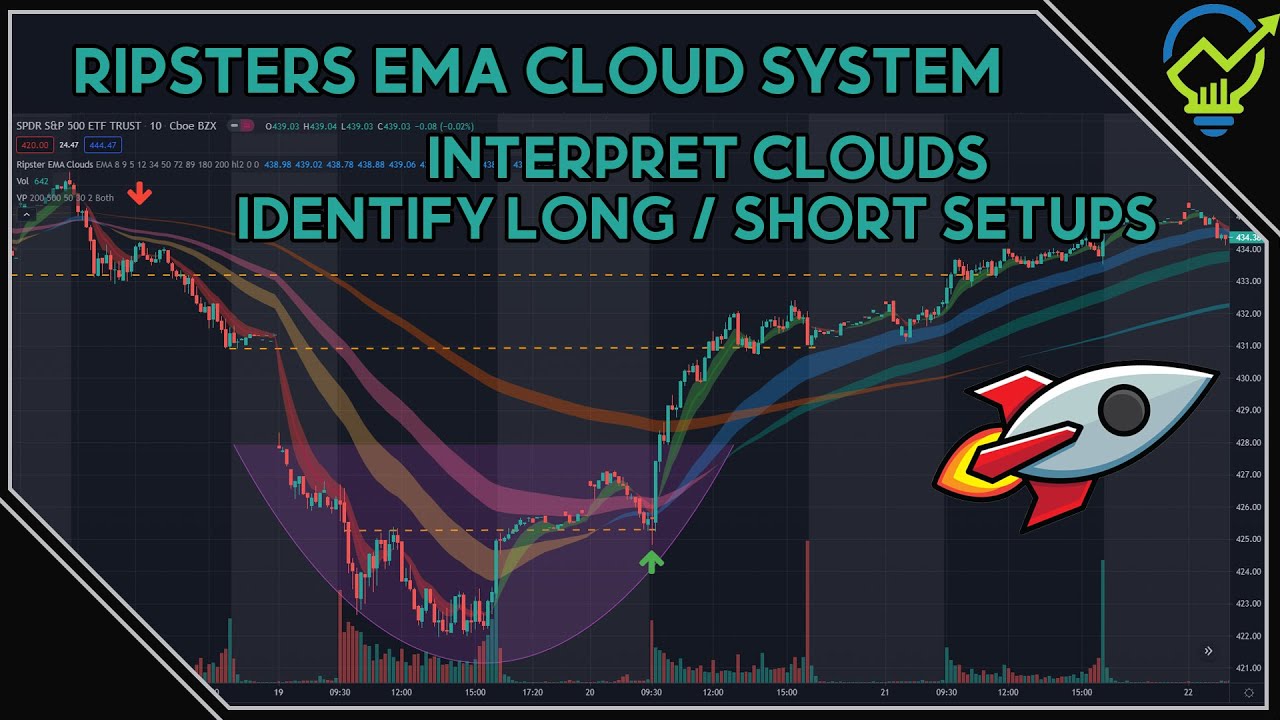

HOW TO USE RIPSTERS EMA CLOUDS – DETERMINING LONG/SHORT SETUPS ON THE 10M TIME FRAME

Latest clips about Counter Trend, Three Moving Averages, Commitment of Traders, Forex Moving Averages, and How to Use Ema in Trading, HOW TO USE RIPSTERS EMA CLOUDS – DETERMINING LONG/SHORT SETUPS ON THE 10M TIME FRAME.

A quick explanation of how to use Ripsters ema cloud system to determine potential long/short setups. Market Engineers (FREE) …

How to Use Ema in Trading, HOW TO USE RIPSTERS EMA CLOUDS – DETERMINING LONG/SHORT SETUPS ON THE 10M TIME FRAME.

What’s The Finest Day Trading Strategy?

What is appropriate for the trending market might not be suitable for a variety bound or a combining market. Trading in the Forex market has actually become easier throughout the last couple of years.

HOW TO USE RIPSTERS EMA CLOUDS – DETERMINING LONG/SHORT SETUPS ON THE 10M TIME FRAME, Explore new full videos about How to Use Ema in Trading.

