How to programe moving average trading rules in Excel

Top YouTube videos top searched Stock Trading Tips, Most Advanced Live Trading Forex Robot Capable of Doubling Your Money, Complex Indicators, Swing Trading for Beginners, and 50 Day Ema Trading Rule, How to programe moving average trading rules in Excel.

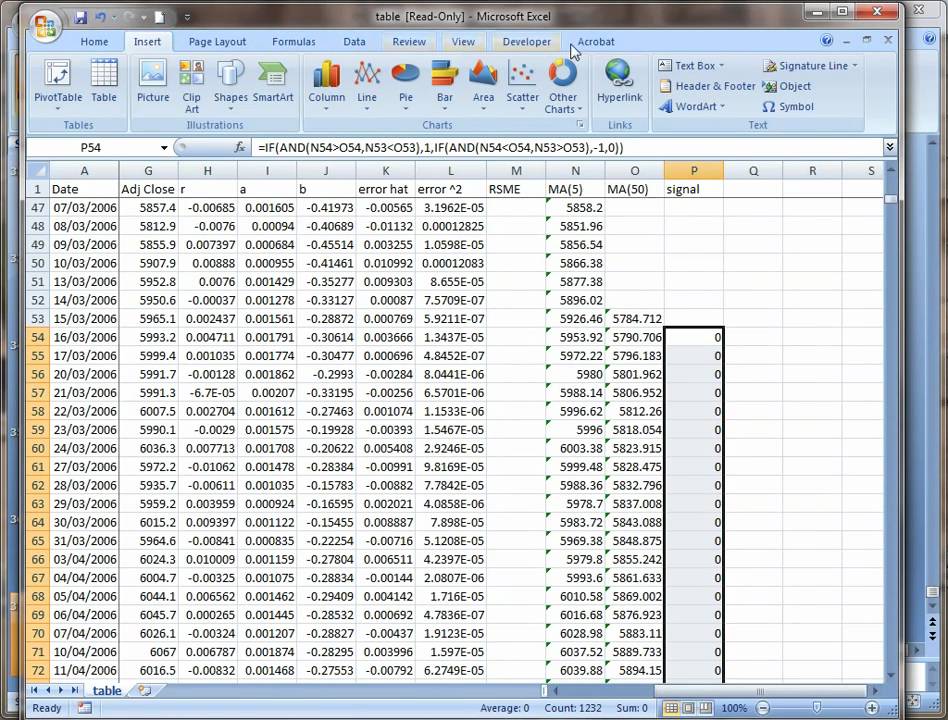

50 Day Ema Trading Rule, How to programe moving average trading rules in Excel.

Forex Revenues – 2 Simple Signs Anybody Can Use To Enhance Trading

That setup might not happen for XYZ throughout the remainder of the year. Palladium looks to be holding while platinum is anybody’s guess at this point. Naturally, these moving averages are utilized as vibrant support and resistance levels.

How to programe moving average trading rules in Excel, Find most shared complete videos relevant with 50 Day Ema Trading Rule.

Support And Resistance In Cfd Trading

Not just commission however the spread (difference between trading cost). When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and ought to be purchased.

The Bollinger Bands were produced by John Bollinger in the late 1980s. Bollinger studied moving averages and experimented with a brand-new envelope (channel) sign. This research study was among the very first to measure volatility as a vibrant motion. This tool provides a relative definition of rate highs/lows in regards to upper and lower bands.

“Remember this Paul,” Peter Moving Average Trader stated as they studied the long term chart, “Wealth comes from taking a look at the big image. Many individuals believe that holding for the long term indicates forever. I prefer to hold things that are increasing in value.I take my cash and wait till the trend turns up once again if the trend turns down.

Technical Analysis utilizes historic costs and volume patterns to predict future behavior. From Wikipedia:”Technical analysis is often contrasted with basic Analysis, the study of economic aspects that some experts say can influence costs in financial markets. Technical analysis holds that costs currently show all such impacts prior to financiers know them, hence the study of rate action alone”. Technical Experts strongly believe that by studying historic costs and other key variables you can forecast the future price of a stock. Nothing is outright in the stock exchange, however increasing your likelihoods that a stock will go the direction you expect it to based upon cautious technical analysis is more accurate.

It’s appealing to start trading at $10 or $20 a point just to see how much cash, albeit make-believe money, you can Forex MA Trading in as brief a time as possible. But that’s an error. Then you ought to treat your $10,000 of make-believe money as if it were genuine, if you’re to find out how to trade currencies successfully.

The creators of technical analysis concerned it as a tool for an elite minority in a world in which essential analysis reined supreme. They regarded themselves as smart Stocks MA Trading predators who would conceal in the weeds and knock off the big game fundamentalists as they came thundering by with their high powered technical rifles.

The most utilized MA figures consist of the 20 Day MA, the 50 Day MA and the 200 Day MA. The 20 Day MA looks at the brief term average, the 50 Day looks that a more intermediate timespan and the 200 Day takes a look at a longer timespan. The entire purpose for this strategy is to just be invested when the security is over their moving average. It is ideal when it is over all 3 averages, but that typically isn’t the case. To keep threats down, I suggest just opting for the 200 Day Moving Average.

Getting in the market at this stage is the most aggressive technique due to the fact that it does not enable for any type of confirmation that the stock’s break above the resistance level will continue. Possibly this strategy ought to be reserved for the most appealing stocks. Nevertheless it has the benefit of supplying, in many circumstances, the cheapest entry point.

There you have the two most important lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can generally be done longer up to 2 months, using stops along the way, one doesn’t even really need to watch it, obviously one can as they ca-ching in one those safe revenues. The other pattern is fish lips, they are usually held for less than a month, and are exited upon upper band touches, or mare exactly retreats from upper band touches. (When the cost touches the upper band and then retreats). Fish lips that re formed out of a flat pattern can typically develop into ‘riding the wave,’ and then are held longer.

You can utilize any signs that you’re comfortable with to go through a similar procedure. To be ahead of the video game and on top of the circumstance, plan ahead for contingency steps in case of spikes.

If you are looking unique and entertaining reviews relevant with 50 Day Ema Trading Rule, and Forex System Trading, Stock Market for Beginners dont forget to join for newsletter totally free.