How to Build a MetaTrader Moving-Average Crossover Custom Indicator Using VTS

Latest full length videos highly rated Options Trading, Stock Trading System, Stock Buy Signals, Exit Strategy, and Ma Crossover EA, How to Build a MetaTrader Moving-Average Crossover Custom Indicator Using VTS.

How to Build a MetaTrader Moving-Average Crossover Custom Indicator Using VTS

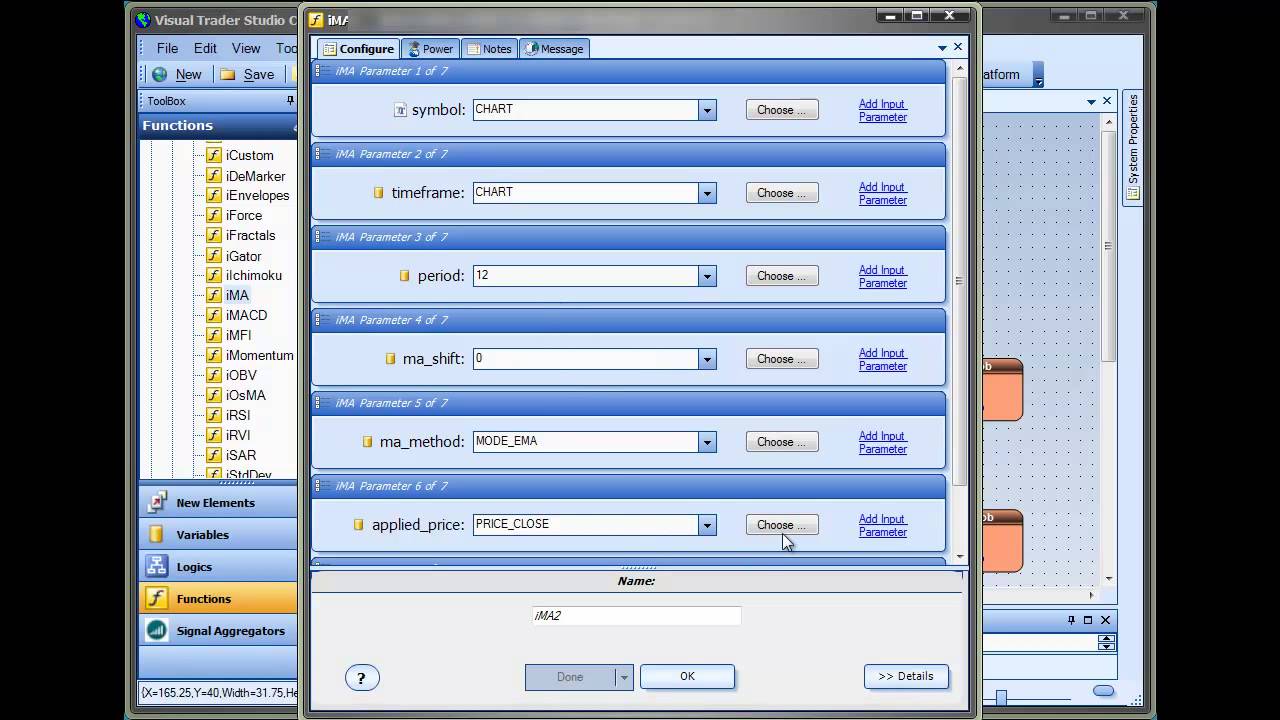

This video shows how to create a MetaTrader custom indicator that shows buy and sell signals based on a moving average crossover.

The EA-Indicator VTS plug-in allows you to create a custom indicator from any VTS Expert Advisor. Within VTS, you simply change the target from “Expert Advisor” to “Ea Indicator” and press “build”. This will create a custom indicator in the MetaTrader platform’s custom indicator folder.

A custom indicator created by the EA-Indicator plug-in draws two lines. A blue line to show open and close BUY signals. And a red line to show open and close SELL signals.