Forex Trading Success – A Basic Method For Substantial Gains

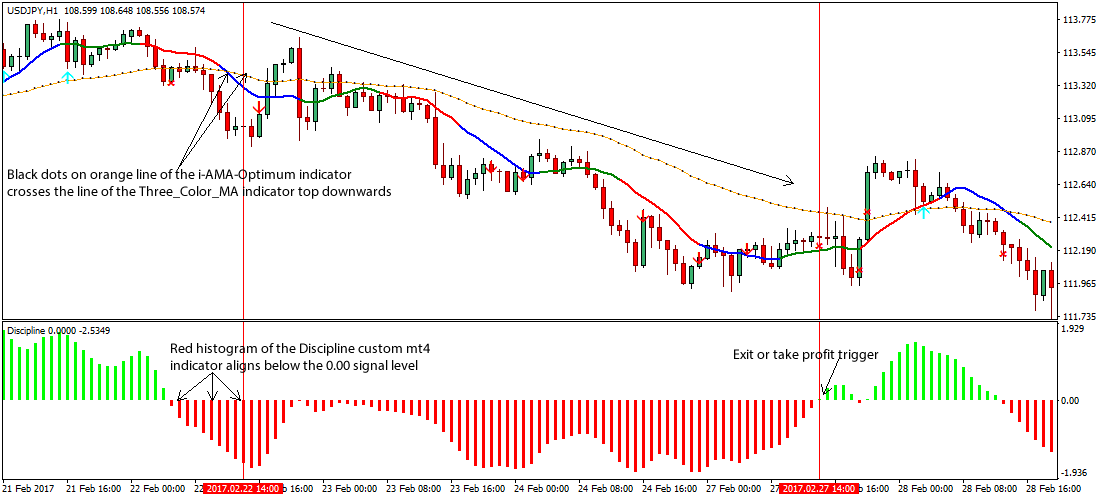

A strategy that is reasonably popular with traders is the EMA crossover. Comparing the closing price with the MA can assist you determine the trend, among the most essential things in trading. Oil had its biggest percentage drop in three years.

If you trade stocks, you should understand how to chart them. Some people explore charts to discover buy or offer signals. I discover this wasteful of a stock traders time. You can and need to chart all types of stocks including penny stocks. When to sell or buy, charting informs you where you are on a stocks cost pattern this implies it informs you. There are lots of terrific companies out there, you don’t want to get captured purchasing them at their 52 week high and having to wait around while you hope the cost returns to the price you paid.

This environment would suggest that the currency set’s price is trending up or down and breaking out of its present trading variety. This usually takes place when there are modifications impacting the currency’s country. When the cost of the currency set increases below or above the 21 Exponential Moving Average and then going back to it, a quick trending day can be seen. A Moving Average Trader needs to study the basics of the country before choosing how to trade next.

The two charts below are same duration everyday charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & utility stocks. The 2 charts listed below show SPX started the current rally about a month prior to OIH. Also, the charts suggest, non-energy & energy stocks fell over the previous week or two, while energy & utility stocks remained high or rose further.

Selecting an amount of time: If your day trading, purchasing and offering intra day, a 3 year chart will not assist you. For intra day trading you want to use 3,5 and 15 minute charts. Depending upon your longterm investment strategy you can look at a 1 year, which I utilize frequently to a ten years chart. The annual chart give me a look at how the stock is doing now in today’s market. I’ll look longer for historical assistance and resistance points however will Forex MA Trading my buys and sells based on what I see in front of me in the yearly.

Now that you have determined the daily pattern, drop down to the lower timeframe and take a look at the Bollinger bands. You are searching for the Stocks MA Trading price to hit the extreme band that is versus the everyday pattern.

You will be able to see the pattern amongst traders of forex if you utilize info offered by FXCM. Everyday earnings and loss changes show there is a large loss and this implies traders do not benefit and end up losing money instead. The gain per day was just 130 pips and the highest loss was a drop of over 170 points.

If the rate of my stock or ETF is up to the 20-day SMA and closes below it, I like to include a couple of Put choices– perhaps a third of my position. If the stock then continues down and heads toward the 50-day SMA, I’ll include another 3rd. If the cost closes below the 50-day SMA, I’ll include another 3rd.

The trader who receives a signal from his/her trading system that is trading on a medium based timeframe is permitting the information to be taken in into the market prior to taking a position and also to determine their threat. This trader whether he thinks costs are random or not believes that information is collected and reacted upon at different rates therefore giving chance to go into alongside The Wizard.

You require to set very specified set of swing trading rules. Once you have actually enjoyed share market you need to comprehend how it works. You must establish your own system of day trading.

If you are looking most entertaining reviews about How to Use Ema in Trading, and Trading Tip, Simple Moving Average, Forex Artificial Intelligence dont forget to join for subscribers database for free.