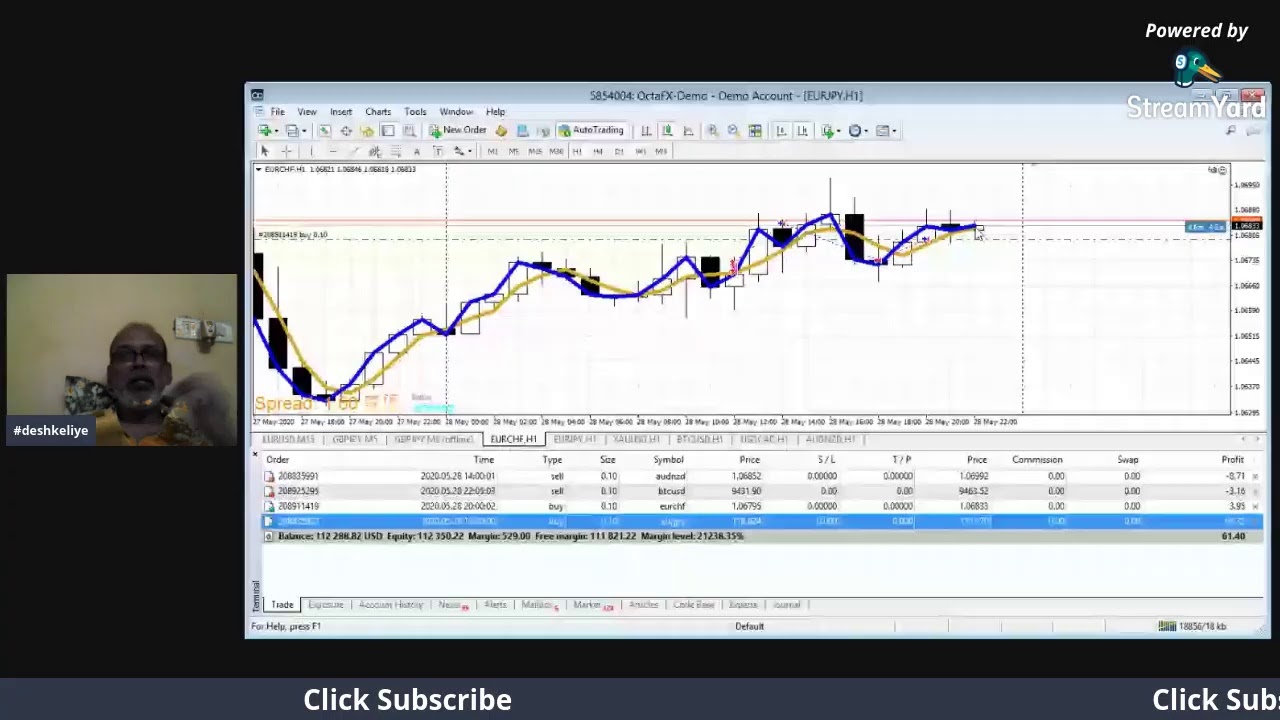

LIVE TELECAST OF MT4 EA – Ultimate MA 1vs3 Crossover 1hr

Latest guide about Oil Stocks, Chinese Markets, Swing Trading Basics, and Ma Crossover EA, LIVE TELECAST OF MT4 EA – Ultimate MA 1vs3 Crossover 1hr.

LIVE TELECAST OF MT4 EA – Ultimate MA 1vs3 Crossover 1hr

#MT4

#ea

#trading www.sharekingpro.com

www.tips1973.com

Ma Crossover EA, LIVE TELECAST OF MT4 EA – Ultimate MA 1vs3 Crossover 1hr.

The Rate Wave – Forecasting With Cycle Analysis

We need to wait for a setup that guarantees an excellent return in a brief time. You will typically see rate appreciating these lines and then blowing right through them. And the best way has 3 important ingredients.

LIVE TELECAST OF MT4 EA – Ultimate MA 1vs3 Crossover 1hr, Watch trending reviews related to Ma Crossover EA.

Do You Trade Es Emini Market Sound Or The Trend

However it has the benefit of providing, in numerous scenarios, the cheapest entry point. You seek the bigger rate at the end of the trade. It was during my look for the ideal robotic that I check out Marcus B.

There are a terrific range of forex indications based upon the moving average (MA). This is an evaluation on the basic moving average (SMA). The simple moving average is line produced by calculating the average of a set number of period points.

But if you have a couple of bad trades, it can actually sour you on the whole trading game Moving Average Trader .When you just have to step back and take a look at it, this is. Possibly, you just need to get away for a day or 2. Unwind, do something different. Your unconscious mind will work on the problem and when you return, you will have a better outlook and can find the trading chances faster than they can come at you.

The 2 charts below are same period everyday charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & energy stocks. The two charts below show SPX began the recent rally about a month prior to OIH. Also, the charts suggest, non-energy & utility stocks tipped over the previous week or so, while energy & utility stocks stayed high or rose even more.

The chart below is a Nasdaq weekly chart. Nasdaq has been producing a rising wedge for about 2 years. The Forex MA Trading indication has been relocating the opposite direction of the cost chart (i.e. negative divergence). The 3 highs in the wedge fit well. Nevertheless, it doubts if the 3rd low will also offer a great fit. The wedge is compressing, which need to continue to produce volatility. Many intermediate-term technical indications, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, etc., suggest the marketplace will be greater at some point within the next couple of months.

Your job is simply to find out direction. Once the bands throws off this signal you need to figure out instructions because Bollinger bands will not inform you that. We figured out instructions due to the fact that we Stocks MA Trading had actually a failed higher swing low. To put it simply broken swing low assistance, and after that damaged assistance of our 10 period EMA. Couple that with the growth of the bands and you end up with a trade that paid almost $8,000 dollars with threat kept to an outright minimum.

Let’s expect you remain in the exact same camp as we are and you believe the long term outlook on gold is extremely favorable. So, each time it dips listed below a particular value level, you include more to your portfolio, basically “purchasing on the dips”. This might be quite various from somebody else who looked at a roll over as a reason to offer out. Yet, both traders are taking a look at the exact same technical levels.

If the rate of my stock or ETF falls to the 20-day SMA and closes listed below it, I like to add a few Put choices– maybe a third of my position. If the stock then continues down and heads towards the 50-day SMA, I’ll add another third. If the price closes below the 50-day SMA, I’ll include another third.

5 distribution days throughout March of 2000 indicated the NASDAQ top. Likewise crucial is the fact that lots of leading stocks were revealing top signals at the same time. The really best stock market operators went primarily, or all in cash at this time, and kept their incredible gains from the previous 4 or 5 years. They did this by properly analyzing the everyday cost and volume action of the NASDAQ. It makes no sense at all to enjoy significant revenues disappear. When you find out to recognize market tops, and take appropriate action, your total trading results will improve significantly.

Also getting in and out of markets although more affordable than in the past still costs money. It is constantly much easier to paddle in the direction of the river! Long as the stock holds above that breakout level.

If you are looking updated and engaging reviews relevant with Ma Crossover EA, and Learn to Trade Forex, Stock Trading Online, Forex Trading please list your email address in email subscription DB totally free.

![RSI overbought | moving average golden cross [Quizzes 10 – 13] RSI overbought | moving average golden cross [Quizzes 10 – 13]](https://MovingAverageTrader.com/wp-content/uploads/1643651659_RSI-overbought-moving-average-golden-cross-Quizzes-10-200x137.jpg)