How to autotrade using stochastic crossovers in MetaTrader MT4

Popular high defination online streaming about Most Advanced Live Trading Forex Robot Capable of Doubling Your Money, Sell Strategy, Stock Buy Signals, Buy or Sell, and Ma Crossover mt4, How to autotrade using stochastic crossovers in MetaTrader MT4.

https://www.fxalgotrader.com

SUBSCRIBE TO OUR CHANNEL

https://www.youtube.com/channel/UCOsi3jBpHqiSlOMmc1dMyNw?sub_confirmation=1

Automated Trading system using Stochastic Crossover Alerts and advanced MA trend filtering techniques. Developed by FX AlgoTrader for MetaTrader MT4

#metatrader #autotrading #system #stochastic #crossover #alert #mt4 #indicator

Ma Crossover mt4, How to autotrade using stochastic crossovers in MetaTrader MT4.

What Forex Timeframe Do You Trade And Why?

In a ranging market, heavy losses will take place. Lots of traders do not have the perseverance to enjoy their trade become a profit after a few hours or more. Chart: A chart is a graph of price over a time period.

How to autotrade using stochastic crossovers in MetaTrader MT4, Search top full length videos about Ma Crossover mt4.

How To Trade Stocks – Part 4 – Bearishness, Booming Market, What The H?

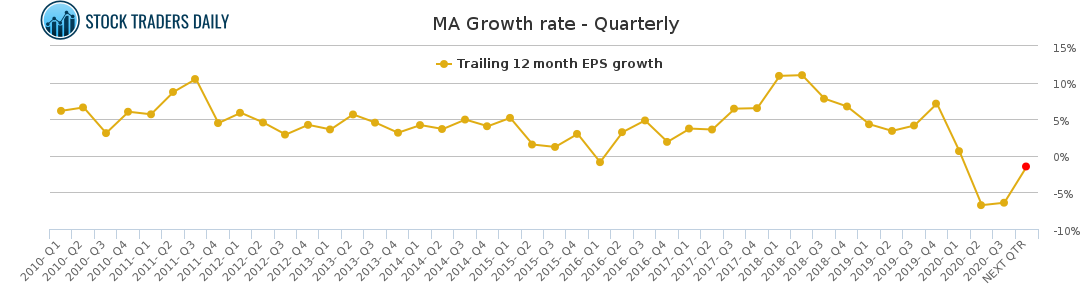

Traders seek to discover the maximum MA for a specific currency set. Support and resistance are levels that the marketplace reaches prior to it reverses. Utilizing indicators for forex trading is essential.

In less than four years, the price of oil has actually risen about 300%, or over $50 a barrel. The Light Crude Constant Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil prices will eventually slow financial growth, which in turn will cause oil costs to fall, ceritus paribus.

A normal forex cost chart can look really irregular and forex candlesticks can obscure the pattern further. The Moving Average Trader typical gives a smoothed chart that is plotted on top of the forex chart, together with the japanese candlesticks.

The most standard application of the BI principle is that when a stock is trading above its Predisposition Sign you ought to have a bullish predisposition, and when it is trading listed below its Bias Indication you need to have a bearish bias.

Market timing is based on the “truth” that 80% of stocks will follow the instructions of the broad market. It is based upon the “truth” that the Forex MA Trading pattern over time, have actually been doing so considering that the beginning of easily traded markets.

A Forex trading technique needs 3 Stocks MA Trading basic bands. These bands are the time frame picked to trade over it, the technical analysis used to determine if there is a cost trend for the currency set, and the entry and exit points.

While the year-end rally tends to be quite dependable, it doesn’t occur every year. And this is something stock market investors and traders may wish to pay attention to. In the years when the markets signed up a loss in the last days of trading, we have actually often experienced a bear market the next year.

For these kind of traders short-term momentum trading is the very best forex trading method. The aim of this short term momentum trading technique is to hit the earnings target as early as possible. This is accomplished by going into the market long or short when the momentum is on your side.

As a bonus offer, two MAs can also work as entry and exit signals. When the short-term MA crosses the long-lasting back in the direction of the long-term trend, then that is a fun time to get in a trade.

Likewise getting in and out of markets although less expensive than in the past still costs money. It is always easier to paddle in the instructions of the river! Long as the stock holds above that breakout level.

If you are finding exclusive engaging reviews relevant with Ma Crossover mt4, and Forex Chart, Forex Trading Strategy, Currency Trading Charts dont forget to join in email alerts service totally free.