How to trade with 200 SMA

Best high defination online streaming related to Forex Investors, Moving Average, and How To Use Sma In Trading, How to trade with 200 SMA.

LINKS RELATED TO HYIT :

========================

TELEGRAM : @hyitintradaycalls

YOUTUBE : https://www.youtube.com/channel/UC6e2…

TWITTER : @mangalece (HighYieldTradings)

INSTAGRAM : mangalece (HighYieldTradings)

WEBSITE : https://www.highyieldtradings.com

HYIT TRAININGS : https://www.highyieldtradings.com/tra…

TRADINGVIEW : https://in.tradingview.com/u/mangalece/

TRAINEE’S/MEMBER’S REVIEW & PERFORMANCES : @HYITiansReflection

DISCLAIMER : @HYITDisclaimer

TO GET IN TOUCH WITH ME PERSONALLY –

TELEGRAM : @mangaldeep

WHATSAPP : +91-9741433991

———————————————————————————————————–

WHAT IS HYIT ALL ABOUT ?

HighYieldTradings firmly believes in sharpening the technical skills and giving it an edge, wherein the traders and investors can make their own trading decisions without being dependent on others. We emphasize on the practice to repeat the right things again and again, so that it becomes a practice, and in turn it becomes your discipline, which is the key to be a successful trader. Knowing the basics of trading is very important, but knowing where and when exactly to implement it, is far more important and critical. Here we will teach you the exact same thing. Remember, making no money is always a better option than losing money.

It is believed that day trading or intraday trading is a way to loose your capital but this does not hold good for everyone out there. There are hundreds and thousands of traders who make consistent profits with day trading on a regular basis. What is the MANTRA ? The mantra is to make sure that your losses are much lesser than the profits that you make. And believe me, we have very clear and pre-defined rules for this but the only problem is that, people don’t follow them. It becomes very tough for most of us to digest the fact that we are in losses. I mean, what’s the big deal … It is the part and parcel of this game called Day Trading. It should not be bothering us so much. If we are in loss today, we can be in profit tomorrow. But our monkey mind does not allow us to accept this fact and what people end up doing is to take revenge trades, forget all the rules/discipline, make more losses and finally quit the game regretting, why did they do, what they did. And that is the whole reason why we are here, to make sure that our clients do not regret their decisions !!!

Having that said, we welcome you all to the most fascinating world of trading.

Happy Trading !!!

How To Use Sma In Trading, How to trade with 200 SMA.

Market Sentiment Analysis

The wedge is compressing, which should continue to produce volatility. It was during my look for the ideal robot that I check out Marcus B. Your trading plan need to include what timespan you are concentrating on.

How to trade with 200 SMA, Enjoy trending updated videos about How To Use Sma In Trading.

News Trading (Part Ii)

