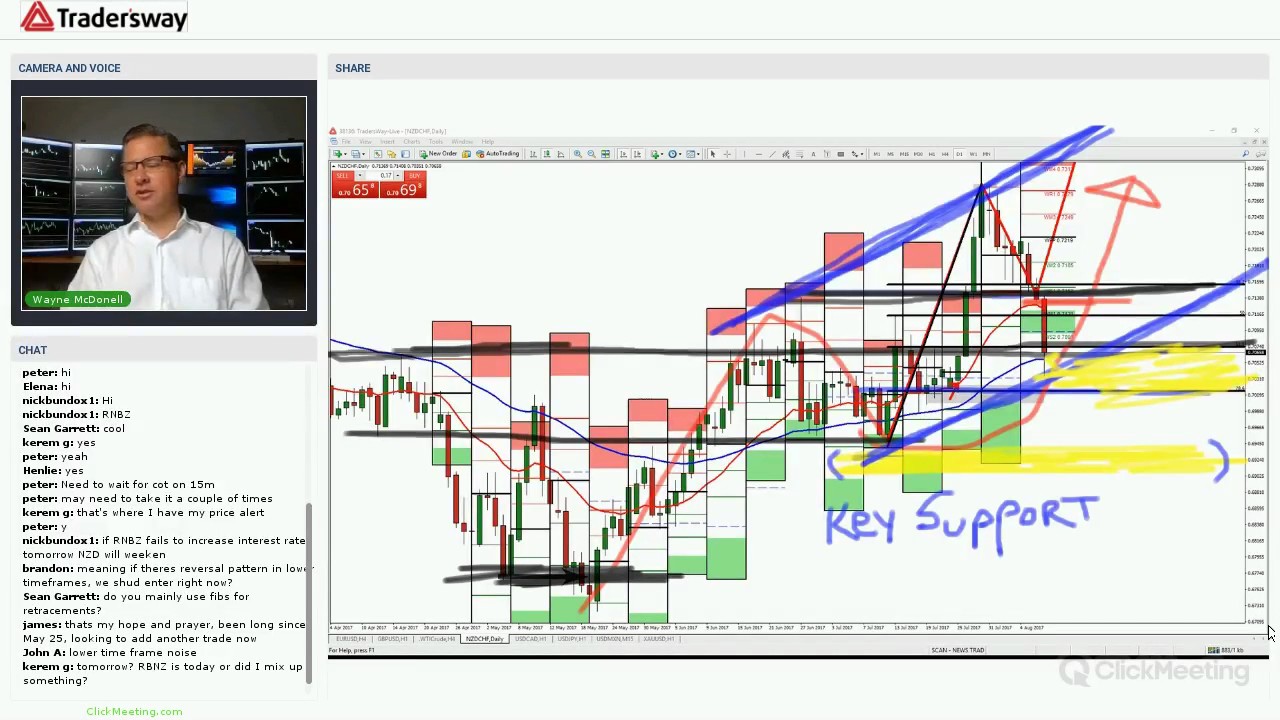

Forex Trading Strategy Webinar Video For Today: (LIVE Wednesday August 9, 2017)

Best full length videos about Forex Market, Fundamental Analysis, and Sma Trading Egypt, Forex Trading Strategy Webinar Video For Today: (LIVE Wednesday August 9, 2017).

Watch our videos or attend our live events here: http://Forex.Today

Daily Trading Strategy For Traders of the Foreign Currency Exchange (FOREX)

May the pips be with you!

– Wayne McDonell

Chief FX Market Strategist

TradersWay Is A Global Trading ECN

Forex Broker: http://www.TradersWay.com?forex.today.youtube

YouTube Channel: https://www.youtube.com/channel/UChRC072YJGlNNNYhg_0hZeA

Forex.Today Channel:

http://forex.today/users/administr8/

Live Forex Strategy Sessions

Monday – Friday

7:30am ET (London Lunch)

RISK WARNING

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Seek education and gain experience before risking real money, but please always remember, your past performance does not guarantee future results.

What Is Forex?

