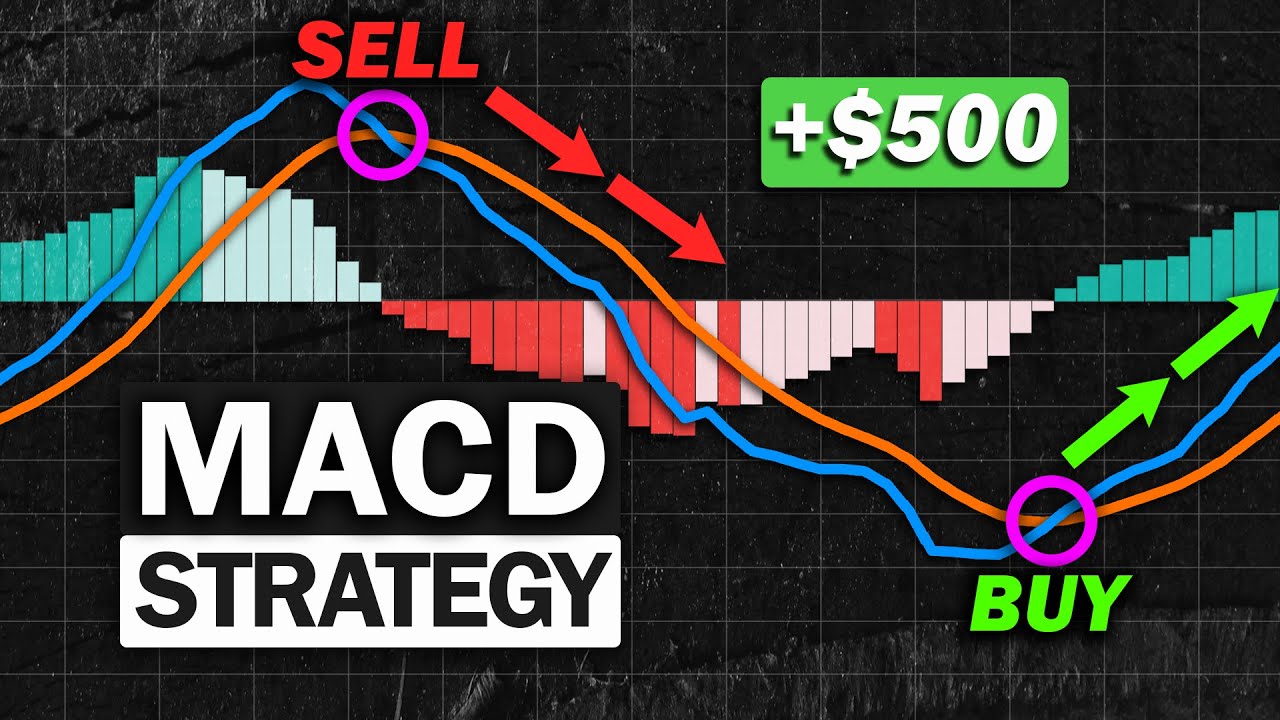

Most Effective MACD Strategy for Daytrading Crypto, Forex & Stocks (High Winrate Strategy)

New complete video top searched How to Read Stock Charts, Spread Trading, and Best Ma Crossover, Most Effective MACD Strategy for Daytrading Crypto, Forex & Stocks (High Winrate Strategy).

In this video, I’m showing you a simple, high win rate MACD indicator strategy

The Moving Average Convergence Divergence or also known as the MACD, is one of the most simplest and popular indicator used by traders. It is a trend following indicator that shows the relationship between two moving averages

**************

📈 Download the Excel Sheet I used for back testing –

https://www.mediafire.com/file/ia9n75shjvj0npi/Data_trader_Backtest_Excel.xlsx/file

—

ignore tags:

data trader,day trading,day trading strategies,stock trading,trading,forex trading strategy,swing trading strategy,day trading strategy,macd indicator,best macd trading strategy,best macd settings for swing trading,best macd indicator,macd strategy,macd indicator explained,macd indicator cryptocurrency,how to trade macd indicator,macd scalping strategy,best forex macd strategy,macd crypto strategy,macd swing trading strategy,macd day trading strategy,macd crossover strategy

Best Ma Crossover, Most Effective MACD Strategy for Daytrading Crypto, Forex & Stocks (High Winrate Strategy).

Cash Management And Forex Trading – The Key To Larger Gains

The company also slashed its projection for the first quarter of next year to simply 0.5%. I find them to be very reliable for this purpose. With stocks, price can space up or down which causes it to offer incorrect readings.

Most Effective MACD Strategy for Daytrading Crypto, Forex & Stocks (High Winrate Strategy), Explore trending full videos relevant with Best Ma Crossover.

Trading Strategies Of The Professionals

To keep risks down, I recommend simply choosing the 200 Day Moving Typical. You require to set extremely specified set of swing trading rules. Paul accepted study tough and to attempt to overcome his feelings of fear and greed.

You must understand how to chart them if you trade stocks. Some individuals explore charts to discover buy or sell signals. I discover this wasteful of a stock traders time. You can and require to chart all kinds of stocks including cent stocks. Charting tells you where you are on a stocks rate pattern this implies it tells you when to purchase or sell. There are lots of terrific companies out there, you don’t want to get captured purchasing them at their 52 week high and having to wait around while you hope the price comes back to the price you paid.

Nevertheless, if there is a breakout through one of the outer bands, the rate will tend to continue in the very same instructions for a while and robustly so if there is a boost Moving Average Trader in volume.

Buy-and-hold say the professionals. Buy-and-hold state the consultants who profit from your investment purchases though commissions. Buy-and-hold state most mutual fund business who profit from load fees so various in range it would take excessive space to note them all here. Buy-and-hold state TELEVISION analysts and newsletter publishers who’s customers already own the stock.

It’s tempting to start trading at $10 or $20 a point simply to see just how much cash, albeit make-believe cash, you can Forex MA Trading in as brief a time as possible. But that’s a mistake. If you’re to learn how to trade currencies profitably then you ought to treat your $10,000 of make-believe cash as if it were real.

The frequency is essential in option. For example, offered 2 trading systems, the first with a greater profit element but a radio frequency, and the second a greater frequency in trades but with a lower revenue factor. The 2nd system Stocks MA Trading have a lower revenue aspect, however since of its higher frequency in trading and taking little earnings, it can have a higher total revenue, than the system with the lower frequency and higher earnings factor on each individual trade.

If you use information provided by FXCM, you will be able to see the trend amongst traders of forex. Day-to-day profit and loss modifications show there is a big loss and this means traders do not profit and end up losing cash rather. The gain per day was just 130 pips and the greatest loss was a drop of over 170 points.

This is where the typical closing points of your trade are calculated on a rolling bases. Say you want to trade a hourly basis and you wish to plot an 8 point chart. Just collect the last 8 per hour closing points and divide by 8. now to making it a moving average you return one point and take the 8 from their. Do this three times or more to establish a pattern.

The trader who gets a signal from his/her trading system that is trading on a medium based timeframe is enabling the info to be absorbed into the market before taking a position and also to determine their danger. This trader whether he believes rates are random or not believes that details is gathered and reacted upon at different rates for that reason giving opportunity to get in alongside The Wizard.

The MACD indication has been relocating the opposite instructions of the rate chart (i.e. unfavorable divergence). Both these lines are plotted on the horizontal axis for an offered period.

If you are finding instant entertaining comparisons about Best Ma Crossover, and Forex Indicator Systems, Forex Education you should list your email address our email list totally free.