How to Day Trade Using Volume | Tradingsim.com

New full videos about Trading Part Time, Trading Tool, Current Sector Trends, and What Sma Stand For In Trading, How to Day Trade Using Volume | Tradingsim.com.

See how volume can help avoid the pitfalls of false breakouts. Learn the 3 simple signals that can keep you on the right side of the market.

To learn more about volume and day trading, please visit: https://tradingsim.com/blog/volume-analysis-technical-indicator/

Visit Tradingsim.com to practice trading on over 2 years of historically recorded market sessions. Tradingsim is like a DVR for the stock markets. http://tradingsim.com/

What Sma Stand For In Trading, How to Day Trade Using Volume | Tradingsim.com.

Break Devoid Of Old Trading Ideas

Nasdaq has rallied 310 points in 3 months, and struck a brand-new four-year high at 2,201 Fri early morning.

Many indicators are offered in order to recognize the trends of the marketplace.

How to Day Trade Using Volume | Tradingsim.com, Find new videos relevant with What Sma Stand For In Trading.

Forex Exchange – How To Predict Price Movements

Presently, SPX is oversold enough to bounce into the Labor Day holiday. Nasdaq has rallied 310 points in 3 months, and hit a new four-year high at 2,201 Fri early morning. Likewise active trading can impact your tax rates.

In less than four years, the rate of oil has actually increased about 300%, or over $50 a barrel. The Light Crude Constant Contract (of oil futures) struck an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Constantly high oil prices will eventually slow financial growth, which in turn will cause oil costs to fall, ceritus paribus.

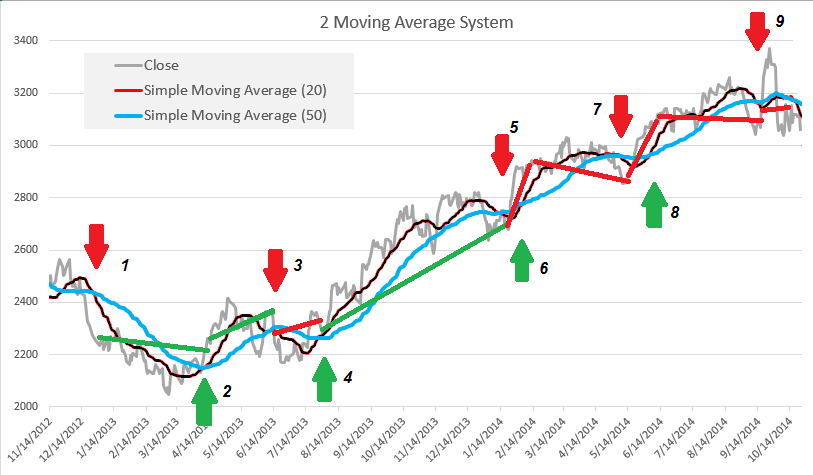

Technical analysis can be extremely helpful for Moving Average Trader to time our entries and exits of the trade. It shouldn’t be used alone since it can be confusing details if not used properly.

The dictionary quotes an average as “the ratio of any amount divided by the variety of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

The near-term indications on the market have actually deteriorated on the Dow Jones. The DJIA was in a bullish pattern but it fell below its 20-day average of 11,156. If the average can not hold, this means that the market could fall. In addition, the Relative Strength is revealing a loss while the Forex MA Trading is at a moderate sell.

The online Stocks MA Trading platforms offer a lot of sophisticated trading tools as the Bolling Bands indicator and the Stochastics. The Bolling Bands is including a moving average line, the upper standard and lower standard variance. The most utilized moving average is the 21-bar.

A 50-day moving typical line takes 10 weeks of closing cost information, and after that plots the average. The line is recalculated daily. This will reveal a stock’s cost trend. It can be up, down, or sideways.

To enter a trade on a Pattern Turnaround, he requires a Trendline break, a Moving Average crossover, and a swing greater or lower to ready in an uptrend, and a trendline break, a Moving Average crossover and a lower swing low and lower swing high to get in a downtrend.

Now, this really important if you alter the number of durations of the easy moving average, you ought to change the basic deviation of the bands too. For instance if you increase the duration to 50, increase the standard discrepancy to two and a half and if you decrease the duration to 10, reduce the basic deviation to one and a half. Periods less than 10 do not seem to work well. 20 or 21 period is the optimum setting.

There you have the two most crucial lessons in Bollinger Bands. The objective is to make more profit using the least quantity of leverage or risk. It simply may save you a lot of money.

If you are looking unique and exciting reviews related to What Sma Stand For In Trading, and Day Forex Signal Strategy Trading, Momentum Forex Trading dont forget to join in email alerts service totally free.