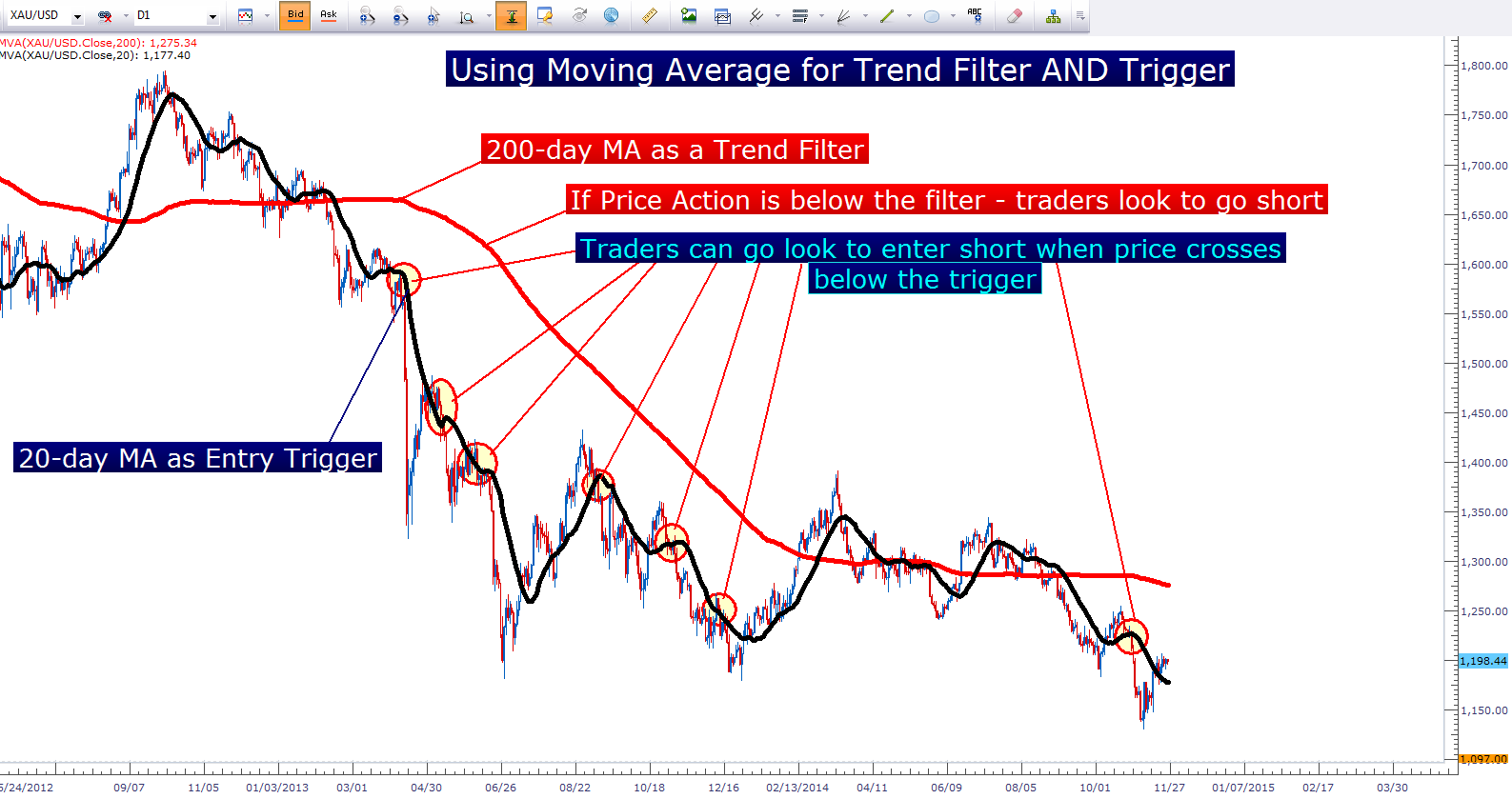

To keep dangers down, I recommend simply choosing the 200 Day Moving Average. You need to set really specified set of swing trading guidelines. Paul accepted study difficult and to attempt to conquer his emotions of worry and greed.

When I first heard of FAP Turbo, I was not excited because I have lost cash trading forex on my own with a particular robot and without the right tools and techniques. It was during my search for the ideal robotic that I check out Marcus B. Leary statement of it being the most innovative live trading forex robotic capable of doubling your money every month. I relied on Marcus and so chose to give it a shot by downloading it for $149. Was I happy with the outcome? You wager I did. Read the very best FAP Turbo evaluation listed below prior to you choose to begin online currency trading utilizing this robotic or any other.

If that ratio gets extremely high, like 100, that means that silver is inexpensive relative to gold and may be a great value. If the number is low, silver Moving Average Trader might be getting extremely costly.

Buy-and-hold say the professionals. Buy-and-hold say the consultants who make money from your investment purchases though commissions. Buy-and-hold state most shared fund companies who make money from load costs so numerous in range it would take too much space to list them all here. Buy-and-hold state TELEVISION analysts and newsletter publishers who’s clients currently own the stock.

The chart below is a Nasdaq weekly chart. Nasdaq has actually been developing a rising wedge for about two years. The Forex MA Trading indicator has actually been relocating the opposite direction of the cost chart (i.e. negative divergence). The 3 highs in the wedge fit well. Nevertheless, it doubts if the 3rd low will likewise give a good fit. The wedge is compressing, which must continue to generate volatility. Numerous intermediate-term technical signs, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, and so on, suggest the marketplace will be higher at some point within the next few months.

Rather of subscribing to an advisory letter you Stocks MA Trading choose to comprise your own timing signal. It will take some initial work, once done you will not have to pay anyone else for the service.

Draw the line to recognize the support and resistance levels. The more the line is touched, the more crucial it becomes as an assistance or resistance levels. An uptrend is suggested by higher highs and greater lows. A sag is indicated by lower highs and lower lows.

It has been quite a couple of weeks of disadvantage volatility. The cost has dropped some $70 from the peak of the last run to $990. The green line depicts the significant fight area for $1,000. While it is $990 rather of $1,000 it does represent that milestone. Therefore we have actually had our 2nd test of the $1,000 according to this chart.

In this short article is illustrated how to sell a stylish and fading market. This article has only illustrated one technique for each market situation. When they trade Forex online, it is advised traders utilize more than one strategy.

The cost has dropped some $70 from the peak of the last go to $990. So, ignoring the news for the moment, what do the numbers inform us? The default settings are red for down and blue for up.

If you are looking instant exciting comparisons relevant with How To Use Sma In Trading, and Buy Signal, Sector Trends please signup our email list totally free.