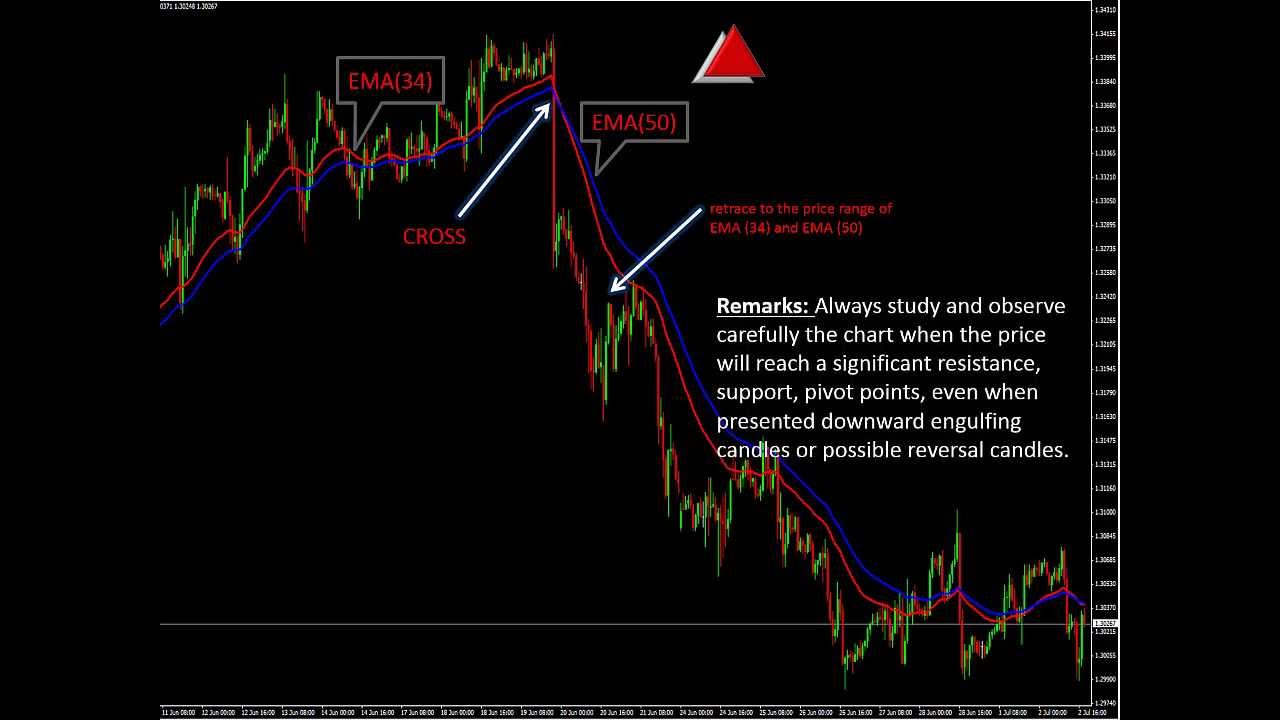

Forex Trading Strategy with EMA(34) and EMA(50)

Trending overview relevant with Current Sector Trends, How to Read Stock Charts, and How to Use Ema in Forex Trading, Forex Trading Strategy with EMA(34) and EMA(50).

Video Forex Trading Strategy with EMA(34) and EMA(50). In our webpage you will find: Forex Signals, Forex Technical Analysis articles, Free Stuff, Forex Tools. You can send your own comments and observations.

http://www.forexsignalmasters.com

Like Forex Signal Masters on Facebook : https://www.facebook.com/forexsignalm…

Follow Forex Signal Masters on Twitter : https://twitter.com/fxsignalmasters

Follow Forex Signal Masters on Google+ : http://tinyurl.com/mvjtzbu

Follow Forex Signal Masters on Pinterest : http://pinterest.com/fxsignalmasters

Follow Forex Signal Masters on Instagram : http://instagram.com/forexsignalmasters

How to Use Ema in Forex Trading, Forex Trading Strategy with EMA(34) and EMA(50).

How Finding Out New Rsi Principles Can Turn Your Trading Around Overnight

Consider the MA as the same thing as the cockpit console on your ship. The 2nd line is the signal line represented as %D. %D is a basic moving average of %K. In this action, you might increase your money and gold allocations even more.

Forex Trading Strategy with EMA(34) and EMA(50), Find latest high definition online streaming videos relevant with How to Use Ema in Forex Trading.

Here Are Four Suggestions To Make You Money In The Stock Market

What were these essential experts missing? As soon as a trend is in movement, we like to trail stops behind the 40 day ma. An uptrend is shown by greater highs and higher lows. Since they are lagging signs.

Brand-new traders typically ask how lots of indicators do you suggest utilizing at one time? You do not require to succumb to analysis paralysis. You should master just these two oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence).

Technical analysis can be really helpful for Moving Average Trader to time our entries and exits of the trade. It should not be used alone due to the fact that it can be confusing details if not utilized correctly.

Grooved variety can likewise hold. If the selling is intense, it may press the stock right past the grooved area – the longer a stock remains at a level, the more powerful the support.

OIH significant support is at the (increasing) 50 day MA, presently simply over 108. Nevertheless, if OIH closes below the 50 day MA, then next Forex MA Trading support is around 105, i.e. the longer Price-by-Volume bar. Around 105 may be the bottom of the combination zone, while a correction might result somewhere in the 90s or 80s. The short-term rate of oil is largely depending on the rate of global economic development, reflected in month-to-month economic information, and supply disturbances, including geopolitical occasions and typhoons in the Gulf.

One of the primary signs that can assist you develop the method the index is moving is the Moving Average (MA). This takes the index cost over the last specific number of days and averages it. With each brand-new day it drops the first cost utilized in the previous day’s calculation. It’s constantly excellent to inspect the MA of numerous periods depending if you are seeking to day trade or invest. If you’re aiming to day trade then a MA over 5, 15, and thirty minutes are an excellent concept. Then 50, 100, and 200 days might be more what you require, if you’re looking for long term financial investment. For those who have trades lasting a couple of days to a few weeks then durations of 10, 20 and 50 days Stocks MA Trading be better suited.

For every single time a short article has actually been e-mailed, award it three points. An e-mailed short article indicates you have at least strike the interest nerve of some member of your target market. It may not have been a publisher so the classification isn’t as important as the EzinePublisher link, but it is better than a simple page view, which does not necessarily suggest that someone read the whole post.

Going into the marketplace at this stage is the most aggressive technique because it does not permit any type of verification that the stock’s break above the resistance level will continue. Possibly this method needs to be scheduled for the most appealing stocks. Nevertheless it has the advantage of providing, in lots of situations, the most affordable entry point.

Keep in mind, the secret to understanding when to buy and offer stocks is to be constant in applying your rules and understanding that they will not work whenever, but it’s a whole lot better than not having any system at all.

I then integrated this Non-Lagging AMA with another indicator called the Beginners Alert. You need to constantly protect your trades with a stop loss. So this system has the very same winning average in time as turning a coin.

If you are searching instant entertaining videos related to How to Use Ema in Forex Trading, and Forex Chart, Buying Signals, Forex Trading Strategies, Currency Brokers please join in subscribers database now.