Learn to Trade Live & Free

Top full length videos highly rated Trading Trends, Foreign Currency Trading, Stock Trading Online, Daily Forex Signals, and Sma Trading Egypt, Learn to Trade Live & Free.

Powered by Restream https://restream.io/

Watch our FREE show “Learn To Trade Live & FREE” and don’t forget to subscribe to our channel to learn more about Fundamental trading, Technical Trading and Trading Psychology on your feed & turn on your notifications for timely update on our show!

Join our FREE Telegram Channel: https://t.me/joinchat/AAAAAEdDcMnJ2H9U2ylidA

Actions To Wealth

Website: www.actionstowealth.com

FACEBOOK: https://www.facebook.com/ActionsToWealth/

Instagram: @actionstowealth.insta

Twitter: @ActionsToWealth

Online Trading Profits

Website: www.onlinetradingprofits.com

FACEBOOK: https://www.facebook.com/OnlineTradingProfits/

Instagram: @onlinetradingprofits.insta

Twitter: @OTradingProfits

Sma Trading Egypt, Learn to Trade Live & Free.

Support And Resistance In Cfd Trading

Naturally, these moving averages are used as dynamic support and resistance levels. Intricately developed strategies do not always work. Let’s begin with a system that has a 50% opportunity of winning.

Learn to Trade Live & Free, Watch new complete videos related to Sma Trading Egypt.

Why Does The Stock Market Dislike Me – The Psychology Of Trading

The strongest signal is where the existing rate goes through both the SMAs at a high angle. On April 28, the gold-silver ratio was about 30, fairly low. I have been trading futures, options and equities for around 23 years.

Occasionally the technical signs start making news. Whether it’s the VIX, or a moving average, someone gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as an investor one has to ask, “are technical indications actually a reason to purchase or offer?” In some respects the response is no, given that “investing” is something various from swing trading or day trading.

But if you have a number of bad trades, it can really sour you on the entire trading game Moving Average Trader .When you just have to step back and take an appearance at it, this is. Perhaps, you simply need to escape for a day or two. Unwind, do something various. Your unconscious mind will work on the issue and when you come back, you will have a much better outlook and can identify the trading chances quicker than they can come at you.

The most basic application of the BI concept is that when a stock is trading above its Bias Indication you should have a bullish predisposition, and when it is trading below its Bias Indication you ought to have a bearish predisposition.

You require to identify the start of the break out that developed the relocation you are going to trade versus. The majority of people use Assistance and resistance lines to identify these locations. I find them to be very Forex MA Trading efficient for this function.

A Forex trading strategy needs 3 Stocks MA Trading standard bands. These bands are the time frame chosen to trade over it, the technical analysis utilized to identify if there is a rate trend for the currency pair, and the entry and exit points.

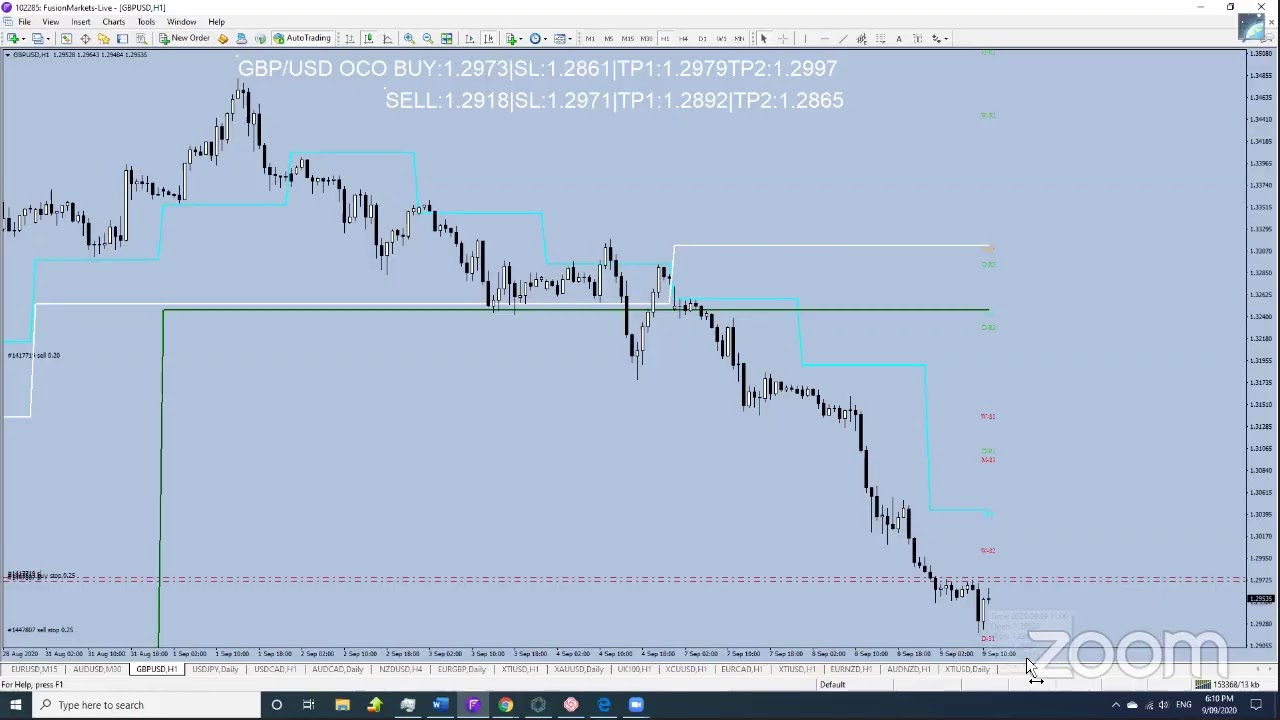

Here is a perfect example of a method that is easy, yet creative sufficient to ensure you some included wealth. Start by selecting a particular trade that you think pays, say EUR/USD or GBP/USD. When done, select two indicators: weighted MA and simple MA. It is recommended that you use a 20 point weighted moving average and a 30 point moving average on your 1 hour chart. The next action is to look out for the signal to sell.

This trading tool works much better on currency set cost history than on stocks. With stocks, price can space up or down which causes it to offer false readings. Currency set’s rate action rarely spaces.

There you have the two most vital lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can usually be done longer up to 2 months, using stops along the way, one doesn’t even truly need to watch it, of course one can as they ca-ching in one those safe earnings. The other pattern is fish lips, they are normally held for less than a month, and are exited upon upper band touches, or mare precisely retreats from upper band touches. When the cost touches the upper band and then retreats), (. Fish lips that re formed out of a flat pattern can frequently become ‘riding the wave,’ and then are held longer.

From its opening rate on January 3rd 2012 through the closing cost on November 30th, the SPX rose by 12.14%. The vertical axis is outlined on a scale from 0% to 100%. You don’t need to succumb to analysis paralysis.

If you are searching instant entertaining reviews related to Sma Trading Egypt, and Chinese Stocks, Range Trading please join our email alerts service now.