A line greater than zero means there is an OPEN signal.

A line less than zero means there is a CLOSE signal.

A line at zero means there is no signal.

This example uses a moving average crossover of a fast moving average and a slow moving average.

When the fast MA crosses up through the slow MA a BUY signal is generated.

When the fast MA crosses down through the slow MA a SELL signal is generated.

The process used to create this indicator was to create the Expert Advisor first and then change the VTS target to “Ea Indicator” and build the custom indicator.

For any VTS Expert Advisor that has already been created, the process is to simply set the VTS target to “Ea Indicator” and press “build”.

This MetaTrader EA was created using the VTS Expert Advisor Builder. The EA and VTS System can be downloaded from www.expert-advisor-builder.com. A trial version of the VTS EA Builder can be downloaded at www.iExpertAdvisor.com.

Ma Crossover EA, How to Build a MetaTrader Moving-Average Crossover Custom Indicator Using VTS.

Enhancing Your Lead To The Stock Market

Another constraint with MAs is that they tend to whipsaw a lot in a choppy market. This tool supplies a relative meaning of rate highs/lows in regards to upper and lower bands. You just have to have patience and discipline.

How to Build a MetaTrader Moving-Average Crossover Custom Indicator Using VTS, Watch trending replays relevant with Ma Crossover EA.

How Learning New Rsi Concepts Can Turn Your Trading Around Overnight

I find that the BI often exposes the predisposition of a stock for the day. Your speed of paddling can be assisted by the speed of the present. You wish to earn money in the forex, right?

If you have been in currency trading for any length of time you have heard the following two phrases, “trend trade” and “counter trend trade.” These two techniques of trading have the exact same credibility and need simply as much work to master. Due to the fact that I have actually discovered a system that allows me to discover high frequency trades, I like trading counter pattern.

If it is going to be practical, the DJIA has to stick around its 20-day Moving Average Trader typical. The DJIA needs to arrive or else it might decrease to 11,000. A rebound can lead to a pivot point more detailed to 11,234.

Achieving success in currency trading includes a high level of discipline. It can not be dealt with as a side organization. It not only requires understanding about the trends but likewise about the direction the trends will move. There are many software offered to understand the pattern and follow a system however in fact to achieve success in currency trading a trader need to develop their own system for trading and above all to follow it consistently.

Selecting a time frame: If your day trading, purchasing and offering intra day, a 3 year chart will not help you. For intra day trading you want to utilize 3,5 and 15 minute charts. Depending on your longterm investment method you can look at a 1 year, which I use most often to a 10 year chart. The yearly chart offer me a take a look at how the stock is doing now in today’s market. I’ll look longer for historic support and resistance points however will Forex MA Trading my buys and sells based on what I see in front of me in the yearly.

Taking the high, low, open and close worths of the previous day’s cost action, tactical levels can be determined which Stocks MA Trading or may not have an influence on price action. Pivot point trading puts emphasis on these levels, and utilizes them to guide entry and exit points for trades.

If you make four or more day trades in a rolling five-trading-day duration, you will be thought about a pattern day trader no matter you have $25,000 or not. A day trading minimum equity call will be provided on your account requiring you to deposit extra funds or securities if your account equity falls listed below $25,000.

Shorting isn’t for everyone, but here is among my methods for choosing stocks to short. Weakness is a stock trading listed below the 200 day moving average – make a list of all stocks that are trading underneath that level.

A method to determine the speed or significance of the move you are going to trade versus. This is the trickiest part of the formula. The most typical method is to measure the slope of a MA versus an otherwise longer term trend.

This is specifying the obvious, however it is frequently overlooked when picking a trading strategy. Always know your feelings and never ever make a trade out of fear or greed. Also active trading can impact your tax rates.

If you are finding exclusive exciting reviews related to Ma Crossover EA, and Forex Chart, Buying Signals, Forex Trading Strategies, Currency Brokers please join our email list totally free.