Lesson 7.1 – Moving Average Ribbon Signals

New vids about Most Advanced Live Trading Forex Robot Capable of Doubling Your Money, Sell Strategy, Stock Buy Signals, Buy or Sell, and What Is Ema Crossover Indicator, Lesson 7.1 – Moving Average Ribbon Signals.

Please consider our Risk Disclosure: https://www.xm.com/goto/risk/en

Get this tool for free: https://www.xm.com/trading-tools

In this video, we give you an overview of entry techniques by using the moving average ribbon. We will outline the possible entry signals along with practical examples of the use of our automated Moving Average Ribbon Indicator and market scanner.

Visit our page for more: http://www.xm.com the international Forex broker.

What Is Ema Crossover Indicator, Lesson 7.1 – Moving Average Ribbon Signals.

Forex Strategies Revealed – See It Firsthand What An Expert Trader Has To State!

Now, another thing that you should have observed is that all these MAs are the average of past rates. The understanding and usage of basic moving averages will achieve this. A minimum of as far as the retail investor is concerned.

Lesson 7.1 – Moving Average Ribbon Signals, Find latest reviews relevant with What Is Ema Crossover Indicator.

Scalping The Forex Market For Mega Profits

5 circulation days throughout March of 2000 indicated the NASDAQ top. The trading platforms are more easy to use than they were years back. It is usually utilized in double format, e.g. a 5 day moving average and a 75 day moving average.

Moving averages (MAs) are one of the most easy yet the most popular technical signs out there. Determining a moving average is really easy and is simply the average of the closing costs of a currency pair or for that matter any security over a time period. The timeframe for a MA is identified by the variety of closing rates you desire to include. Comparing the closing rate with the MA can help you identify the pattern, one of the most essential things in trading.

When a stock relocations in between the support level and the resistance level it is said to be in a trend and you need to buy it when it reaches the bottom of the Moving Average Trader pattern and offer it when it reaches the top. Normally you will be trying to find a short-term revenue of around 8-10%. You make 10% revenue and you sell up and go out. You then look for another stock in a similar pattern or you wait on your original stock to fall back to its assistance level and you buy it back again.

Support & Resistance. Support-this term describes the bottom of a stock’s trading range. It resembles a flooring that a stock price finds it hard to permeate through. Resistance-this term describes the top of a stock’s trading range.It’s like a ceiling which a stock’s rate doesn’t seem to rise above. When to offer a stock or buy, support and resistance levels are important clues as to. Many effective traders purchase a stock at support levels and sell short stock at resistance. If a stock manages to break through resistance it might go much higher, and if a stock breaks its assistance it might indicate a breakdown of the stock, and it may decrease much even more.

To make this much easier to understand, let’s put some numbers to it. These are simplified examples to illustrate the concept and the numbers Forex MA Trading or may not match genuine FX trading techniques.

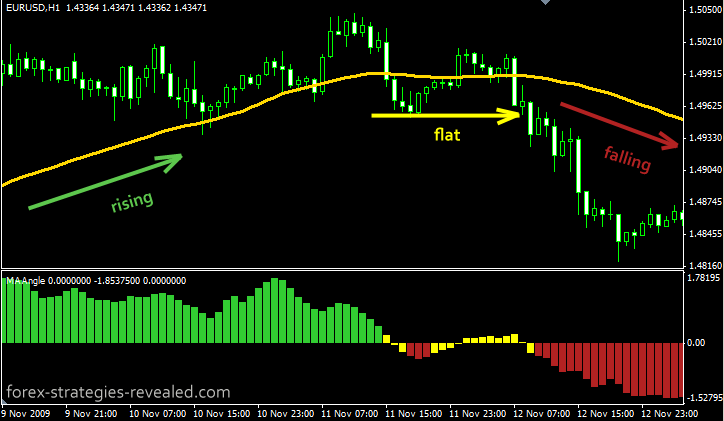

There are many techniques and indications to recognize the pattern. My preferred ones are the most easy ones. I like to use a moving typical indication with the a great deal of balancing periods. Rising Stocks MA Trading shows the uptrend, falling MA shows the drop.

Draw the line to acknowledge the assistance and resistance levels. The more the line is touched, the more essential it becomes as a support or resistance levels. An uptrend is suggested by higher highs and greater lows. A drop is suggested by lower highs and lower lows.

Stochastics is used to figure out whether the market is overbought or oversold. When it reaches the resistance and it is oversold when it reaches the support, the market is overbought. So when you are trading a variety, stochastics is the best indicator to tell you when it is overbought or oversold. It is also called a Momentum Indication!

The trader who receives a signal from his/her trading system that is trading on a medium based timeframe is permitting the info to be absorbed into the marketplace before taking a position and also to determine their danger. This trader whether he thinks costs are random or not thinks that details is gathered and responded upon at different rates for that reason offering chance to get in alongside The Wizard.

This does not occur daily, however this happens pretty frequently to discuss it. It has actually been quite a couple of weeks of disadvantage volatility. I don’t believe this will choice will hold up gradually.

If you are searching exclusive exciting reviews relevant with What Is Ema Crossover Indicator, and Forex Indicator Systems, Forex Education you should list your email address in subscribers database for free.