MAVA Xonax Expert Advisor for VertexFX Trading Terminal

Popular vids about Forex Megadroid, Moving Averages, Stock Market Tips, and Ma Crossover Expert, MAVA Xonax Expert Advisor for VertexFX Trading Terminal.

https://www.hybridsolutions.com/plugins/owner/OmSaiTech.html

For more Expert Advisers Working principle and descriptions visit http://www.tips.omsaitech.co.in/category/forex-ea-and-indicators/how-to-use-expert-advisors/

The MAVA Xonax Expert Advisor is an innovative VertexFX client side script based upon Exponential Moving Average crossover of two price-series, namely the OPEN and CLOSE prices.

The idea behind the MAVA Xonax Expert Advisor is that in bullish markets, the closing prices are above the opening prices, and similarly in bearish markets the closing prices are below the opening markets. Whenever this pattern changes, the market will change direction from bullish to bearish or vice-versa. This idea is incorporated in this Expert Advisor. It uses two data series, namely the Exponential Moving Average (EMA) of the OPEN prices, and the Exponential Moving Average of the CLOSE prices.

This Expert Advisor provides the flexibility of trading on a different time-frame than that of the current chart by using the appropriate value of the TIME_FRAME parameter.

BUY RULE –

A BUY trade is opened at the close of the candle when the EMA of the CLOSE price series crosses above the EMA of the OPEN price series. This crossover is an important signal that implies the market has turned bullish from bearish or neutral mode.

SELL RULE –

A SELL trade is opened at the close of the candle when the EMA of the CLOSE price series crosses below the EMA of the OPEN price series. This crossover is an important signal that implies the market has turned bullish from bearish or neutral mode.

EXIT RULE –

The Expert Advisor uses a stop-loss of 40 pips, and a take-profit target of 60 pips. The BUY and SELL trades can co-exist at the same time, and are managed independently by the Expert Advisor.

Configurable Inputs

1. LOTS – The lot-size of the trade opened by the Expert Advisor.

2. PERIOD – The period used to calculate the Exponential Moving Average (EMA) over the specified TIME_FRAME.

3. TIME_FRAME – The time-frame (in minutes) over which the Exponential Moving Average (EMA) is calculated. For example, if this value is 240, it implies that the EMA will be calculated on the 4-hour candles.

Ma Crossover Expert, MAVA Xonax Expert Advisor for VertexFX Trading Terminal.