The foreign exchange market (or “forex” for short) is the biggest financial market in the world, with over $4 trillion worth of transactions occurring every day. Simply, forex is the market in which currencies, or money, are traded in the interbanking system.

Forex Tutorial: What is Forex Trading?

By Investopedia Staff

What Is Forex?

The foreign exchange market is the “place” where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. and want to buy cheese from France, either you or the company that you buy the cheese from has to pay the French for the cheese in euros (EUR). This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars (USD) into euros. The same goes for traveling. A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate.

What is the spot market?

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a “spot deal”. It is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Note that you’ll see the terms: FX, forex, foreign-exchange market and currency market. These terms are synonymous and all refer to the forex market.

Sma Trading Egypt, Forex Trading Strategy Webinar Video For Today: (LIVE Wednesday August 9, 2017).

Finance And Forex Trading – The Key To Bigger Gains

Basic moving averages weigh every rate in the previous similarly. Buy-and-hold state TV analysts and newsletter publishers who’s customers currently own the stock. Also take a look at more info on deep in the money calls.

Forex Trading Strategy Webinar Video For Today: (LIVE Wednesday August 9, 2017), Search latest high definition online streaming videos relevant with Sma Trading Egypt.

Trading The Forex Market – What Are The Best Forex Trading Indicators?

You can use any signs that you’re comfortable with to go through a similar treatment. It’s really true that the market pays a lot of attention to technical levels. At least as far as the retail investor is worried.

Here I am going to show you how to attain forex trading success with a basic technique which is sensible, proven and you can utilize directly away for big earnings. Let’s have a look at it.

3) Day trading suggests quick revenue, do not hold stock for more than 25 min. You can constantly sell with profit if it starts to fall from leading, and then buy it back later on if it Moving Average Trader end up going up once again.

Support & Resistance. Support-this term explains the bottom of a stock’s trading range. It’s like a floor that a stock price discovers it difficult to permeate through. Resistance-this term describes the top of a stock’s trading range.It’s like a ceiling which a stock’s price does not appear to rise above. Assistance and resistance levels are necessary clues as to when to purchase or offer a stock. Numerous effective traders buy a stock at assistance levels and offer brief stock at resistance. If a stock handles to break through resistance it might go much greater, and if a stock breaks its assistance it might signal a breakdown of the stock, and it might decrease much even more.

While there is no way to predict what will take place, it does suggest that you should be prepared in your investments to act if the Forex MA Trading begins to head south.

Let us say that we wish to make a short term trade, between 1-10 days. Do a screen for Stocks MA Trading in a brand-new up trend. Raise the chart of the stock you are interested in and raise the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving average the stock is going to continue up and should be purchased. But as soon as the 9 day crosses over the 4 day it is a sell signal. It is that easy.

Here is a perfect example of a strategy that is simple, yet smart enough to guarantee you some added wealth. Start by picking a particular trade that you think is lucrative, say EUR/USD or GBP/USD. When done, choose 2 signs: weighted MA and basic MA. It is advised that you use a 20 point weighted moving typical and a 30 point moving average on your 1 hour chart. The next step is to keep an eye out for the signal to sell.

Utilizing the moving averages in your forex trading company would show to be extremely advantageous. First, it is so easy to utilize. It is presented in a chart where all you need to do is to keep an eager eye on the very best entryway and exit points. Thats an indication for you to start buying if the MAs are going up. However, if it is going down at a continuous pace, then you ought to begin selling. Being able to read the MAs right would definitely let you understand where and how you are going to make more cash.

To help you determine patterns you ought to also study ‘moving averages’ and ‘swing trading’. For example 2 fundamental guidelines are ‘do not purchase a stock that is below its 200-day moving average’ and ‘do not buy a stock if its 5-day moving average is pointing down’. If you don’t comprehend what these quotes mean then you need to research study ‘moving averages’. Excellent luck with your trading.

The MACD sign has actually been relocating the opposite instructions of the rate chart (i.e. negative divergence). Both these lines are outlined on the horizontal axis for a given period.

If you are finding instant engaging videos relevant with Sma Trading Egypt, and Oil Stocks, Two Moving Averages, Pips Currency Trade you are requested to subscribe for email list for free.