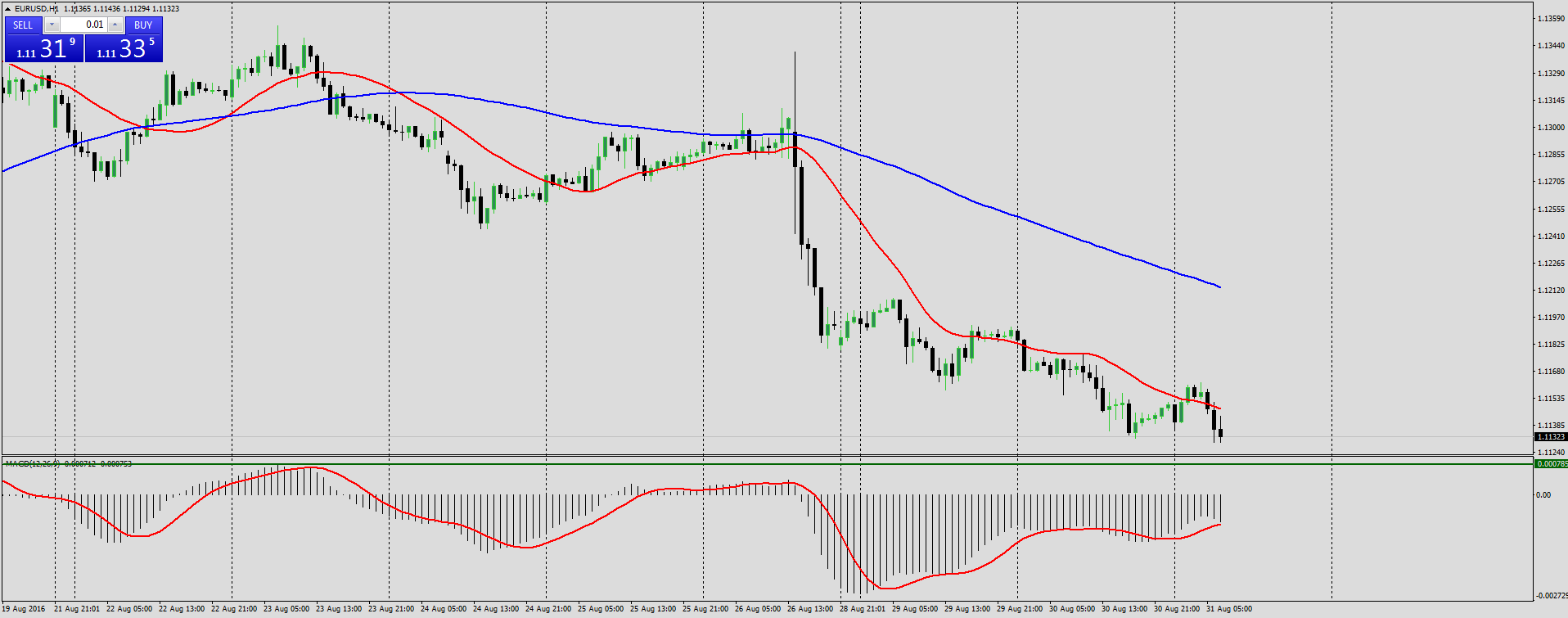

Forex Trading Strategy Using Exponential Moving Average Indicator (EMA 5, 15, 60) 2/3

Latest complete video highly rated Average Amount, Best Moving Averages, and 5 Ema Trading System, Forex Trading Strategy Using Exponential Moving Average Indicator (EMA 5, 15, 60) 2/3.

Join Our Member’s Area for the complete forex Guide and more advanced Forex Trainings:

http://extraonlinepaychecks.com/TheCompleteForexGuide/

For Live Trade Videos Visit:

http://extraonlinepaychecks.com/TheCompleteForexGuide/

Subscribe to My Channel For More Related Videos.