Market Belief Analysis

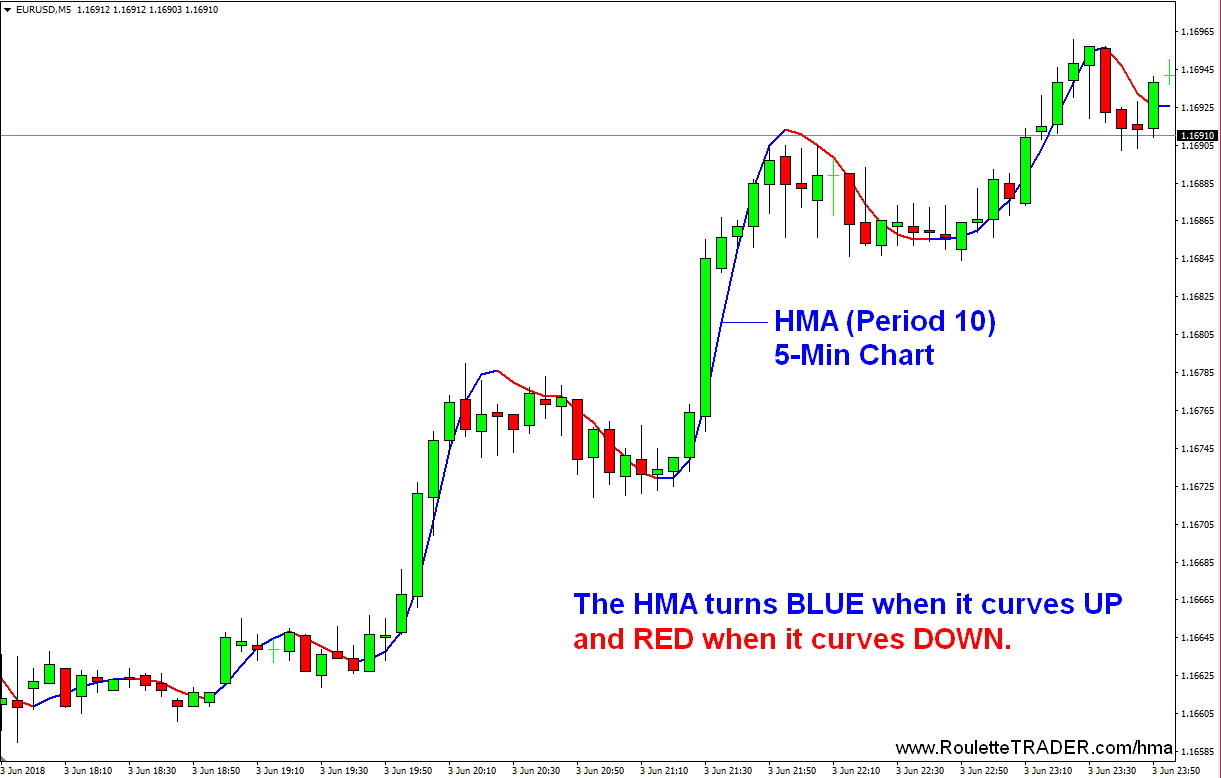

A ‘moving’ average (MA) is the average closing rate of a particular stock (or index) over the last ‘X’ days.

A lot of amateur traders will take out of a trade based upon what is taking place.

MAVA Xonax Expert Advisor for VertexFX Trading Terminal, Get most searched explained videos related to Ma Crossover Expert.

3 Things You Require To Understand About Variety Trading

The software application the traders use at the online trading platforms is more easy to use than it was years ago. It’s not clear which companies will be affected by this decree but Goldcorp and DeBeers have mining projects there.

In less than four years, the rate of oil has actually increased about 300%, or over $50 a barrel. The Light Crude Continuous Contract (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil prices will ultimately slow economic growth, which in turn will trigger oil rates to fall, ceritus paribus.

The finest method to generate income is purchasing and selling Moving Average Trader breakouts., if you include them in your forex trading technique you can utilize them to stack up substantial gains..

Peter warned him however, “Remember Paul, not all trades are this easy and turn out too, but by trading these types of trends on the daily chart, when the weekly pattern is also in the exact same instructions, we have a high probability of a rewarding result in a big percentage of cases.

Choosing a timespan: If your day trading, buying and selling intra day, a 3 year chart will not help you. For intra day trading you wish to use 3,5 and 15 minute charts. Depending upon your longterm investment technique you can look at a 1 year, which I utilize usually to a ten years chart. The annual chart provide me a take a look at how the stock is doing now in today’s market. I’ll look longer for historical support and resistance points but will Forex MA Trading my buys and sells based on what I see in front of me in the yearly.

Can we purchase before the share cost reaches the breakout point? In numerous circumstances we can, however ONLY if the volume boosts. Sometimes you will have a high opening rate, followed by a quick retracement. This will sometimes be followed by a fast upswing with high volume. This can be a buy signal, but once again, we need to Stocks MA Trading sure that the volume is strong.

Another forex trader does care too much about getting a return on financial investment and experiences a loss. This trader loses and his wins are on average, much bigger than losing. He wins double what was lost when he wins the game. This reveals a balancing in losing and winning and keeps the financial investments open up to get a revenue at a later time.

Stochastics is utilized to figure out whether the market is overbought or oversold. The marketplace is overbought when it reaches the resistance and it is oversold when it reaches the assistance. So when you are trading a range, stochastics is the best indicator to tell you when it is overbought or oversold. It is likewise called a Momentum Indicator!

To assist you recognize patterns you need to likewise study ‘moving averages’ and ‘swing trading’. For example 2 basic guidelines are ‘do not purchase a stock that is below its 200-day moving typical’ and ‘don’t buy a stock if its 5-day moving average is pointing down’. If you don’t comprehend what these quotes indicate then you require to research ‘moving averages’. Excellent luck with your trading.

Nasdaq has been creating an increasing wedge for about two years. I would not let this prevent me getting in a trade, however I would keep a close appearance on it. This trader loses and his wins are on average, much larger than losing.

If you are looking instant exciting comparisons related to Ma Crossover Expert, and Counter Trend Trade, Market Indicators, Foreign Exchange Market you should signup our email subscription DB for free.