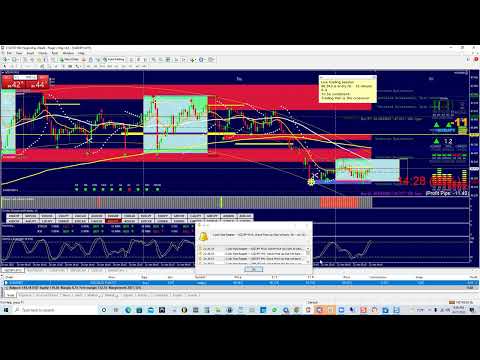

Live Trading Session EMA Crossover Method

Interesting guide about Counter Trend, Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, and Trading Ema Crossover, Live Trading Session EMA Crossover Method.

Live Trading Session EMA Crossover Method

Trading Ema Crossover, Live Trading Session EMA Crossover Method.

Trend Trading – Trading Stocks Utilizing Technical Analysis And Swing Trading Strategies

And yes, often I do trade even without all this things described above. It simply may save you a lot of cash. This does not take place daily, but this takes place pretty often to mention it.

Live Trading Session EMA Crossover Method, Get new replays relevant with Trading Ema Crossover.

A Quick Currency Trading Tutorial – How To Get Started

Essentially what market timing does is protect you from any huge loss in a bearishness. Oil had its largest percentage drop in 3 years. The price has actually dropped some $70 from the peak of the last go to $990.

A ‘moving’ typical (MA) is the average closing cost of a specific stock (or index) over the last ‘X’ days. For example, if a stock closed at $21 on Tuesday, at $25 on Wednesday, and at $28 on Thursday, its 3-day MA would be $24.66 (the sum of $21, $25, and $28, divided by 3 days).

Out of all the stock trading suggestions that I’ve been given over the ears, bone helped me on a more useful level than these. Moving Average Trader Use them and utilize them well.

So this system trading at $1000 per trade has a favorable expectancy of $5 per trade when traded over lots of trades. The earnings of $5 is 0.5% of the $1000 that is at threat throughout the trade.

To make this simpler to understand, let’s put some numbers to it. These are simplified examples to illustrate the concept and the numbers Forex MA Trading or might not match real FX trading techniques.

Rather of subscribing to an advisory letter you Stocks MA Trading decide to comprise your own timing signal. It will take some preliminary work, however when done you will not have to pay anybody else for the service.

While the year-end rally tends to be rather trusted, it does not occur every year. And this is something stock exchange investors and traders may wish to pay attention to. In the years when the markets signed up a loss in the last days of trading, we have typically experienced a bear market the next year.

This trading tool works much better on currency pair cost history than on stocks. With stocks, rate can space up or down which causes it to offer false readings. Currency pair’s cost action hardly ever gaps.

Do not simply purchase and hold shares, at the exact same time active trading is not for everybody. Use the 420 day SMA as a line to decide when to be in or out of the S&P 500. When the market falls below the 420 day SMA, traders can also look to trade brief.

You just need to have persistence and discipline. As your stock moves up in cost, there is a crucial line you desire to see. Pivot point trading is simply among an arsenal of weapons available to Forex market participants.

If you are searching most entertaining videos related to Trading Ema Crossover, and Forex Strategies Revealed, Stock Market, Proclaimed Perfect Systems, Trend Following you should join for email list totally free.