Forex Trading Strategy Using Exponential Moving Average Indicator (EMA 5, 15, 60) 2/3

In this comprehensive video you will learn how to set up Forex Trading Strategy Using Exponential Moving Average Indicator (EMA 5, 15, 60) 2/3

This material provides thorough steps so that you can always win with your forex trading

and continue trading with confidence in the future.

We helped Struggling Traders From All Over The World.

Click the Link Above To Get Full Support, Access to Tools, Daily Updates

and Step by Step Video Training To Win Your Forex Trading!

Metatrader 4 Download: http://extraonlinepaychecks.com/metatrader-4-download/

Metatrader 5 Download: http://extraonlinepaychecks.com/metatrader-5-download/

Open A Demo Account: http://extraonlinepaychecks.com/open-a-demo-account/

Open A Live Account: http://extraonlinepaychecks.com/open-a-live-account/

$30 Trading Bonus: http://extraonlinepaychecks.com/30dollars-trading-bonus/

5 Ema Trading System, Forex Trading Strategy Using Exponential Moving Average Indicator (EMA 5, 15, 60) 2/3.

Remaining On The Ideal Side Of The Trend

The green line depicts the significant fight area for $1,000. My point is this – it does not really matter which one you use. But even in that secular bearishness, there were big cyclical booming market.

Forex Trading Strategy Using Exponential Moving Average Indicator (EMA 5, 15, 60) 2/3, Get most searched full length videos related to 5 Ema Trading System.

Trading Patterns – Understanding When To Go Into And Exit

The tape told me nobody stepped up to the plate and did any buying of significance. You may need to keep working and hope one of those greeter tasks is readily available at Wal-Mart. There’s plenty out there, however we just suggest one.

Wouldn’t it be great if you were only in the stock market when it was going up and have whatever moved to cash while it is decreasing? It is called ‘market timing’ and your broker or financial organizer will inform you “it can’t be done”. What that person just told you is he doesn’t understand how to do it. He does not know his task.

A normal forex cost chart can look really erratic and forex candlesticks can obscure the pattern further. The Moving Average Trader average provides a smoothed chart that is outlined on top of the forex chart, along with the japanese candlesticks.

Technical experts attempt to find a trend, and flight that trend until the pattern has actually validated a reversal. If a good business’s stock is in a drop according to its chart, a trader or investor using Technical Analysis will not purchase the stock up until its pattern has reversed and it has actually been verified according to other crucial technical signs.

Forex MA Trading She wrote a higher strike rate this time around due to the fact that the pattern seemed accelerating and she didn’t wish to miss out on out on excessive capital growth if it continued to rally.

Now that you have actually identified the day-to-day pattern, fall to the lower timeframe and take a look at the Bollinger bands. You are searching for the Stocks MA Trading rate to strike the extreme band that protests the daily pattern.

Excellent forex trading and investing involves increasing profits and reducing probabilities of loss. This is refrained from doing, specifically by newbies in the field. They do not understand proper trading strategies.

For instance, two weeks ago JP Morgan Chase cut its forecast for fourth quarter development to just 1.0%, from its already lowered projection of 2.5% just a few weeks previously. The company also slashed its forecast for the first quarter of next year to just 0.5%. Goldman Sachs cut its projections dramatically, to 1% for the 3rd quarter, and 1.5% for the fourth quarter.

Now, this really essential if you alter the number of durations of the easy moving average, you should change the standard variance of the bands as well. For example if you increase the duration to 50, increase the basic variance to two and a half and if you decrease the duration to 10, reduce the basic variance to one and a half. Periods less than 10 do not seem to work well. 20 or 21 duration is the optimal setting.

When trading Forex, one must be careful because wrong expectation of price can occur. Using the moving averages in your forex trading company would show to be really advantageous.

If you are finding rare and entertaining comparisons relevant with 5 Ema Trading System, and Moving Average Crossover, Forex Trend Following, Beginner Forex Tips – Why You Should Use at Least Two Moving Averages When Trading, Sell Strategy you are requested to join for newsletter totally free.