How to Think About Moving Averages – 20/50/200 SMA

Latest updated videos about Stock Trading Tips, Most Advanced Live Trading Forex Robot Capable of Doubling Your Money, Complex Indicators, Swing Trading for Beginners, and Sma Trading Account, How to Think About Moving Averages – 20/50/200 SMA.

https://www.t3live.com/pro-desk-qs-yt

Moving Averages are NOT Support and Resistance lines! Moving Averages can give a clear view of a stock’s trend on different time frames using the 20/50/200 SMA and technical equilibrium between the 8 & 21 EMA.

Watch this video to learn more about this powerful tool – what they are, how they are calculated, and the difference they can make in your trading.

Grab Derrick’s Free Prop Trading eBook here: https://www.t3live.com/derrick-ebook-youtube.

Learn about Derrick’s Virtual Trading Floor®: https://www.t3live.com/pro-desk-qs-yt.

#trader #daytrading #stocks #stockmarket #finance

— Disclosure —

T3 Trading Group, LLC is a Registered SEC Broker-Dealer & Member of FINRA / SIPC. T3 Trading Group videos are for educational purposes only. This information neither is, nor should be construed, as an offer, or a solicitation of an offer, to buy or sell securities. You shall be fully responsible for any investment decisions you make, and such decisions will be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Sma Trading Account, How to Think About Moving Averages – 20/50/200 SMA.

Number 1 Loser Indication – Why Trading Moving Averages Fail

What they desire is a forex method that turns into an earnings within minutes of entering into the trade. Despite the fact that I’m not a big fan of scalping there are numerous traders who effectively make such trades.

How to Think About Moving Averages – 20/50/200 SMA, Explore new reviews relevant with Sma Trading Account.

When To Sell And Buy In The Forex Market, Forex Online Trading And.

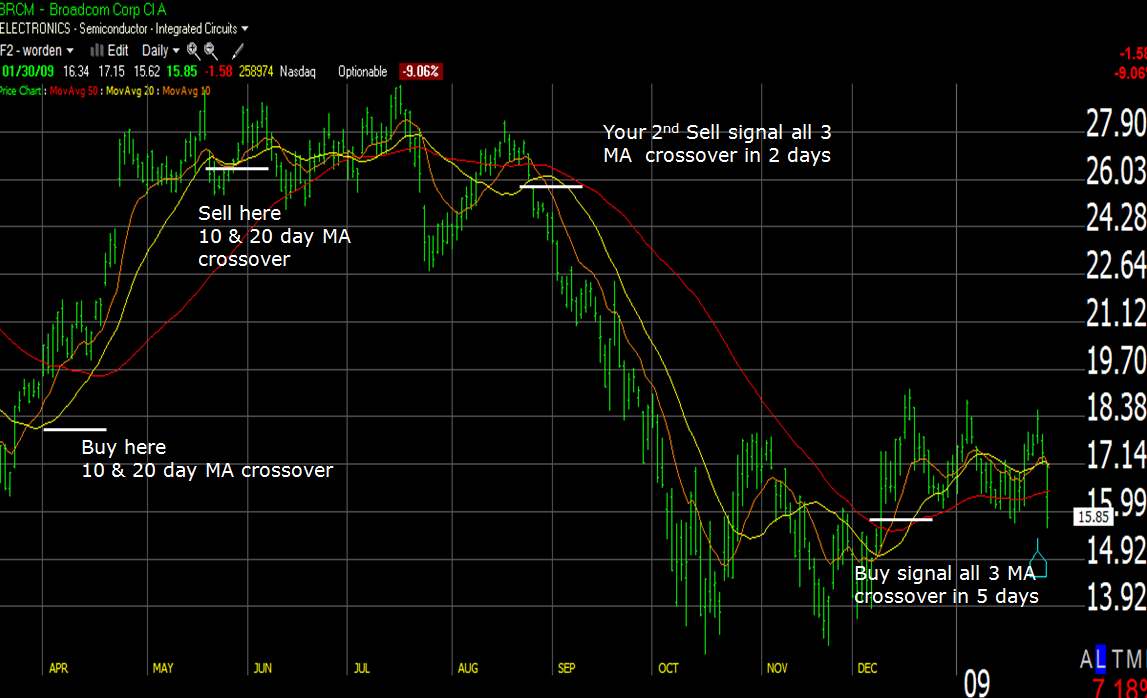

Five distribution days throughout March of 2000 signaled the NASDAQ top. The trading platforms are more user-friendly than they were years earlier. It is invariably used in double format, e.g. a 5 day moving average and a 75 day moving average.

You need to know how to chart them if you trade stocks. Some people search through charts to find buy or sell signals. I find this wasteful of a stock traders time. You can and need to chart all types of stocks including cent stocks. When to sell or buy, charting informs you where you are on a stocks rate pattern this suggests it informs you. There are a lot of fantastic business out there, you don’t want to get captured purchasing them at their 52 week high and needing to wait around while you hope the rate comes back to the rate you paid.

“Remember this Paul,” Peter Moving Average Trader said as they studied the long term chart, “Wealth comes from looking at the big photo. Lots of people think that holding for the long term suggests forever. I prefer to hold things that are rising in value.I take my cash and wait up until the trend turns up once again if the trend turns down.

The two charts below are same duration everyday charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & utility stocks. The 2 charts listed below program SPX began the recent rally about a month before OIH. Likewise, the charts imply, non-energy & utility stocks tipped over the previous week or so, while energy & energy stocks remained high or rose even more.

The near-term indications on the marketplace have actually damaged on the Dow Jones. The DJIA remained in a bullish pattern however it fell listed below its 20-day average of 11,156. If the average can not hold, this implies that the market might fall. In addition, the Relative Strength is showing a loss while the Forex MA Trading is at a moderate sell.

Among the primary indications that can help you develop the way the index is moving is the Moving Typical (MA). This takes the index price over the last given number of averages and days it. With each brand-new day it drops the very first rate used in the previous day’s estimation. It’s always good to inspect the MA of a number of durations depending if you are wanting to day trade or invest. If you’re looking to day trade then a MA over 5, 15, and 30 minutes are an excellent idea. If you’re trying to find long term investment then 50, 100, and 200 days may be more what you need. For those who have trades lasting a few days to a couple of weeks then periods of 10, 20 and 50 days Stocks MA Trading be better suited.

For each time a short article has been e-mailed, award it three points. An e-mailed short article implies you have at least strike the interest nerve of some member of your target audience. It might not have been a publisher so the classification isn’t as important as the EzinePublisher link, however it is better than an easy page view, which doesn’t always indicate that someone read the whole article.

This trading tool works much better on currency set cost history than on stocks. With stocks, price can space up or down which causes it to give incorrect readings. Currency pair’s cost action hardly ever gaps.

The basic rule in trading with the Stochastics is that when the reading is above 80%, it suggests that the market is overbought and is ripe for a downward correction. Similarly when the reading is below 20%, it implies that the marketplace is oversold and is going to bounce down quickly!

This does not take place daily, however this happens quite typically to mention it. It has actually been quite a couple of weeks of drawback volatility. I do not believe this will decision will hold up with time.

If you are finding updated and entertaining reviews related to Sma Trading Account, and Buy Breakouts, Foreighn Exchange Market you should subscribe in newsletter for free.