How to Add more than 3 Indicators in FREE Version of TradingView | 5 SMA in 1 | Pine Code | Hack

Trending vids relevant with Market Conditions, Forex Trader, and Tradingview How To Sma, How to Add more than 3 Indicators in FREE Version of TradingView | 5 SMA in 1 | Pine Code | Hack.

This video give access to SMA indicator that plot 5 SMA lines.

In free version of trading view you can use only max 3 indicator at once.

And by using this indicator you can now have 7 indicator on screen.

***There was some issue with indicator publishing on trading view***

Please copy code from below link and paste the code in Pine Code section of trading view .

Save and Add to your Profile.

Link to 5 SMA In 1 Indicator Pine Code- https://drive.google.com/drive/u/0/folders/100SU2eQFdcP7qunb4r89cl68fnVEKzKp

How to Add Unlimited Watchlist in Free Version of TradingView- https://youtu.be/r6oyVNj3J_4

Breakout Technical Analysis WIPRO – https://youtu.be/AaCXFQN6pvo

Breakout Technical Analysis HINPETRO -https://youtu.be/jZZy3I9ntSk

Breakout Technical Analysis DRREDDY-https://youtu.be/9QGXN6_BRjs

Massive Returns on Positional Stocks -https://youtu.be/7-grzF2JIbI

Difference between Intraday and Cash/Delivery Trading – https://youtu.be/7AmtQIAV4Do

Auto 15mins Morning range plotter on trading view INDICATOR FREE -https://youtu.be/jSjliyoMW2Y

Intraday Trading Analysis -https://youtu.be/k2pDlvoGjLw

#TradingView #sma #indicators #pinecode #freeindicator

#nifty #watchlist #banknifty #swingtrading #intraday #technicalAnalysis #BreakoutTrading #investing #indianstock #trading

#technicalanalysis #nifty #banknifty #stockmarket #nseindia #nse #priceaction

#priceactiontrading #intraday #futures#options #bse #stockmarketindia #stocks #investment#daytrading

#sharemarket #stockmarketindia #swingtrading #breakouttrading #intraday

Tradingview How To Sma, How to Add more than 3 Indicators in FREE Version of TradingView | 5 SMA in 1 | Pine Code | Hack.

Free Day Trading System

So, when the market is varying, the very best trading strategy is variety trading. For the functions of this post lets remain concentrated on the SMA. You can and require to chart all kinds of stocks including penny stocks.

How to Add more than 3 Indicators in FREE Version of TradingView | 5 SMA in 1 | Pine Code | Hack, Find interesting replays about Tradingview How To Sma.

What’s The Very Best Day Trading Strategy?

The aim of this short term momentum trading technique is to hit the revenue target as early as possible. A Forex trading strategy requires three main standard bands. The most efficient indicator is the ‘moving average’.

You should know how to chart them if you trade stocks. Some individuals explore charts to find buy or sell signals. I find this wasteful of a stock traders time. You can and need to chart all kinds of stocks consisting of penny stocks. When to sell or purchase, charting informs you where you are on a stocks cost pattern this means it informs you. There are plenty of fantastic business out there, you do not desire to get captured buying them at their 52 week high and having to wait around while you hope the rate returns to the cost you paid.

Nevertheless, if there is a breakout through among the external bands, the price will tend to continue in the same direction for a while and robustly so if there is an increase Moving Average Trader in volume.

So this system trading at $1000 per trade has a favorable expectancy of $5 per trade when traded over many trades. The profit of $5 is 0.5% of the $1000 that is at danger throughout the trade.

Market timing is based on the “reality” that 80% of stocks will follow the instructions of the broad market. It is based on the “truth” that the Forex MA Trading trend with time, have actually been doing so since the beginning of easily traded markets.

Your task is merely to determine instructions. Since Bollinger bands will not inform you that, as soon as the bands throws off this signal you should figure out direction. We identified direction since we Stocks MA Trading had actually a failed greater swing low. In other words broken swing low assistance, and then broken assistance of our 10 duration EMA. Couple that with the expansion of the bands and you wind up with a trade that paid almost $8,000 dollars with threat kept to an absolute minimum.

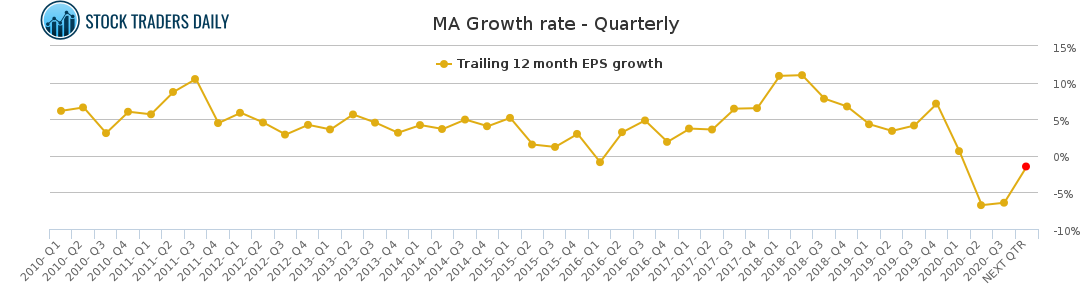

A 50-day moving average line takes 10 weeks of closing cost information, and after that plots the average. The line is recalculated daily. This will reveal a stock’s price pattern. It can be up, down, or sideways.

Utilizing the moving averages in your forex trading business would show to be extremely useful. First, it is so simple to use. It is presented in a chart where all you need to do is to keep a keen eye on the finest entrance and exit points. Thats an indication for you to start purchasing if the MAs are going up. However, if it is going down at a constant speed, then you should begin offering. Being able to check out the MAs right would definitely let you realize where and how you are going to make more money.

5 distribution days during March of 2000 signaled the NASDAQ top. Also essential is the truth that numerous leading stocks were revealing leading signals at the same time. The absolute best stock exchange operators went primarily, or all in money at this time, and retained their unbelievable gains from the previous 4 or 5 years. They did this by effectively examining the everyday price and volume action of the NASDAQ. It makes no sense at all to enjoy major earnings disappear. Once you discover to recognize market tops, and take suitable action, your overall trading results will enhance significantly.

There you have the two most essential lessons in Bollinger Bands. The goal is to make more revenue using the least quantity of utilize or threat. It just may save you a lot of cash.

If you are finding rare and exciting reviews about Tradingview How To Sma, and Bear Markets, Global Market Divergences, Forex Strategy, Penny Stock you are requested to list your email address for email list now.